Download the latest Financial Counterpart Monitor below.

The latest Credit Benchmark consensus data on financial counterparts are largely positive with some exceptions.

Intermediaries came out best. Custodians and Sub Custodians had the strongest ratio of improvements to deteriorations at 3.2:1, followed by Broker Dealers at 1.9:1 and CCP Members at 1.3:1. Central Clearing Counterparts had no instances of deterioration in the latest update. The category of Prime Brokers showed the weakest position but at a 1:1 ratio, remained neutral overall.

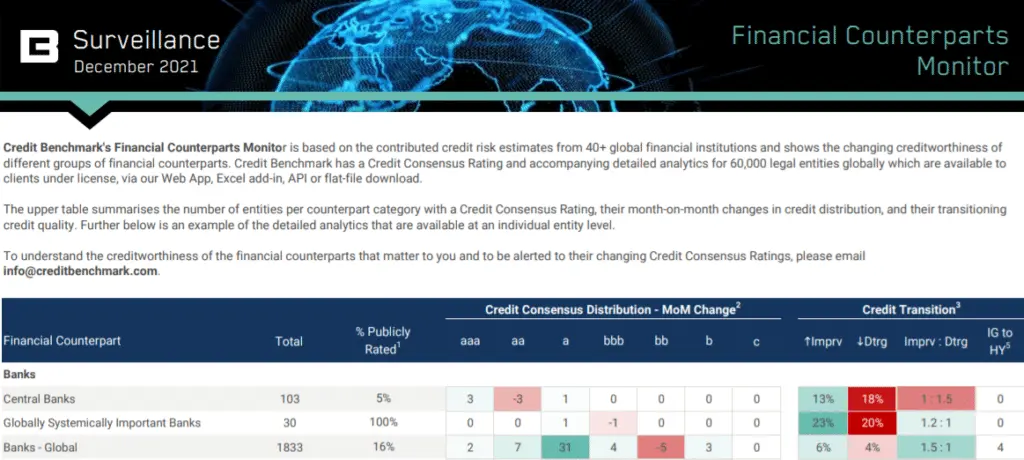

Banks also showed strength but not across the board. With an improving to deteriorating ratio of 1.9:1, APAC Banks were in the best position. The broad category of Global Banks had a ratio of 1.5:1, as did the sub category of EMEA Banks. Ratios for North America Banks and G-SIBs were 1.3:1 and 1.2:1, respectively, still on the positive side. Central Banks saw slightly more deterioration than improvement with a ratio of 1:1.5. Latin America Banks saw only deterioration, but it was minor.

As for the buy side, Asset Managers tipped the balanced slightly towards the negative at 1.1:1 improvements to deteriorations; the reverse was true for Insurance Companies at 1.1:1. Mutual Funds and Pension Funds both side more improvement than deterioration at 1.4:1. Sovereign Wealth Funds saw an equal amount of each.

According to David Carruthers, Research Adviser at Credit Benchmark:

“Improvement is always the goal, but just as one weak month isn’t necessarily cause for alarm, one good month isn’t always cause for celebration. Sector-specific issues exist, but at this point, the best metrics to watch may be overall economic growth related to the pandemic, supply chain challenges, and monetary policy. These macro factors will exert strong influence on the overall financial system.”

One category-specific issue is potential changes to European regulations that could cause increases to the minimum required capital for unrated entities. This is a concern not just for corporates but also for funds, the vast majority of which are unrated, as Credit Benchmark has highlighted.

As Bloomberg noted, there are plenty of related considerations, including sustainability and climate that are not a focus not just for European banks but those in the US and elsewhere, too, like The Wall Street Journal described. Credit Benchmark recently noted this was an issue for insurance firms.

As for the overall economy, supply chain challenges may be easing, as per Bloomberg and The Wall Street Journal, but plenty of pressures remain.

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.