Regional divides and sector stress reshape the US credit risk landscape.

Credit Benchmark’s US Default Risk Regional Trends analysis highlights emerging pressures and resilience across the American economy. Based on forward-looking consensus credit data from 40+ leading banks, the study spans more than 8,000 corporates and financial institutions, with nearly 2,000 indices covering 8 regions, 50 states, and 86 sectors, and history dating back to 2018. The data reveals sharp regional and sectoral contrasts, with clear signs of where default risk is accelerating and where stability persists. From ongoing corporate strain to a nascent rebound in financials, the US landscape reflects shifting economic dynamics with pockets of concentrated stress. For credit and portfolio managers, these insights provide an early warning system, helping identify emerging vulnerabilities, guide exposure decisions, and position portfolios for resilience in a rapidly changing market.

Executive Summary

- Compass split: West and South are riskier.

- Corporate deterioration continues, Financials improving since Q4 2024.

- All regions show corporate deterioration, financials more mixed.

- Rocky Mountain Corporates, Great Lakes Financials show largest deterioration.

- State-level sector default risk spikes concentrated in Autos, Pharma, Chemicals.

- Trucking, Real Estate, and Technology have highest % in c-category.

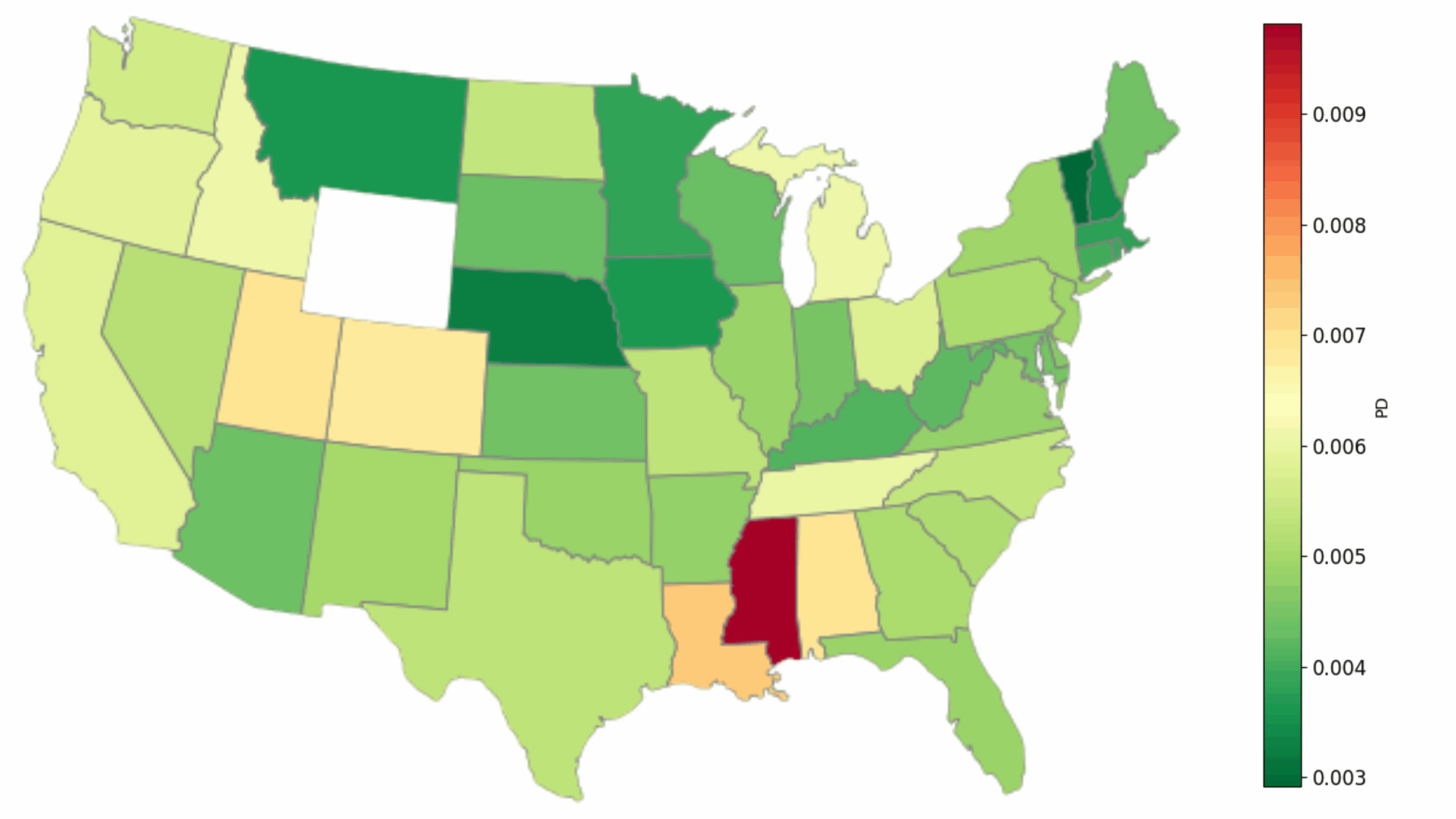

The following map shows average Corporate and Financial default risk for US states:

Corporate & Financial Default Risk for US States

Grouping the states into eight distinct regions shows clear East-West and North-South splits:

Corporate & Financial Default Risk for 8 US Regions

These regions, listed in descending order from highest default risk to lowest default risk are:

- Rocky Mountains

- Far West

- South East

- South West

- Great Lakes

- Mid East

- Plains

- New England

Broadly, these regions group around the economic hubs of California, Colorado, Texas, Illinois, Florida, New York and Massachusetts.

Default Risk Trends

US vs. Global: Corporates and Financials

Global Corporates and Financials began deteriorating after the Ukraine invasion, but Global Financials – including US – have steadily improved since the US election.

New England vs. Mid East: Corporates and Financials

Since 2020, default risks for North East US Corporates and Financials have been trending higher. Mid-East Corporates (includes New York), are the most volatile although New England (includes Boston) have recently overtaken them. New England financials are stabilizing after a recent sharp decline.

Far West vs. South West vs. South East vs. Global: Corporates

South East Corporates track Global Corporates very closely. South West (including Florida) deteriorated most and recovered least during Covid, but other regions are catching up. Far West (including California) initially tracked the Global Corporate aggregate, but risk has risen steadily since late 2022.

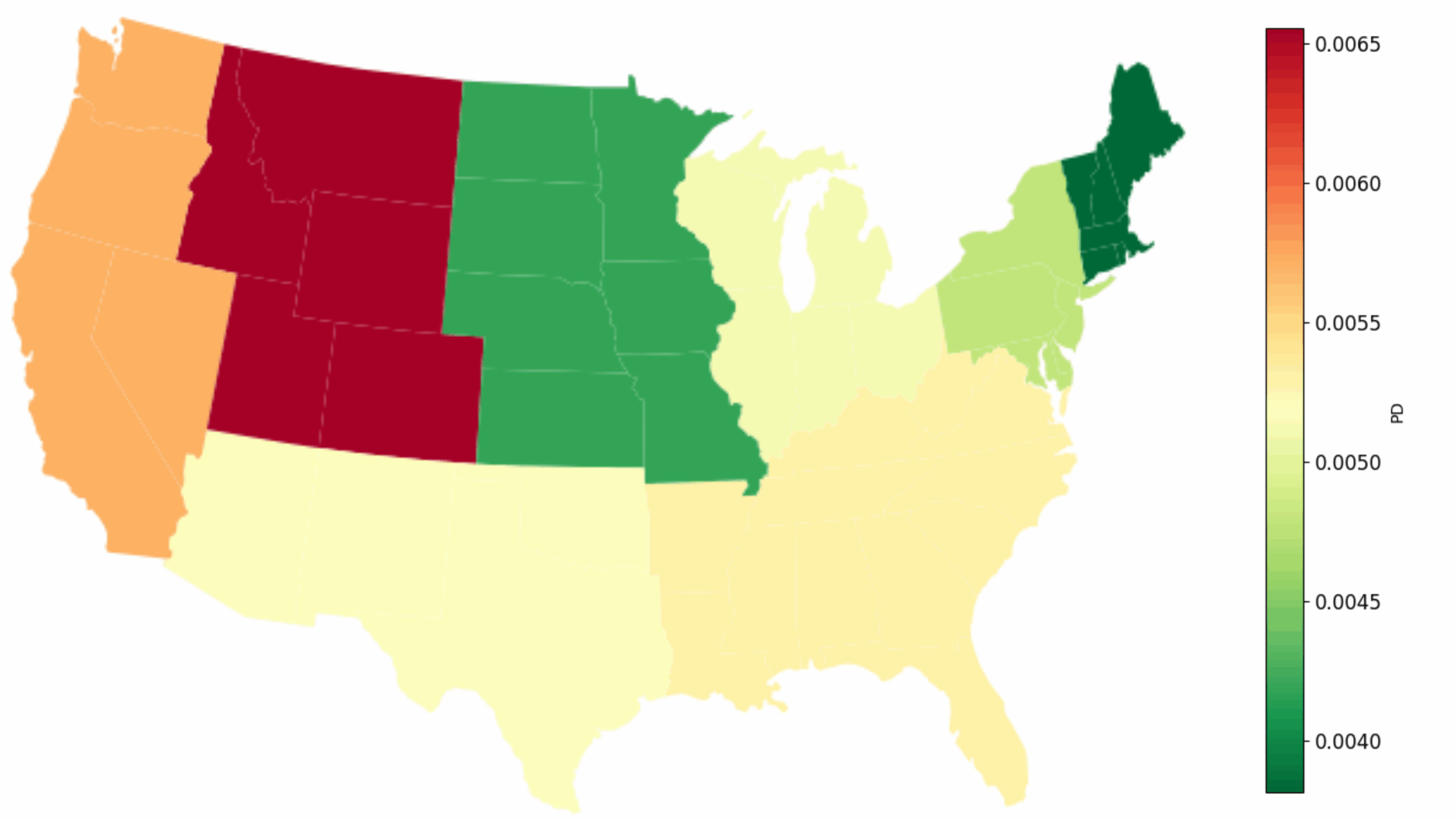

Great Lakes vs. Rocky Mountains vs. Plains vs. Global: Corporates

Great Lakes Corporates (including Chicago) track the Global index very closely. Rocky Mountain Corporates initially followed a similar pattern, but since mid 2022 they have deteriorated faster than any other US regional aggregate. Plains Corporates continued to outperform.

Far West vs. South West vs. South East vs. Global: Financials

South West and South East Financials track the Global Financials index very closely. Far West shows a net credit improvement after Covid, but tracked the other indices during 2023/24. But it has been trending better again since Q4 2024.

Great Lakes vs. Rocky Mountains vs. Plains vs. Global: Financials

Great Lakes are the worst performing Financials region in the US. Plains and Rocky Mountain Financials outperformed the global index significantly during 2020-2022, but they have since deteriorated sharply and caught up with the global index.

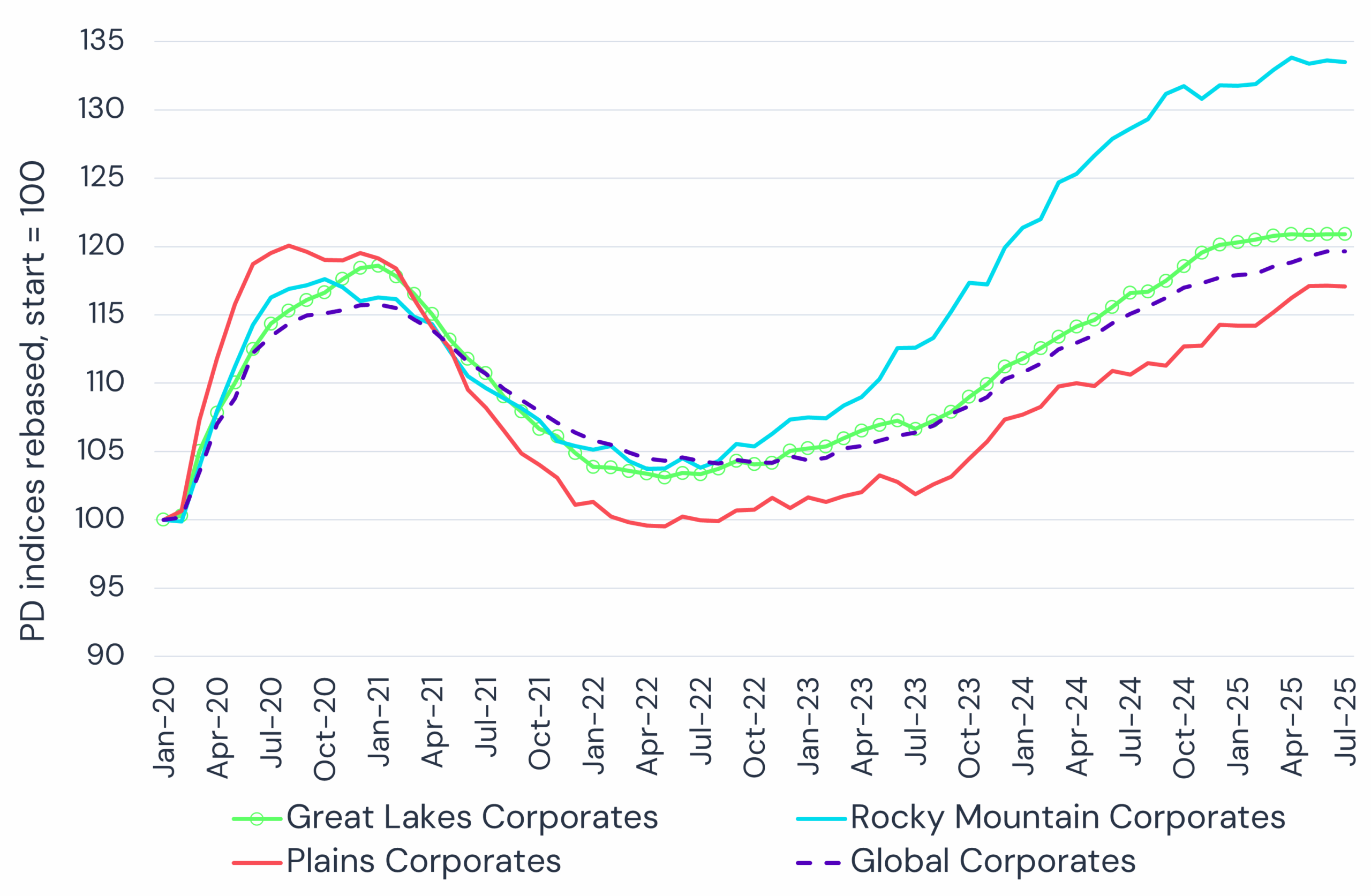

The scale and geographic diversity of the USA makes it effectively a set of overlapping regional economies that at times show large divergences. The chart below summarizes post-election trends by region (sorted by Corporate default risk changes).

Post-Election Change in Default Risk by US Region: Corporates and Financials

All Corporate risks have increased since late 2024. Plains show the largest (4%) Corporate risk spike (but also the largest Financials decrease).

New England is next largest (3.5%) for Corporate increase. Mid East, South East and Rocky Mountain Corporates are all up by around 2%. Financial risks show less variation, up most in South West and Rocky Mountain, down in Plains and Far West.

State by state, net credit downgrades show a mixed picture:

Net Credit Downgrades, Last 6 Months: By US State

Post-election, most states show a credit downgrade bias, but the average credit upgrade bias is much higher. Hawaii, Rhode Island and South Dakota lead the net upgrade group with 13%-20% skew to credit upgrades. Montana, North Dakota and New Mexico are in the 5% – 10% net credit upgrade range. Missouri and Oklahoma lead the downgrades group, but the skew is 10% or less. Arizona, Oregon, Minnesota, Tennessee, Maine, New Jersey and New England all have a net credit downgrade bias of around 5%.

The next chart shows State / Region / Sector combinations with 20 largest decreases and increases in default risk over the past 12 months.

Largest Decrease / Increase in Default Risk, Last 12 Months: By Sector and US State / Region

There are improvements in various consumer, service and insurance sectors, as well as construction and transportation, but the group shows a wide geographic scatter.

Deteriorations are slightly more geographically concentrated (New York and Delaware appear twice, along with other North Eastern states) but sector concentrations are the most striking – Autos, Pharma and Chemicals represent half of the top 20 deteriorations; these are all sectors that have already seen material impacts from the earliest tariffs and other trade-related disruptions.

Across the US, the sectors most at risk of spikes in default rates are those with the highest proportion of borrowers in the ‘c’ category:

US Sectors with Highest Exposure to ‘c’ Credit Category

Trucking is the highest at 11%, with Real Estate at almost the same level. Technology – both Hardware and Software – follow in the 8% – 10% range.

Industrial Engineering, Farming and Specialty Chemicals are all around 8%. The remainder include Pharma and Autos, which also show up in the Top 20 State & Region level deterioration list.

Regional Credit Profiles (Corporate & Financial)

The below table shows that all Corporate regional average PDs are above the High Yield threshold. Rocky Mountain is the highest (82 Bps), Plains the lowest (55 Bps). Financials are all comfortable within the Investment Grade bracket, but New England and Plains stand out as being exceptionally low (both 22 Bps).

Across Corporates, Rocky Mountain also has the highest proportion in the ‘c’ category (8%) with Far West and New England next at 6%. Plains and South West are lowest at 4%. Within Financials, the highest ‘c’ category % regions are Far West and South West, both at 4%. New England and Plains are again the lowest at just 1%.

The net credit downgrade¹ column show Corporates as hardest hit over the past 12 months, but Financials also showed a widespread bias to credit downgrades. Financials shifted to net credit upgrades over the past 6 months, and that trend persists in data for the past 3 months – with Rocky Mountain Financials as the only exception. However, Rocky Mountain Corporates are the only region showing net credit upgrades over the past 3 months.

Conclusion

The US default risk landscape is increasingly uneven, with Corporates deteriorating across every region, Financials showing selective resilience, and sector-specific fault lines intensifying. For credit and portfolio managers, the data suggests that risk is concentrating in defined geographies and industries, making proactive monitoring and dynamic allocation critical. Leveraging forward-looking consensus data offers a competitive edge — helping identify early signals of stress, anticipate default clusters, and safeguard portfolios against the next wave of credit events. Get in touch with us to book a demo with our experts.

Download

¹ Deteriorations minus Improvements as a % of Total Constituents.