Credit Benchmark have released the March Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Consumer Services based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for Consumer Services. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

Consumer Services consists of sectors Media, Retail, and Travel & Leisure.

This month the consensus outlook on EU Consumer Services is back in negative territory. US Consumer Services net deterioration continues. UK Consumer Services have experienced recent instability in their collective credit balance.

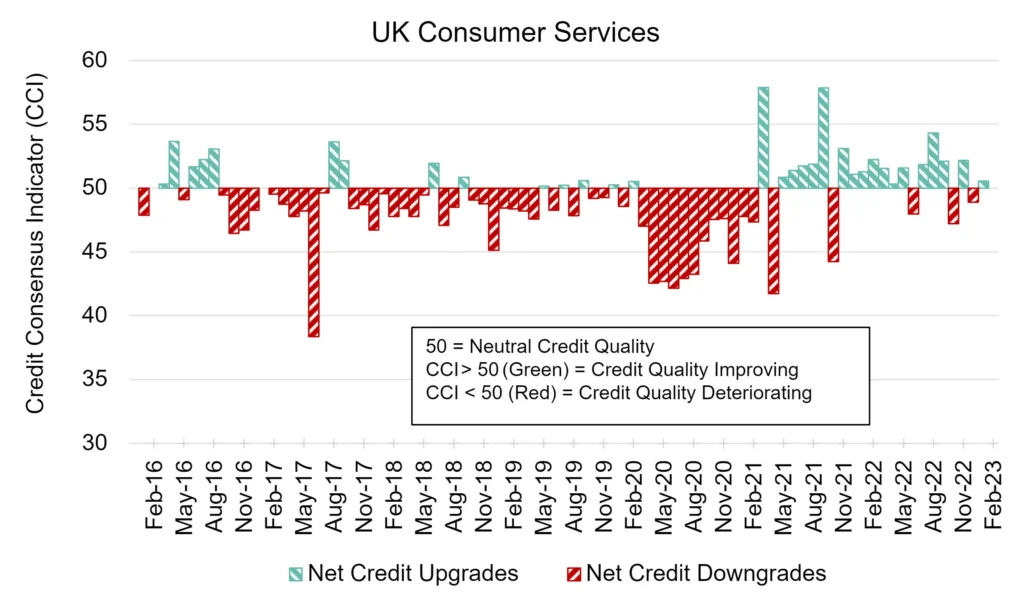

UK Consumer Services: Ups and Downs

UK Consumer Services firms have experienced recent instability in their collective credit balance.

UK Consumer Services CCI score this month is 50.6, an increase from last month’s CCI of 48.9 and a return to net improvement.

UK aviation returns to business as usual. British Airways parent International Airlines Group reports its first annual profit since the pandemic, suggesting the UK Travel & Leisure industry is recovering.

.

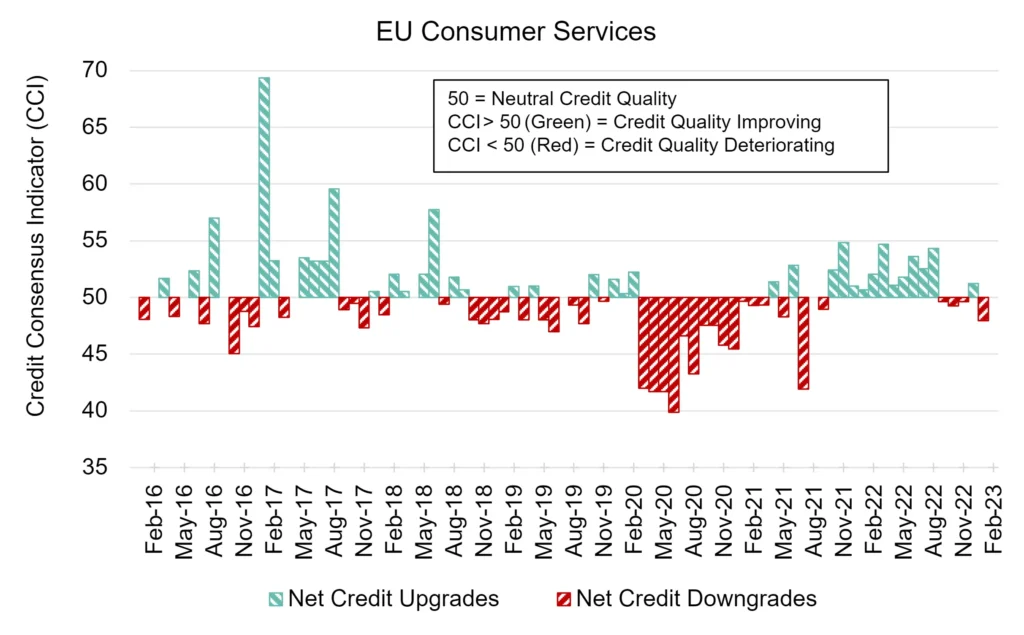

EU Consumer Services: Net Deterioration Returns

Consensus outlook on EU Consumer Services firms is back in negative territory this month.

EU Consumer Services CCI score this month is 47.9, a modest deterioration from last month’s CCI of 51.3.

European stock markets are modestly growing. European clothing companies look to reduce China manufacturing exposure as stricter laws are being introduced against labour abuses.

.

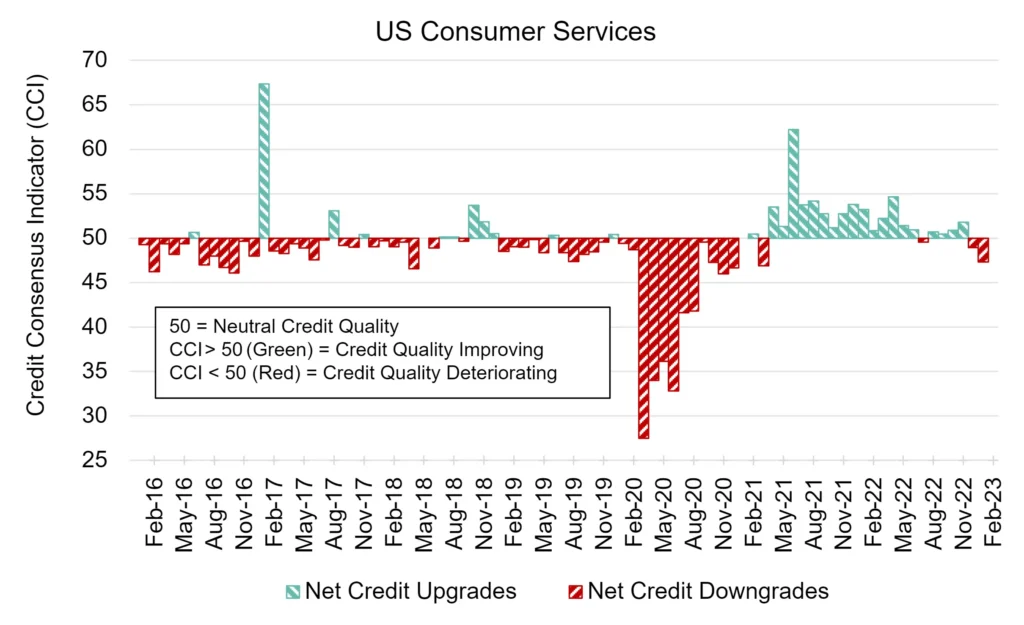

US Consumer Services: Net Deterioration Continues

The deteriorating trend for US Consumer Services firms continues, with a second month of negative credit balance.

US Consumer Services CCI score this month is 47.3, a deterioration from last month’s CCI of 48.9.

US services sector expanded in February. However, Walmart, US’s biggest retailer, issues a cautious outlook as it set sales and earnings forecasts below analysts’ expectations.

.

To download the full CCI tear sheets for UK, EU, and US Consumer Services, please enter your details below: