Download full Covid Crisis Impact infographic below.

April’s consensus credit data shows the dramatic global impact of the Covid crisis on risk estimates.

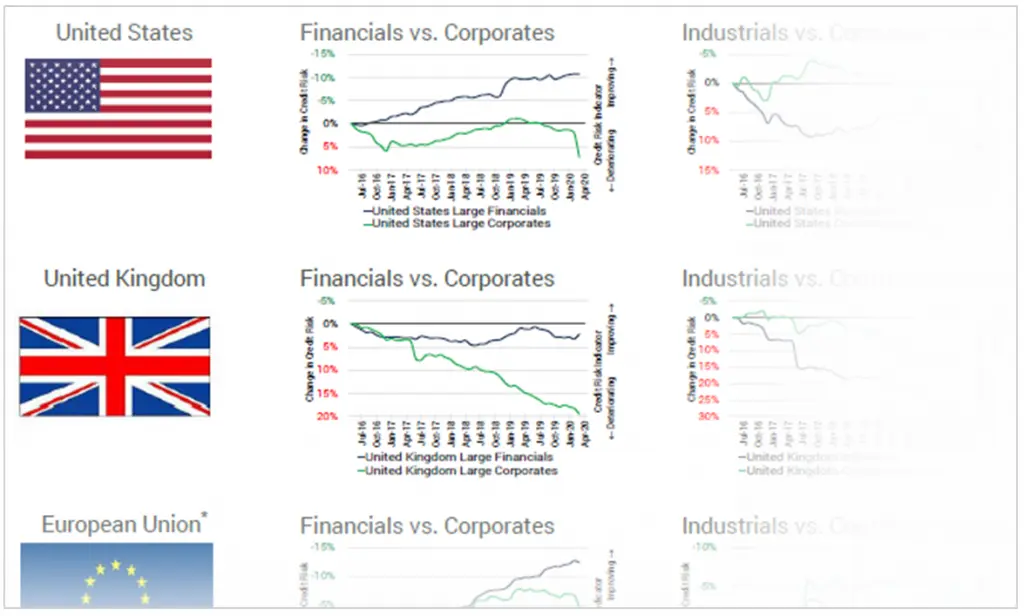

Wall Street vs Main Street

The most striking trend is the growing gap between Wall St and Main St: Financials have continued to improve while Corporates show a sharp deterioration. This is most pronounced in the US, where Corporate credit risk has increased by an average of 10% (and considerably more in some sectors). UK Corporates were beginning to stabilise after the Brexit-related declines of the past three years, but the trend has turned down again.

Within financials, banks and insurance track each other closely in the US, whereas insurance has lagged behind banks in the UK and the EU. Banks have the advantage of record low interest rates and, in some cases, 100% Government backed loans for small businesses. Banks will also benefit from an expected wave of mergers, acquisitions and restructuring as companies with heavy debt loads seek out stronger partners. The Insurance industry has large, captive cash flows and apart from the controversial issue of business interruption payouts, they are likely to see improvements in loss ratios due to the majority of the world’s population being unable to work, fly, or drive.

Basic Materials, Technology, Industrials, Consumer Goods, Oil & Gas, Airlines All Show Decline

In other industries, Basic Materials show declines in US, UK and the EU as supply chains dissolve and economic activity evaporates. Interestingly, these trends were already underway before the crisis unfolded. Technology continues to tread water; technology is likely to be critical in the new normal economy but identifying the individual winners and losers is very challenging at this stage. Quoted technology companies (“Silicon Valley” in the charts) show a sharp decline, mirroring that of “Wall St”. This may be because the quoted firms are dominated by gig economy and product driven firms, who have been hard hit. Even Amazon expects a return to losses despite being the undisputed leader in online retail.

Industrials and Consumer Goods show sharp declines of roughly equal magnitude in US and EU; there is limited impact in the UK so far although these industries have already been heavily downgraded during the Brexit process.

The heavy declines in Oil & Gas and Airlines come as no surprise – the secondary impact on airframe manufactures, parts suppliers, oil-rich Sovereigns and tourism hotspots is likely to appear in coming months.