Over the past year, the iShares Global Timber & Forestry ETF has risen by more than 35%, with the S&P 500 flat over the same period. This surge in investor interest in a previously moribund sector is being driven by a number of factors. These are discussed in detail in a McKinsey podcast from December 2017: https://www.mckinsey.com/industries/paper-and-forest-products/our-insights/how-the-paper-and-forest-products-industry-thrives-in-the-digital-age.

A major driver is the boom in online deliveries, usually wrapped in paper and cardboard. Much of this is recycled, but the online packaging market will show sustained growth for many years, so it will need a steady source of new supply as well. In addition, the growing global middle class is driving demand for viscose textiles and tissues in various forms – another market which shows no signs of slowing.

The most recent development is the new focus on recycling and sustainability, as the plastics backlash gathers pace. Much of the world’s plastic waste ends up in the oceans; the size of the “Great Pacific Garbage Patch” alone has been estimated to be equivalent to the area of France and Germany combined. Alternatives to plastic need to be developed urgently just to slow its rate of increase.

If timber-based products are a credible alternative to plastics, new sustainable sources of timber are required. That means conversion of land to timber-growing, research into faster growing timber types, and more efficient recycling (currently recycling provides about 50% of supply). At the other end of the paper supply chain, research has begun into “smart packaging” to tackle counterfeiting and the development of carbon fibre from timber-based lignin.

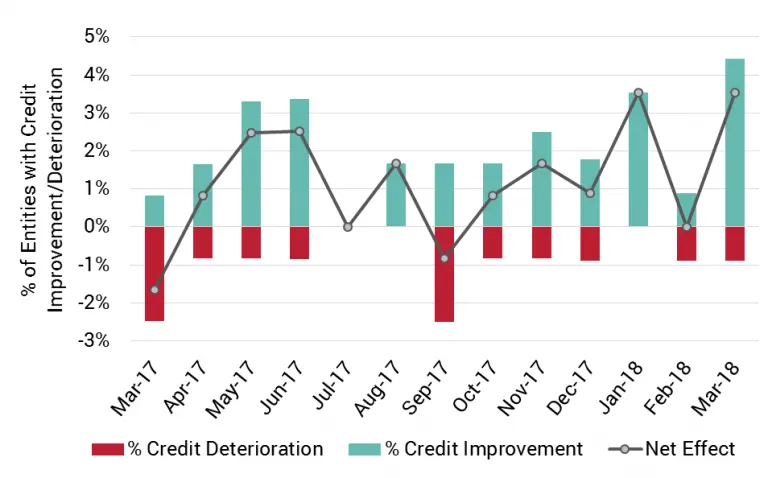

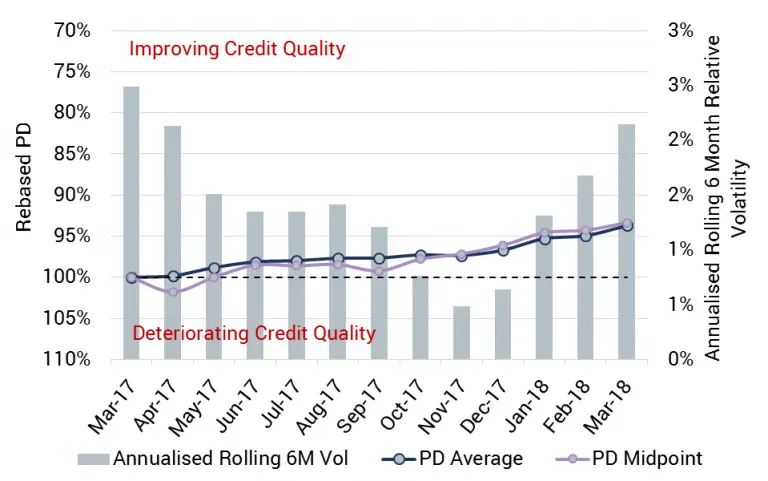

This increasingly positive outlook is reflected in the credit quality of Forest Products companies. The charts below show recent trends in bank-sourced credit risk for more than 100 companies in this sector.

The uppermost chart shows that the balance of upgrades vs. downgrades strongly favours upgrades; the bottom chart shows that there has been a moderate but steady increase in credit quality since early last year. Based on recent equity performance and the sector drivers discussed here, further credit improvements seem likely.