In 2011, FTSE350 boards were 91% male, and 150 of those companies had no female board members at all. In 2015, the Hampton-Alexander review set a 2020 target of 33% for average female representation – and this was achieved in May 2020.

Companies that embrace diversity are more likely to be progressive in multiple ways, but corporate diversity also exerts a subtle but powerful and direct influence on performance, because constraints in any form tend to be bad for business. A McKinsey & Company report found that the greater the representation of women executives at a company, the higher the likelihood of outperformance – with up to 48% separating the most from the least gender-diverse companies.

A gender-diverse leadership certainly seems to be linked to financial strength; consensus credit ratings are noticeably better in companies with more females on their board. Credit Benchmark currently cover 248 companies in the FTSE350 universe, and 80% of these companies meet the 33% target for women on their board.

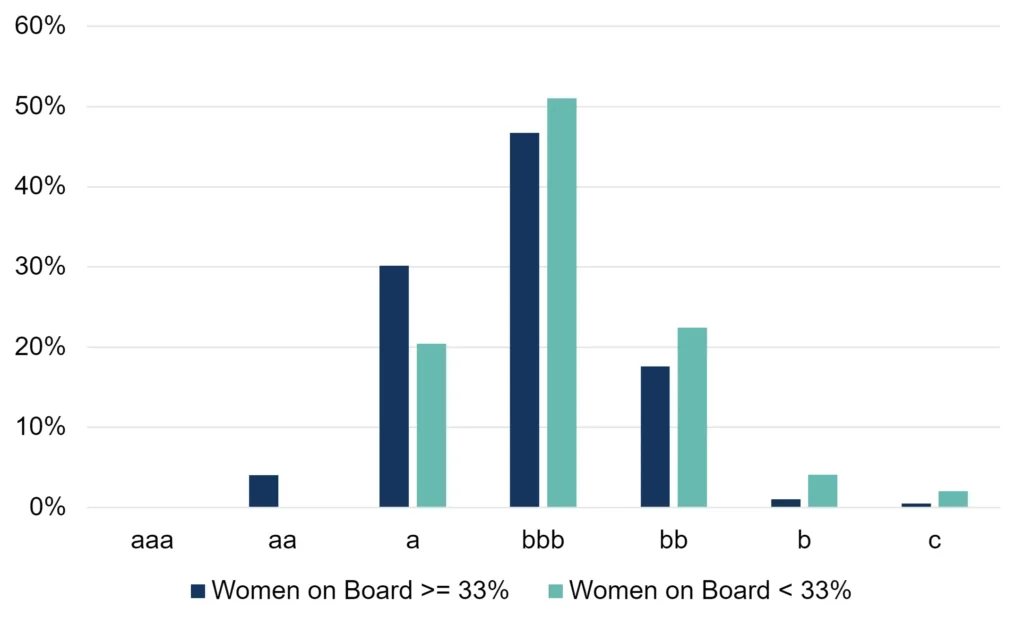

Figures 1 shows the credit distributions of the 248 companies in the FTSE350 universe that meet / don’t meet the 33% target for women on boards.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark for a complimentary trial or coverage check.

Figure 1: Credit Distribution of 248 companies in FTSE350 universe, Jan-2022

81% of companies who do meet the 33% target for women on boards have an IG credit rating in Jan-2022. This is 10 percentage points higher than companies who do not meet the 33% target.

In addition, 4% of companies that meet the target have a credit rating of aa; those that miss the target have no companies higher than the a category.

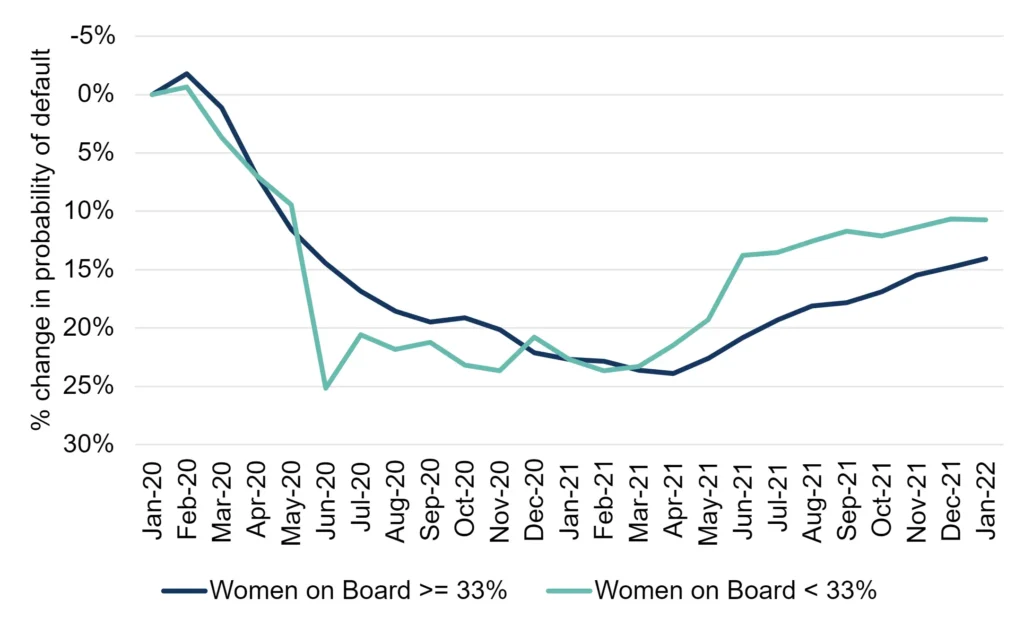

Figure 2 shows credit trends for the 248 companies in the FTSE350 companies that meet vs. don’t meet the 33% target for women on boards.

Figure 2: Credit Trends

Serco Group PLC and Hill & Smith Holdings PLC are examples of FTSE350 companies who meet the 33% target for women on their boards. Both companies have shown improvement in the past year and currently hold an IG credit rating. Both companies are currently not rated by either S&P or Fitch.

Figure 3: Serco Group PLC

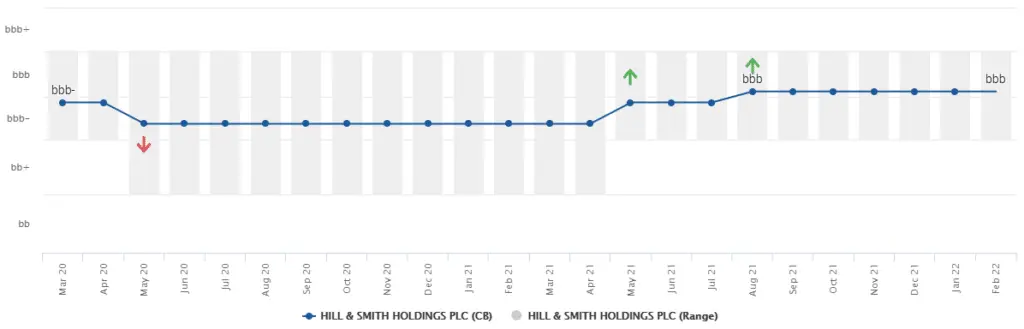

Figure 4: Hill & Smith Holdings PLC