In June 2022, British American Tobacco flagged that the global tobacco industry volume is now expected to shrink by 3% in 2022, worse than the 2.5% decline previously forecast, due in part to the continuing global uncertainty over the war in Ukraine.

For Imperial Brands PLC, one of the top 10 largest tobacco companies in the world, earnings are forecast to decline by an average of 1.9% per year for the next 3 years.

The introduction of stricter tobacco measures globally – such as the Tobacco and Smoking Products Control Bill 2022, requiring retailers to be licensed, raising the age requirements to purchase tobacco products and raising taxes on tobacco products – all contribute to this change. Recent evidence from the US is that raising the age of sale from 18 to 21 has reduced smoking prevalence in that age group by at least 30%.

In addition to this, with smoking highly likely to worsen the symptoms of COVID-19 and the risk of associated death, a Danish study recorded that among regular smokers tobacco purchases declined by about 20% between March 2020 and the end of 2020. This has contributed to a sustained decrease in tobacco purchases.

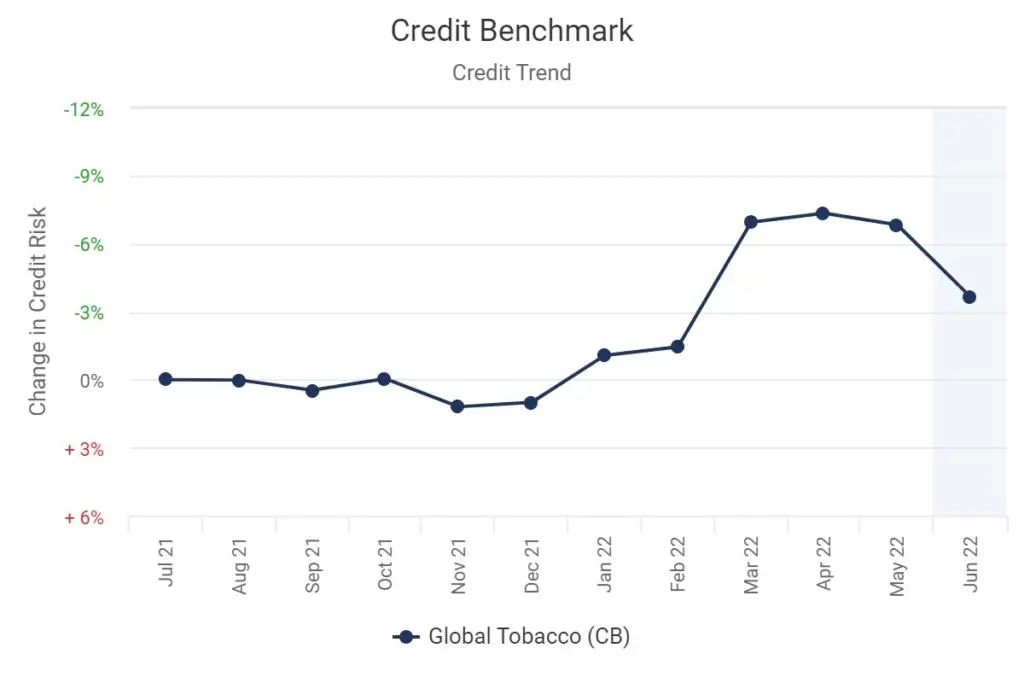

Figure 1 shows the credit trend for the Global Tobacco industry.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: Credit Trend, Global Tobacco; Jul-21 to Jun-22

Global Tobacco credit quality has weakened by 3.4% month-on-month. However, Global Tobacco is still currently rated a bbb+ – an investment grade rating.

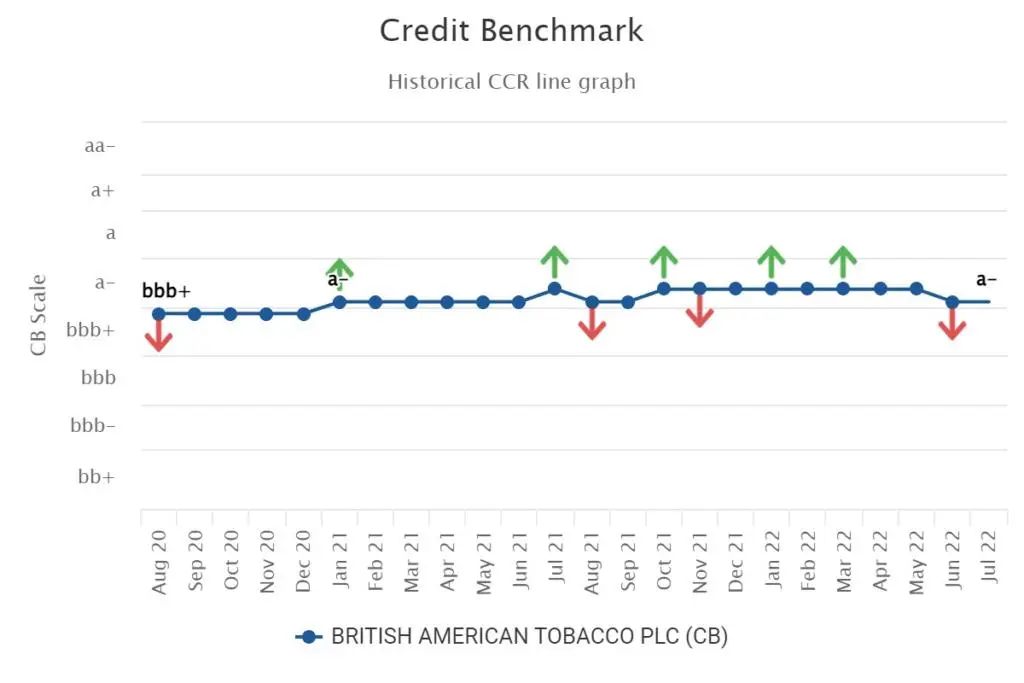

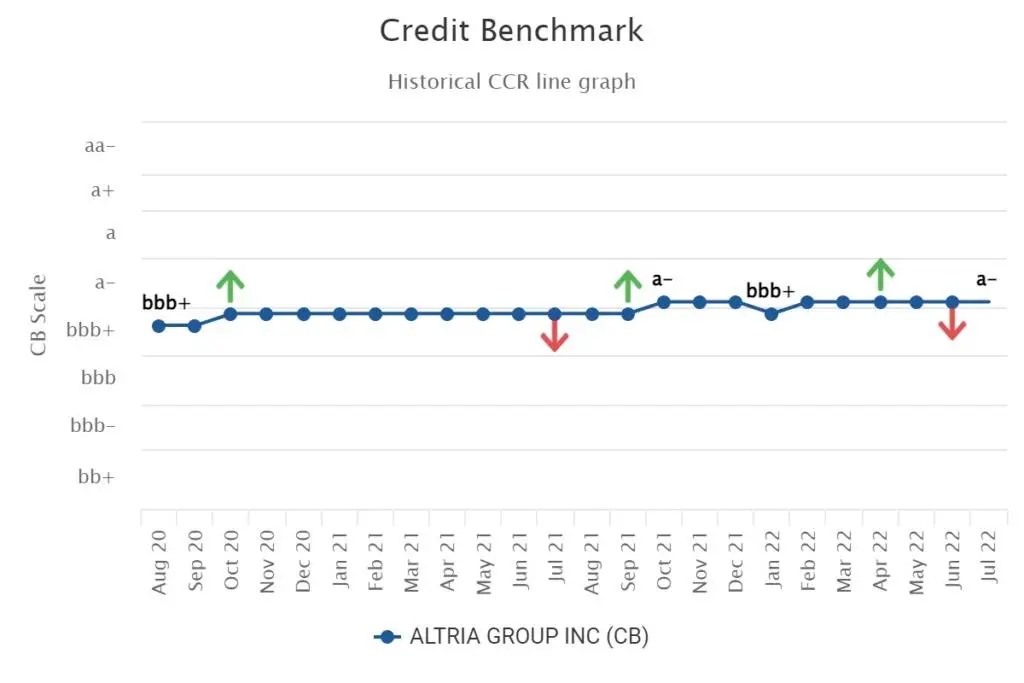

Figures 2-4 show detailed credit trends for some of the largest tobacco companies in the world; many are recording a deteriorating Opinion Change Indicator in the latest month.

Figure 2: Philip Morris International Inc

Figure 3: British American Tobacco Plc

Figure 4: Altria Group Inc

Enjoyed this report? If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 60,000+ public and private global entities, please complete your details to start a trial or to request a coverage check: