German growth numbers are at a five-year low and a recession looks increasingly likely. German exports are still growing but the rate has been hit by China’s internal and external economic challenges, as well more global trade-related problems. The global auto sector is facing a pause in demand as technology pivots towards electric cars, and Brexit-related uncertainty has had a negative impact on manufacturing related output.

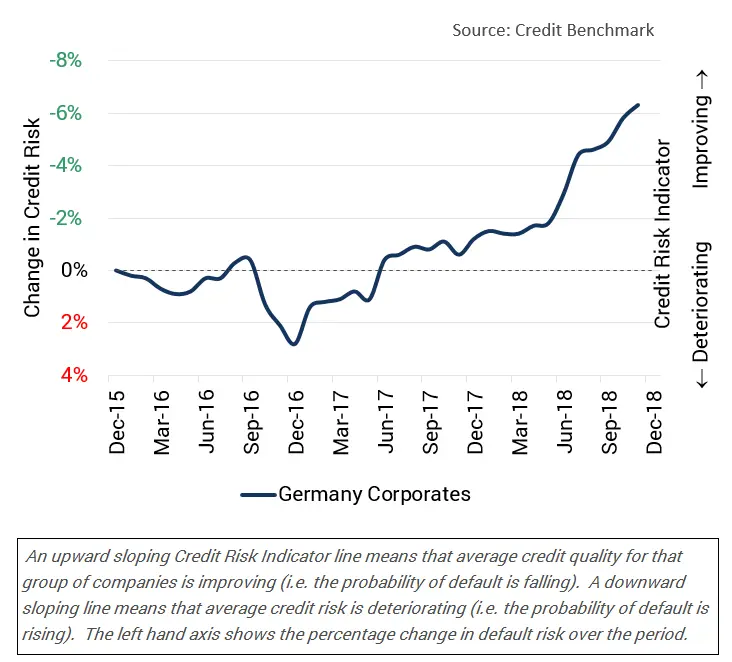

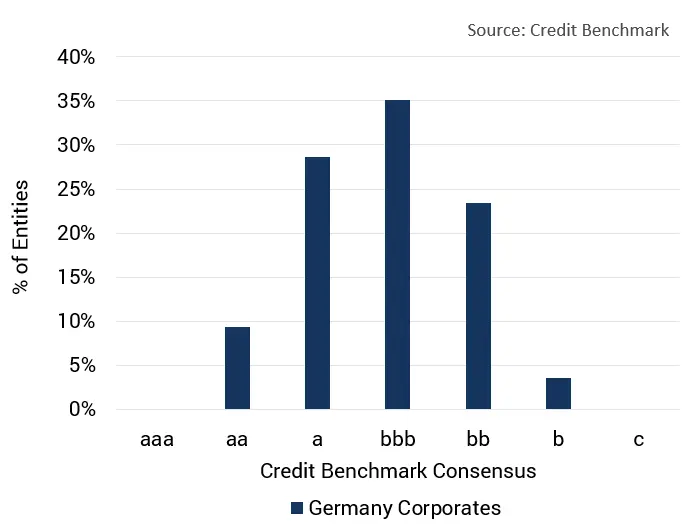

As the top chart below shows, a sample of 195 German corporates are typically of high credit quality; the majority are in the bbb category but the aa category is the second largest. The bottom chart shows a modest but consistent improvement in German Corporate credit quality over the past two years. This improvement may plateau or even reverse if the economy goes through a protracted downturn, but bank-sourced credit data from Credit Benchmark suggests that the German Corporate sector is strongly positioned to weather this.