To download the June 2020 Housing Aggregate PDF, click here.

.

A myriad of problems are confronting the US housing market — far fewer homes are being built and new construction planning processes are diminishing. The rate of home sales is also falling. While there is some evidence emerging that things are beginning to look up, credit problems persist for this sector.

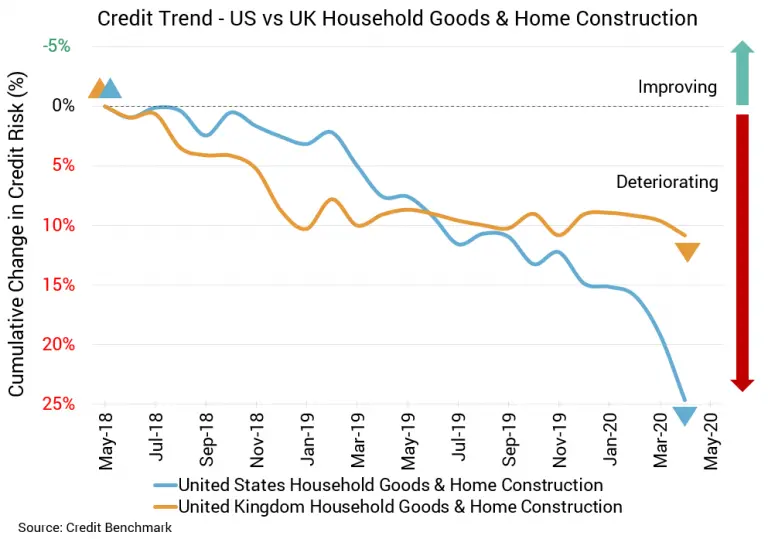

Default Risk Up Almost 16% in Last Year

- Year-over-year deterioration in credit quality for US housing sector is far greater than for UK housing sector

- Despite differences in pace of change, more than 80% of firms in each aggregate have a Credit Benchmark Consensus (CBC) rating of bbb or worse, highlighting overall credit weakness

US Household Goods and Home Construction Firms

Credit difficulties for the US housing sector are becoming more conspicuous. The deterioration in credit quality has been speeding up, with month-over-month declines of 5% and 8% over the last two months. Year-over-year, credit quality has deteriorated by 15.9%. Average probability of default for this sector continues to move up quickly, rising to 57.6 basis points with the most recent update. It was 55 basis points in the prior month and 53.5 basis points two months earlier. At the same point last year, average probability of default was 49.7 basis points. Around 80% of the firms in the sector have a CBC rating of bbb or lower with the most recent update. Over the last 12 months, the overall CBC rating for this aggregate has remained bb+.

UK Household Goods and Home Construction Firms

As described in last month’s update, credit quality for the UK housing sector has been in a holding pattern over the last year, getting worse slowly over the short-term but still flat over the long-term. The month-over-month decline was a mere 1% and the year-over-year decline was about 2%. Average probability of default is 53.4 basis points, which compares to 52.8 basis points the prior month. At the same point last year, average probability of default was 52.6 basis points. About 82% of the firms in the sector have a CBC rating of bbb or lower. The overall CBC rating for the sector over the last 12 months has stayed at bb+.

About Credit Benchmark Monthly Housing Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the household goods and home construction sectors. It illustrates the probability of default for a variety of companies in the home construction space as well as firms that would benefit from increased home building and buying. Worsening credit risk means a greater probability of default; improving credit risk means a reduced probability of default. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.