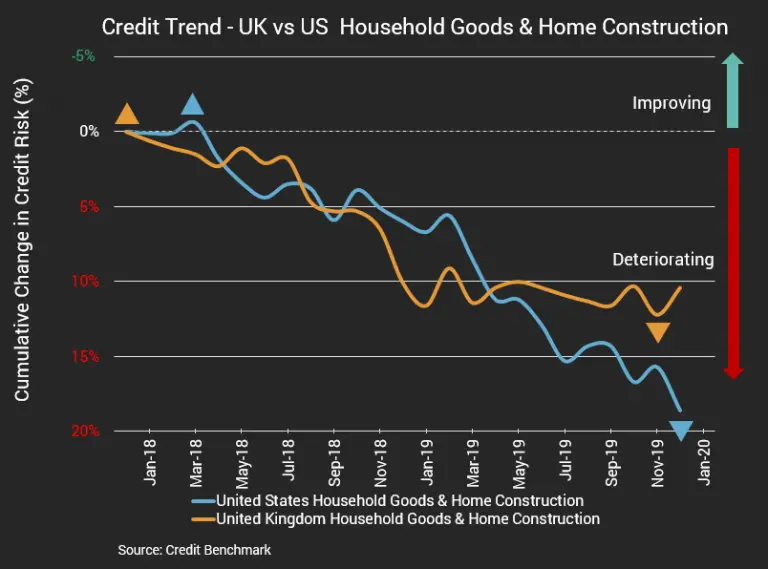

US building permits hit a 13 year high this week, supported by a low mortgage rates. Despite this apparently positive outlook for the sector, Consensus credit risk data indicates that credit quality for US Household Goods & Home Construction companies has been steadily falling for some time.

In the UK, post-election optimism and increased certainty around Brexit has led to a ‘new year bounce’ in the number of new buyers and sellers entering the market. UK Household Goods & Home Construction firms have seen greater stability in their credit quality fortunes over recent months compared to their US counterparts.

Default Risk for US Firms Up Almost 12% in Last Year

- Credit quality for US-based firms continues to deteriorate, with overall probability of default increasing 12% on a year-over-year basis.

- UK-based firms have seen relative credit stability in recent months.

- Credit Benchmark Consensus (CBC) rating is bb+ for both aggregates.

US Household Goods and Home Construction Firms

The overall credit picture for US firms continues to worsen. The group saw credit quality deterioration of 2.5% on a month-over-month basis and 12% on a year-over-year basis. The average probability of default for this aggregate is currently 53.5 basis points, compared to 52.2 basis points in the prior month and 47.8 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) rating is bb+, unchanged from the prior month and a downgrade from bbb- at the same point last year.

UK Household Goods and Home Construction Firms

In contrast to the US, the credit situation for UK firms has stabilized. Credit quality deteriorated by 1.7% on a month-over-month basis but has been essentially flat on a year-over-year basis, dropping by only 0.2%. The average probability of default for this aggregate is 53.7 basis points, compared to 54.6 basis points in the prior month and 53.6 basis points at the same point last year. The current CBC rating is bb+, consistent with last month and the same time last year.

About Credit Benchmark Monthly Housing Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the household goods and home construction sectors. It illustrates the probability of default for a variety of companies in the home construction space as well as firms that would benefit from increased home building and buying. Worsening credit risk means a greater probability of default; improving credit risk means a reduced probability of default. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

About Credit Benchmark

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 50,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 75% of the entities covered are otherwise unrated.

To download the February 2020 Housing Aggregate PDF, click here.