Credit Benchmark have released the June Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

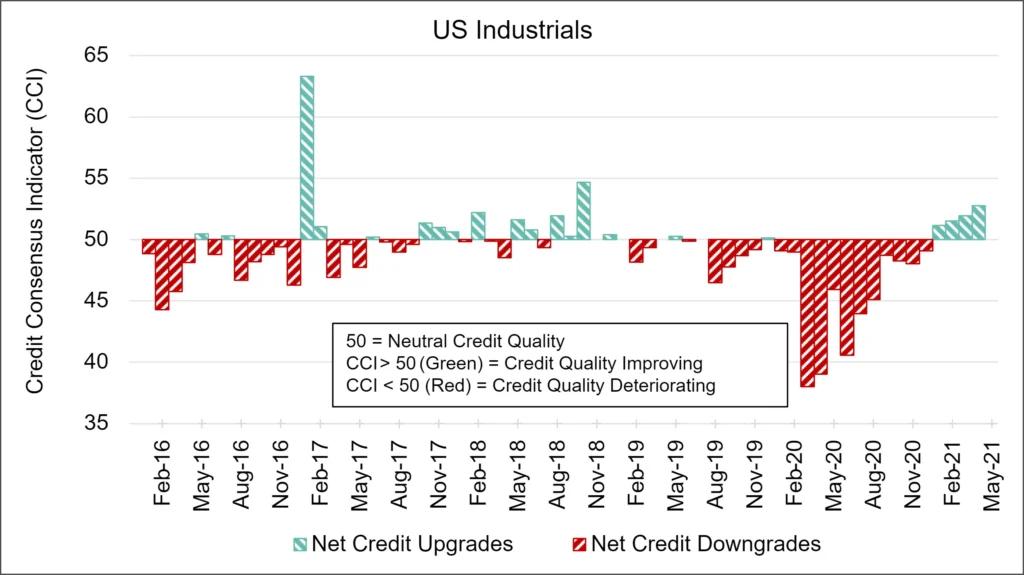

One month does not make a trend, but what about four months? That’s a question for US Industrial companies amid the latest data showing a CCI score above 50 for the fourth consecutive month, the longest stretch of positive readings since late 2018/early 2019. Better still, the overall movement in forward-looking sentiment keeps trending upwards. The latest reading is the highest since October 2018.

The UK and the EU abruptly switched positions. Last month, the UK score was the single best since this data was first tracked; now it’s firmly below 50. The EU score was neutral last month but is now solidly above 50 and in the best position since the second half of 2018.

Recovery has been bumpy in recent months but remains undeniably positive. The good news continues to outweigh the bad news for the three regions, and each have a supply of fiscal and monetary support. Yet there are still obstacles ahead, whether more regionally focused like Brexit or more global in nature like supply chain problems that could wreak havoc for multiple types of firms. Last month’s CCIs indicated that Industrials were on the mend, and the next few months will confirm whether this is true of the UK and EU as well as for the US.

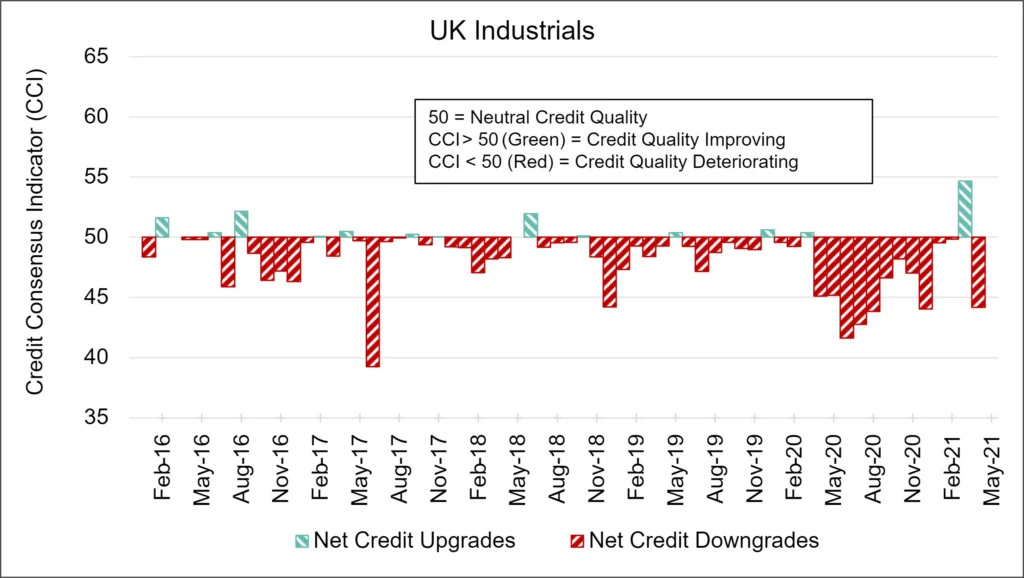

UK Industrials: A Step Backwards

After last month’s big leap forward, UK Industrial firms nosedived back into deterioration.

The UK CCI score is 44.2, a negative change from a score of 54.7 last month.

The UK’s economy and specific areas like manufacturing along with sentiment are moving in the right direction, and the latest movement may be a temporary blip. But supply chain concerns linger.

.

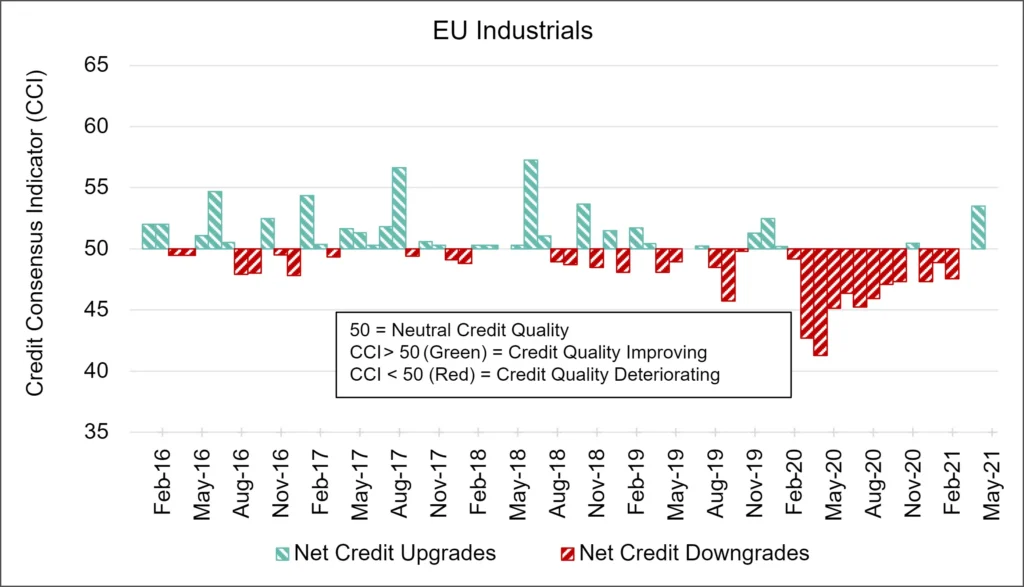

EU Industrials: Moving on Up

EU Industrial companies crossed the CCI threshold into positive territory after last month’s neutral score.

The EU CCI is 53.5 this month, a positive change from a score of neutral 50 last month.

The EU also continues to have a strong foundation, including in manufacturing, but supply chain issues may limit firms’ prospects.

.

US Industrials: Good News Continues

The outlook for US Industrials looks increasingly brighter after a nightmare run in 2020.

The US CCI score is 52.8, another step further into positive territory from last month’s CCI of 51.9.

As with the UK and EU, the US has a strong foundation, in manufacturing and elsewhere, but supply chains may hurt production.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: