The recent award of the 2022 Nobel memorial prize in Economics to Bernanke, Diamond and Dybvig for their work on banking regulation and liquidity is well-timed. As the era of low interest rates draws to a close in the face of post-Covid adjustments and international tensions, it is a reminder that the global financial system has already weathered the 2008/9 crisis and the pandemic, largely thanks to the insights from these economists.

Government intervention in financial markets is rising – power company bailouts (Europe), currency intervention (Japan), record reverse repos to absorb excess investor cash (US Fed) and direct buying of Government bonds (UK). These are signs of stress as investors and business adjust to a high inflation / high interest rate environment. This stress has had a knock-on effect to funds – whether it is banks having to rein in lending to hedge funds, pension funds cutting their interest rate swap exposure, or mutual funds having to manage withdrawals (and halting them in the case of some illiquid property funds).

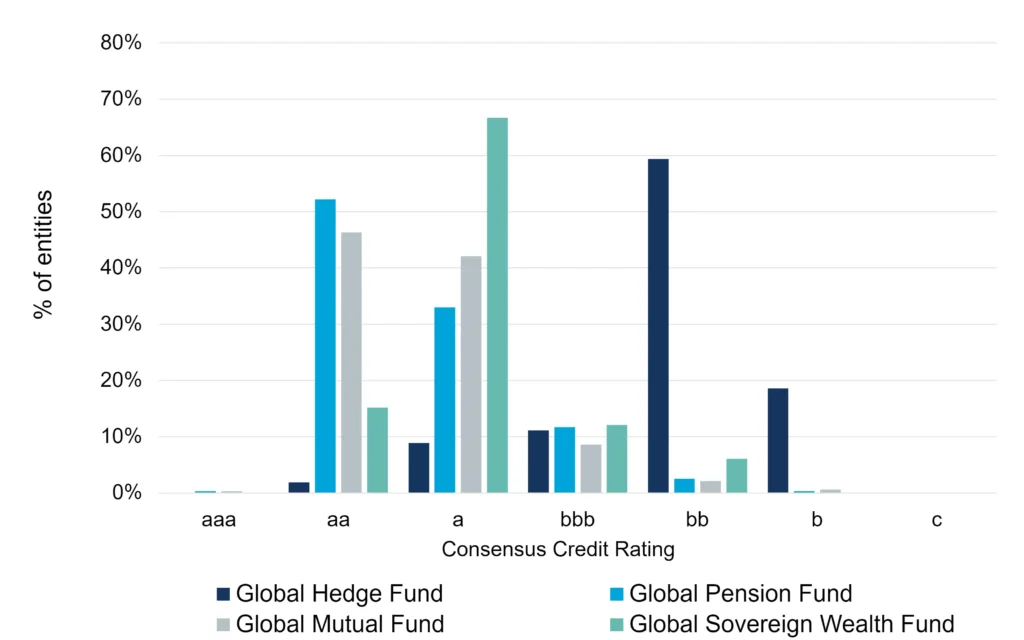

Figure 1 shows the credit distribution for global funds.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. To arrange a demo of all single name and aggregate data detailed in this report, please request this by sending us an email.

Figure 1: Credit Distribution of Global Funds, Aug-22

Sovereign Wealth funds ($10trn) are concentrated in the a category; Pension Funds ($50trn) dominate the aa category. Mutual funds ($45trn) are spread across aa and a, while Hedge Funds ($5trn) are predominantly in the bb category.

One of the key insights from the Nobel Prize Winners is this: “A bank crash leads to loss of crucial information that banks acquire (and can pass on to others) on savers and borrowers. Without such assurances about the credit-worthiness of businesses and households, liquidity cannot be quickly re-established”. This highlights the connection between credit and liquidity, making the point that credit assessments are a form of market information.

Consensus ratings published by Credit Benchmark are, in effect, the same “crucial information” that Bernanke, Diamond and Dybvig describe, contributed monthly by 40+ large banks. Current coverage extends to more than 60,000 legal entities; half of that is in funds, the once overlooked and unrated but now increasingly critical element in global financial plumbing.