Precarious politics are causing flux in global stock markets, with trade wars, Brexit, political shocks in Argentina and protests in Hong Kong all causing investor jitters. Market indicators around the world have been flashing red as US, European and Asian stocks all dropped last week. Investor risk appetite seems to be waning, with the US Treasury yield curve inverted for the first time since June 2007 – a red flag for a possible recession.

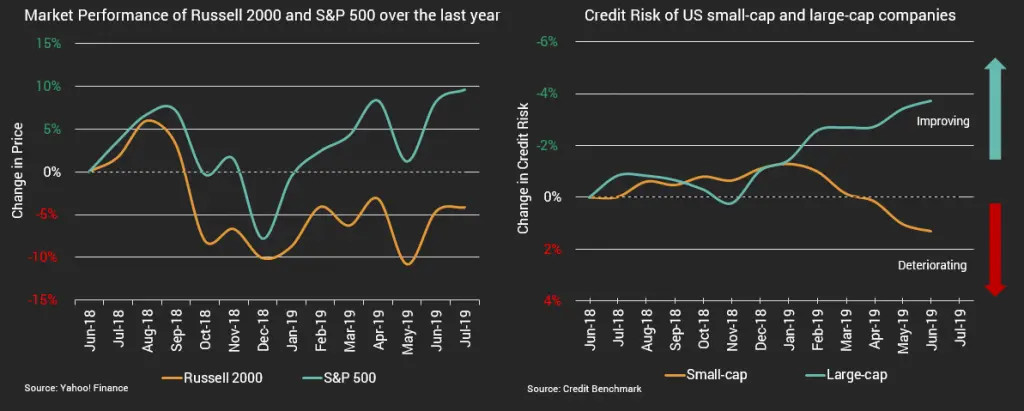

Another well-known financial indicator in uncertain times is the relationship between the S&P 500 and Russell 2000 indices, and their relative performance is closely monitored by investors. These two indices have experienced diverging trends over the last 6 months, with the S&P 500 registering healthy growth of nearly 20%, compared to 7% for the Russell 2000. With the S&P 500 representing large multinational companies, it is strongly correlated with the global economy; the smaller, more volatile businesses in the Russell 2000 are more dependent on domestic trends. Does the weakness of the Russell 2000 show that investors are turning bearish? The divergence could be a temporary slow-down in small-cap companies, or it may signal a more ominous turning point.

Credit Benchmark’s consensus credit risk dataset, sourced from the world’s leading financial institutions, provides a valuable comparison to the S&P 500 and Russell 2000 indices. By comparing the credit risk trend of 450 large-cap and 700 small-cap US companies (all of which are members of the S&P 500 and Russell 2000 indices), a similar pattern of divergence can be seen. The credit quality trends were aligned in 2018 but started to move in opposite directions at the start of 2019, with credit quality for large-caps increasing by 3% over the last 6 months while small-caps deteriorated by 2% over the same time period.

The relationship between the deterioration of the Russell 2000 and the Credit Benchmark small-cap index may be signaling a fundamental problem affecting smaller US companies, and potentially a market turning point.