Risk officers today are managing credit portfolios in an increasingly volatile market. A few key shifts in the global economy are making portfolio-level risk difficult to monitor:

- Credit risk has moved beyond the rated universe. With increasing exposure across shadow banking, including private credit, fund finance, and structured lending, banks and other financial institutions are now managing large volumes of unrated and opaque assets. The shift challenges conventional risk frameworks and complicates portfolio-level oversight.

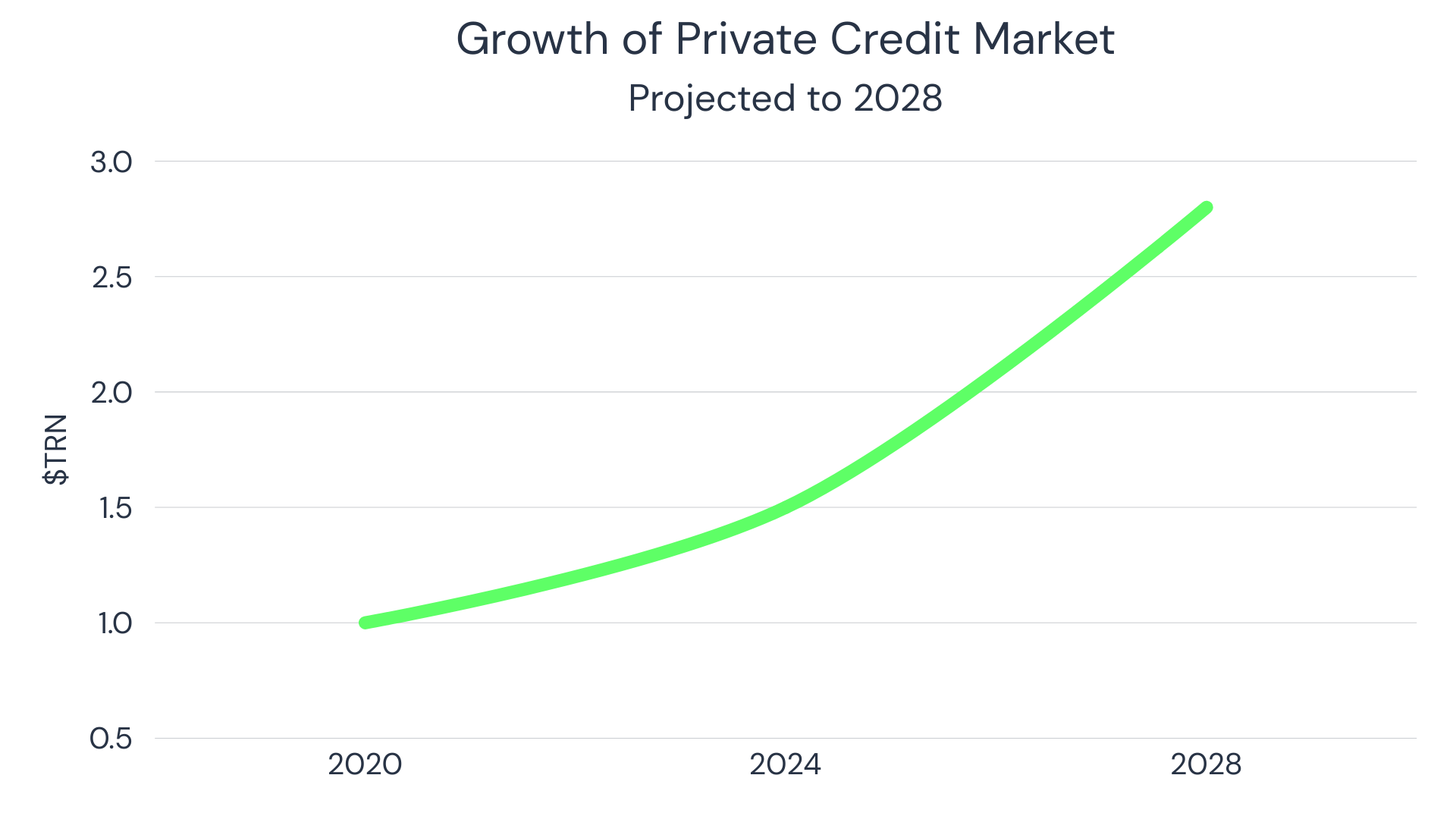

- The private credit market is projected to reach $2.8 trillion by 2028 (up from $1 trillion in 2020), signalling this broader trend. Despite the rapid growth, transparency remains limited.

- Default risk itself is also rising. In 2025, High Yield Corporates and Financials across the G7 and China (excluding the U.S.) are expected to see increased default rates. Elevated interest costs are putting pressure on highly leveraged borrowers, and credit quality is beginning to diverge. High-Yield portfolios are deteriorating, while Investment Grade remains more stable. Credit transitions are becoming more frequent, including movements into default.

- Financial institutions face ongoing regulatory scrutiny from IFRS 9 / CECL Impairment Benchmarking and Basel Endgame. They’re being pushed to adopt more transparent and forward-looking credit risk frameworks.

Traditional credit indicators are no longer sufficient. Agency ratings often trail underlying credit deterioration, internal models struggle with visibility into opaque exposures, and market spreads offer limited insight into illiquid or unrated segments.

Effective portfolio oversight now requires forward-looking, consensus-based intelligence grounded in actual credit exposure and peer-aligned benchmarks.

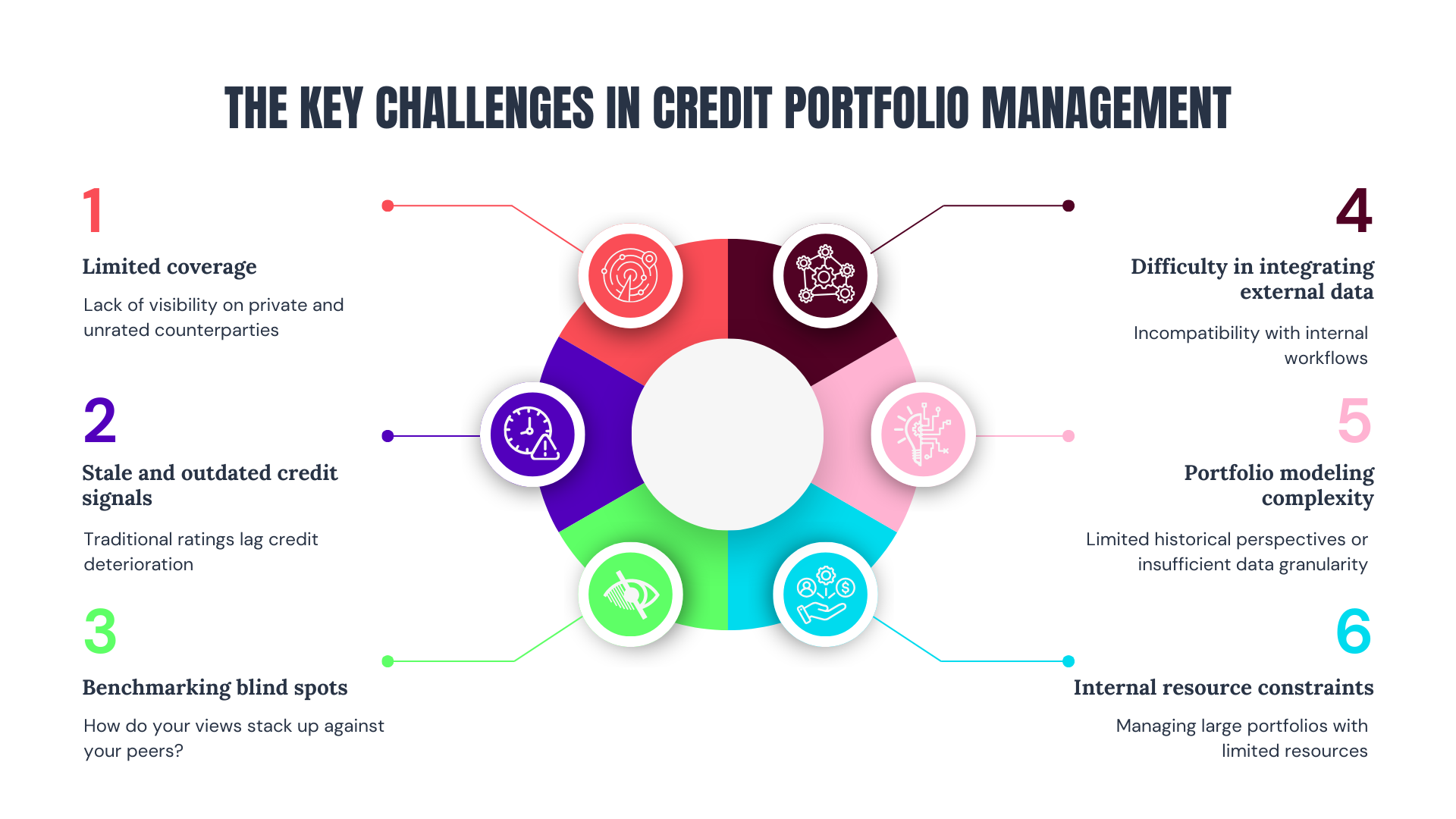

The Key Challenges in Credit Portfolio Management

Here are the key challenges risk teams face today:

Limited coverage of unrated entities and opaque data

Over 90% of entities covered by Credit Consensus Ratings (CCRs) lack ratings from major credit agencies. That’s a massive gap when you’re trying to assess portfolio risk, especially when dealing with private companies, smaller businesses, or entities buried in complex supply chains.

The private credit market shows the scale of the coverage gap. Exposure decisions in derivatives, fund finance, and structured lending are made without consistent credit signals or external benchmarks. That lack of visibility limits the ability to assess concentration risk, validate assumptions, and maintain a defensible view across increasingly complex portfolios.

Stale and outdated credit signals

Traditional ratings lag credit deterioration, reducing their value for tracking migration, adjusting exposure, or triggering timely risk actions.

You need timely signals that detect trouble before it impacts your portfolio. These signals include shifts in supplier payment terms, delayed filings, changes in trade credit insurance coverage, or increasing default probabilities in peer cohorts.

Reactive ratings shift the burden to internal models, many of which lack the granularity to capture emerging trends across regions, asset classes, or counterparties.

Benchmarking blind spots

You may trust your internal credit risk views, but how do they compare to what other institutions are thinking? Without visibility into market consensus and peer group ratings, it’s hard to know if you’re being too conservative, too aggressive, or if you’re missing shifts in industry norms.

This steep benchmarking gap makes it tough to validate PD and LGD models, stress assumptions, or sector-level concentration thresholds against market consensus.

When you can’t see how your views stack up against the broader market, it’s harder to justify risk decisions to audit committees and regulators who demand more transparency around credit risk models.

Difficulty in integrating external credit data into internal workflows

External credit intelligence (such as rating agency data, financial statements, or sector-level insights) sometimes requires manual extraction, normalization, and mapping before it’s usable in internal models or review frameworks.

The burden intensifies with unrated or private entities, where standard disclosures are absent.

As a result, risk teams face a persistent tradeoff: maintain depth of analysis or scale coverage and responsiveness. Few systems allow for both.

Internal resource constraints

Executing thorough credit assessments across large portfolios within existing capacity remains a persistent challenge, especially when you factor in second-order risks and complex transaction structures.

When you’re working with limited resources, your attention naturally shifts to the biggest exposures, while smaller positions might be developing problems under the radar.

The challenge gets worse as portfolios grow across regions and asset classes. You need solutions that let you cover more ground without hiring proportionally more people, but most traditional approaches don’t scale well.

Portfolio modeling complexity

Calibrating default models and building credit rating transition matrices is complicated enough when you have good data. When you’re working with limited historical perspectives or insufficient granularity for correlation analysis, it becomes even more challenging.

For credit portfolio managers, understanding how different parts of your portfolio might behave together requires robust data that many traditional sources just can’t provide. Stress testing and scenario modeling become difficult when you can’t accurately model how credit migration patterns might shift under different conditions.

These challenges point to a clear need for a consensus-driven view of credit, built from collective risk assessments of leading financial institutions.

How Risk Officers Can Address These Gaps in Credit Portfolio Management

Financial institutions are addressing these challenges by adopting more market-aligned credit intelligence solutions.

Credit Benchmark is one such solution, built on anonymized, consensus-based credit views from 40+ leading global financial institutions. It helps risk teams close coverage gaps, benchmark internal assessments against peers, and monitor credit migration with greater accuracy and scale.

Here’s how Credit Benchmark equips you to address the systemic challenges of credit portfolio management:

1. Address coverage gaps with deeper entity insights

Credit Benchmark tackles coverage gaps head-on with a scope that traditional sources can’t match. The platform provides CCRs on over 115,000 individual obligors across 160+ countries. Beyond individual obligors, Credit Benchmark also offers over 130,000 bond and loan rating assessments, representing more than $34 trillion in outstanding debt.

What makes this particularly powerful is the extensive private company coverage that was previously invisible to risk teams. The data comes from approximately 40 of the world’s leading global financial institutions, providing perspectives from institutions with real lending exposure to these entities.

Because the data refreshes weekly rather than annually, you’re working with dynamic insights that can catch shifts in credit quality before they become obvious to everyone else. For clearing houses evaluating member clients or asset managers assessing private market investments, this means a comprehensive risk assessment across entire portfolios.

The enhanced visibility proves useful for institutions managing derivative portfolios, where counterparty risk extends beyond direct relationships to include clearing member clients and their underlying exposures. You can now evaluate second-order risks and supplier relationships that previously operated in complete data blind spots.

2. Make faster decisions with unbiased credit consensus ratings

Credit Benchmark offers an independent view of credit risk by tapping into the aggregated and anonymized risk assessments of around 40 of the world’s largest banks, nearly half of them being Global Systemically Important Banks (GSIBs).

Unlike traditional ratings, these Credit Consensus Ratings reflect how institutions with actual exposure are assessing risk in real time, bringing the perspective of those with true “skin in the game.”

What makes these insights impactful is their foundation: model-driven estimates from over 20,000 experienced credit analysts. These aren’t theoretical scores; they’re the same internal assessments banks use to manage real-world credit exposures and risk-sharing transactions.

Because Credit Benchmark doesn’t rely on an “issuer-pays” model (where the company being rated funds the rating) and removes individual bank identifiers, the resulting data is free from the usual conflicts of interest. And that gives you a truly unbiased, market-grounded view of creditworthiness across inbound portfolios.

3. Integrate external credit data directly into internal risk and reporting workflows

Credit Benchmark is not a standalone credit portfolio management software, but its consensus data integrates directly with your existing risk management platforms and workflows.

You can access the data through multiple channels, including a secure web application, Excel add-in, direct API, SFTP data feeds, and third-party channels, including Bloomberg Terminal and cloud platforms like AWS and Snowflake.

The platform also assists with entity mapping and delivers data in customized formats for seamless integration. You can easily embed consensus intelligence into annual reviews, new client approvals, credit committees, and portfolio monitoring exercises without disrupting established processes.

Automated integration reduces the manual effort required for external data incorporation, so your analysts would have more time to focus on strategic tasks.

4. Benchmark internal risk views against market consensus to strengthen oversight

Risk officers can compare internal credit assessments against consensus views to see how their portfolio risk perspectives align with broader market intelligence. This benchmarking capability provides transparency into peer landscape views at granular entity levels, something that’s often difficult to get elsewhere.

Credit Benchmark enables risk teams to optimize capital allocation by understanding how their risk appetite compares to market consensus at the entity, sector, and portfolio levels. When your internal views are more conservative than the consensus, you can evaluate opportunities for increased exposure. When they’re more aggressive, it signals that additional due diligence may be warranted.

The platform’s 1,200 credit indices across 170+ countries and nearly 200 industries lets you track macro-level trends and understand how your portfolio concentrations stack up against market movements.

5. Free up resources with automated portfolio monitoring

Credit Benchmark’s automated portfolio surveillance flags positive and negative rating movements across your portfolio. With consensus data refreshed weekly, you’re getting timely signals about credit shifts that matter to your positions.

It creates additional analyst capacity to cover larger entity sets and focus on the exceptions that need immediate attention. Instead of manually reviewing thousands of static positions, your team can manage broader portfolios without having to hire proportionally more people.

The early warning indicators help you spot emerging risks before they show up in your portfolio performance numbers. When the platform’s automated alerts flag credit deterioration, you can take proactive steps rather than scrambling to react after credit events have already occurred.

You can also set up exception-based workflows that direct analyst attention to entities showing deterioration signals while the platform maintains automated oversight of your stable positions.

6. Track credit migration with credit rating transition matrices

Credit Benchmark provides Credit Rating Transition Matrices (CTMs) that forecast credit risk exposure and model risk under real-world conditions. These matrices help you predict how many entities in a portfolio are likely to upgrade, downgrade, or default over time, while adjusting for credit cycles and stress scenarios to get more accurate, forward-looking default risk projections.

You can plot credit trends, build sector-specific views, and produce term structures that reflect real-world credit behavior. These matrices address sampling variation issues by using large sample sizes and credit cycle adjustments.

To surface hidden concentration risks hiding in your portfolio, Credit Benchmark’s correlation matrices map out industry and regional correlations. This intelligence becomes valuable during stress testing and scenario analysis, where you need to understand how different credit classes might behave together under pressure.

Monthly Credit Risk IQ Industry Reports provide forward-looking analysis of default risk across sectors, geographies, and industries, including rated, unrated, private, and public entities. These reports help you spot macro trends early and adjust your portfolio positioning accordingly.

What Real Risk Teams Are Achieving with Credit Benchmark

Leading financial institutions in different sectors are using Credit Benchmark’s consensus intelligence to improve their credit portfolio management capabilities and achieve measurable improvements in risk oversight.

Here are some case studies:

How Credit Benchmark helps with credit risk management in banks

A major U.S. financial services company with approximately $190B in total assets, has embedded Credit Benchmark data into its credit models since 2017. The Chief Credit Officer uses consensus ratings to evaluate how other banks assess similar credits, particularly in preparation for Shared National Credit (SNC) examinations.

The bank initiated an internal recalibration of credit models using Credit Benchmark data to pressure test and refine probability of default (PD) and loss given default (LGD) calculations. The calibration process enhances alignment between internal models and market views, improving model accuracy and regulatory compliance.

This approach shows how consensus intelligence strengthens benchmarking for performance and efficiency in today’s risk landscape. The bank improved confidence in risk assessments by validating them against anonymized peer views for unrated entities where traditional models lacked external validation.

"Credit Benchmark has given us a clearer lens into how our peers assess credit risk, especially for unrated names. The ability to benchmark our internal views has significantly increased our confidence in risk decisions, and it's directly informed model recalibration efforts," notes the Chief Credit Officer.

How Credit Benchmark supports money management firms with portfolio monitoring

A state investment board, managing $162B in assets in retirement and trust funds, faced significant challenges in monitoring extensive networks of derivatives, securities finance, and repo counterparties. Less than 10% of their counterparties had publicly available ratings or financial disclosures.

The organization deployed Credit Benchmark data to support counterparty risk management decisions, with particular value from Legal Entity Identifier (LEI) level risk insights. Evaluating new entities previously took days of manual effort, but can now be accomplished in approximately three hours with high confidence levels.

Credit Benchmark enables the organization to expand its monitoring span exponentially, allowing it to engage with more counterparties while maintaining rigorous risk oversight. Their quarterly liquidity exercises now provide clear visibility into risk concentrations and potential operational concerns.

The investment organization also uses Credit Benchmark data to set counterparty limits more intelligently and adjust underlying exposures based on credit risk assessments. The team operates more efficiently and can make better risk decisions while maintaining comprehensive portfolio oversight.

How Credit Benchmark helps clearing houses analyze unrated companies

Canadian Derivatives Clearing Corporation (CDCC), the integrated central clearing counterparty for exchange-traded derivatives in Canada, uses Credit Benchmark data to harmonize credit assessment for different participant types. With more than 30 clearing members, including major financial institutions, CDCC requires robust risk oversight to maintain market integrity.

CDCC employs Credit Benchmark data through API integration and web applications to augment the risk assessment of clearing members and counterparties. The platform provides significant insights for private and unrated entities that traditional rating sources do not cover.

Vladimir Levtsun, Acting Director of Financial Resilience Risk at CDCC, explains: "Credit Benchmark's data has contributed to directly strengthening our ability to manage counterparty risk and enhance internal reporting, leading to more confident, proactive risk decisions. We are able to more efficiently monitor various members and service providers."

The integration enables CDCC to refine decision-making processes, manage counterparty exposures more effectively, and strengthen risk oversight capabilities in its clearing operations.

Take Control of Your Credit Portfolio Risk

Credit Benchmark provides an additional layer of insight that traditional ratings miss. It aggregates anonymized credit risk views from over 40 global financial institutions, offering broader coverage, faster updates, and a consistent reference point for validating internal assessments against market consensus.

Leading banks and financial institutions are already using this data to benchmark internal assessments, extend coverage to unrated entities, catch early signals of credit change, and optimize portfolio performance.

Interested in how Credit Benchmark can support your team’s risk analysis and portfolio management frameworks? Book a demo today.