On January 25th, the Dow Jones Industrial Average (the “Dow”) closed above 20,000 for the first time in its history. This milestone has made headlines around the world, and is seen as a vote of confidence in the economic agenda of the new administration. However, bank data shows that the credit risk of the Dow constituents has been trending steadily higher.

The Dow has been continuously calculated since 1896, and its constituents represent some of the largest listed corporations in the US. Although it has some idiosyncrasies (it is a price weighted average of just 30 stocks), it remains one of the most globally recognised indices.

Since the US Presidential Election in November, the Dow has risen by 10% in line with the broader US stock market rally. Investor mood has been buoyed by expectations that Trump’s pro-business and anti-regulation policies will boost the economy, as well as a specific campaign promise of $1 trillion in infrastructure investment.

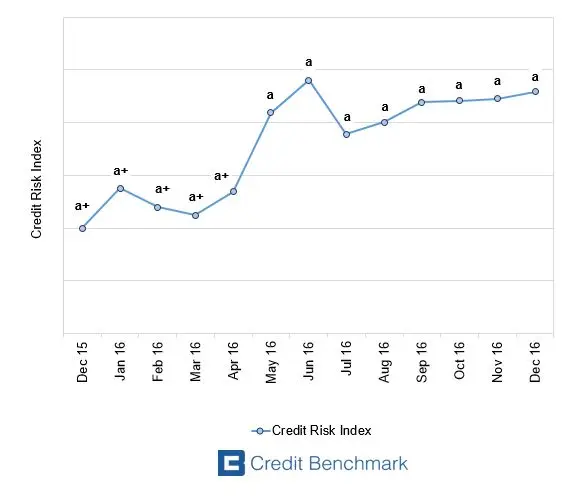

The Credit Benchmark dataset provides a CBC* for each of the 30 Dow constituents. Seven of these showed an improvement in credit risk over the past year; the remaining 23 have deteriorated. And as the chart below shows, the average CBC for the 30 constituents has declined one full notch from a+ to a over 2016, with the largest move occurring in May 2016.

US Government policy may be pro-business, but banks appear to be increasingly cautious about the wider economic environment.

*CBC = Credit Benchmark Consensus; a 21-category scale which is explicitly linked to probability of default estimates sourced from major banks. A CBC of bbb+ is broadly comparable with BBB+ from S&P and Fitch or Baa1 from Moody’s.

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.