Download the latest Financial Counterpart Monitor below.

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions.

It has been a mixed bag in terms of credit movement this month, across all Global Financial Counterpart categories.

Banks

Banks are dominated by negative credit movements this month. North American Banks and APAC Banks have the weakest showing, with improving to deteriorating ratios of 1:1.6. Conversely, Central Banks have the strongest showing, with an improving to deteriorating ratio of 1.6:1.

Intermediaries

Broker Dealers stand out with the strongest bias towards credit improvement, with an improving to deteriorating ratio of 1.7:1. However, Custodians and Sub Custodians are in the red with a ratio of 1:1.4.

Buy Side

Buy Side Managers are wholly negative this month. On the other hand, Buy Side Owners are either positive or balanced.

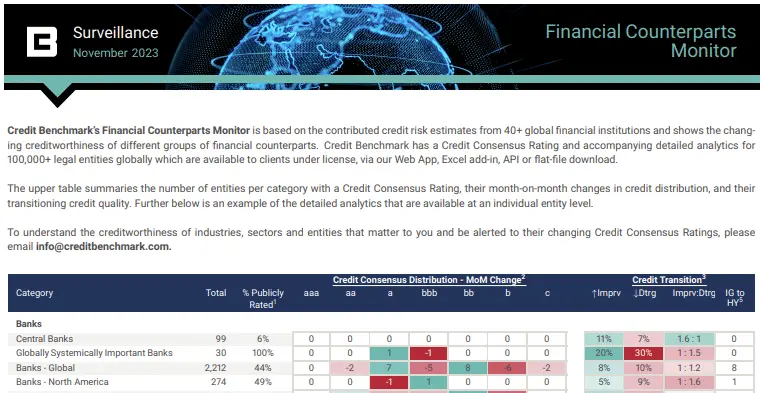

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.