Tariff threats are reshaping global credit risks, exposing sectoral and regional vulnerabilities.

- Tariff proposals have already triggered investment shifts, trade disruptions, and significant rises in corporate default risk globally.

- Forestry, Transport, Retail, and Basic Materials are facing rising pressures; some sectors like Airlines and Gold Mining show improvement.

- Countries like Ireland, Mexico, and Canada see increased credit risk, while others adjust via new supply chains and sectors.

US tariff proposals announced on 2nd April are on pause till this month, but have already led to a string of trade deals and impacts on investment decisions, trade flows and credit risks.

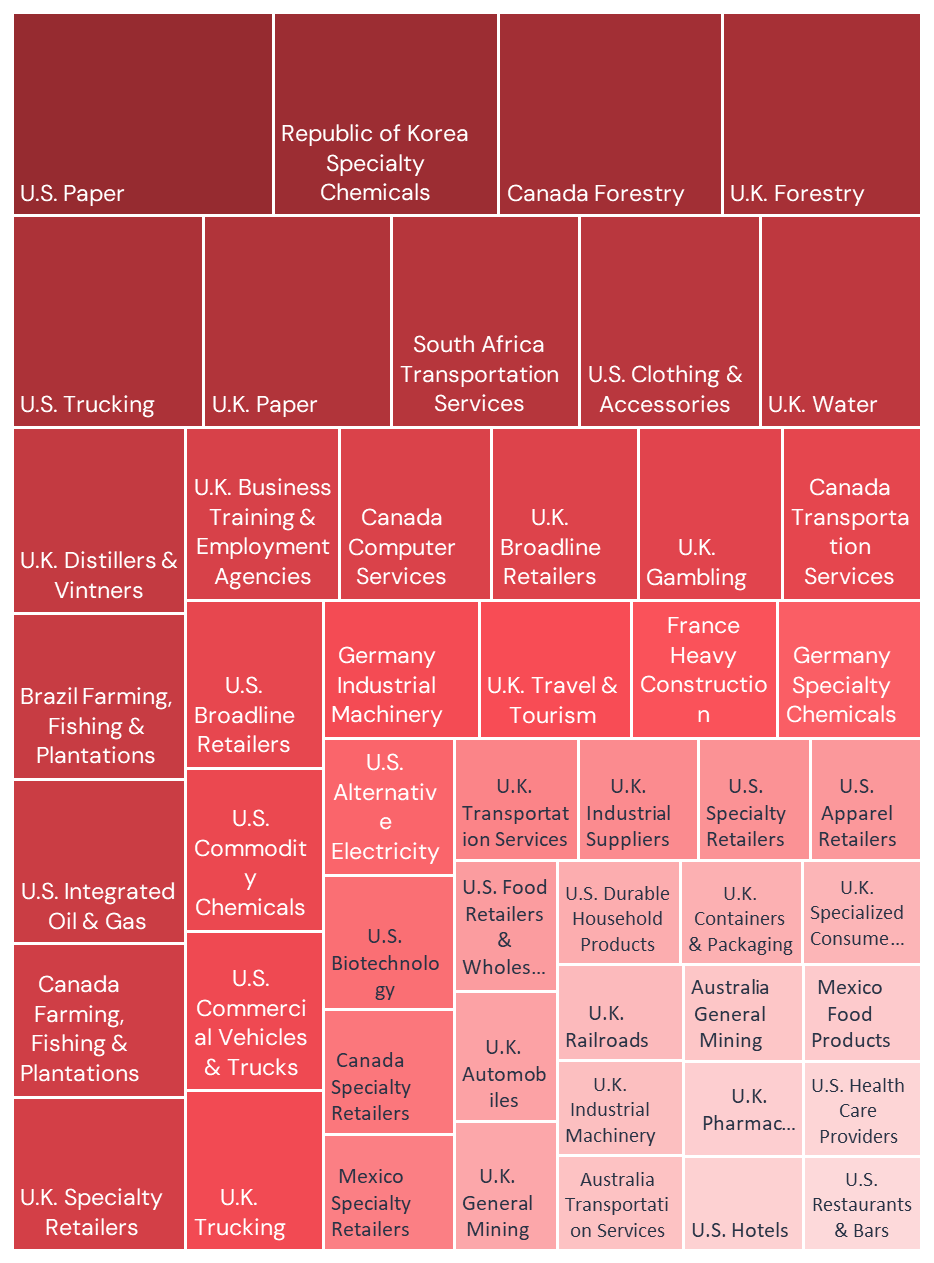

The tree map below shows the 50 largest 3-month increases in default risk by Country and Sector according to Credit Benchmark’s credit consensus indices.

Top 50 Increases in Default Risk Since March 2025 - by Country / Sector

Paper and Forestry across North America and Europe stand out – continuing trends highlighted in consensus data in May.

Transportation Services, especially Trucking, were also major casualties of the air pocket in Chinese export flows.

Basic Materials including Chemicals, Autos, Clothing, Alcoholic Drinks, Farming/Fishing have also continued to deteriorate; most of these were also highlighted early in consensus analytics.

Retailers are also beginning to appear on the list – even at the base tariff level of 10%, Retailers are often the shock absorber, seeing further squeeze in their already thin margins.

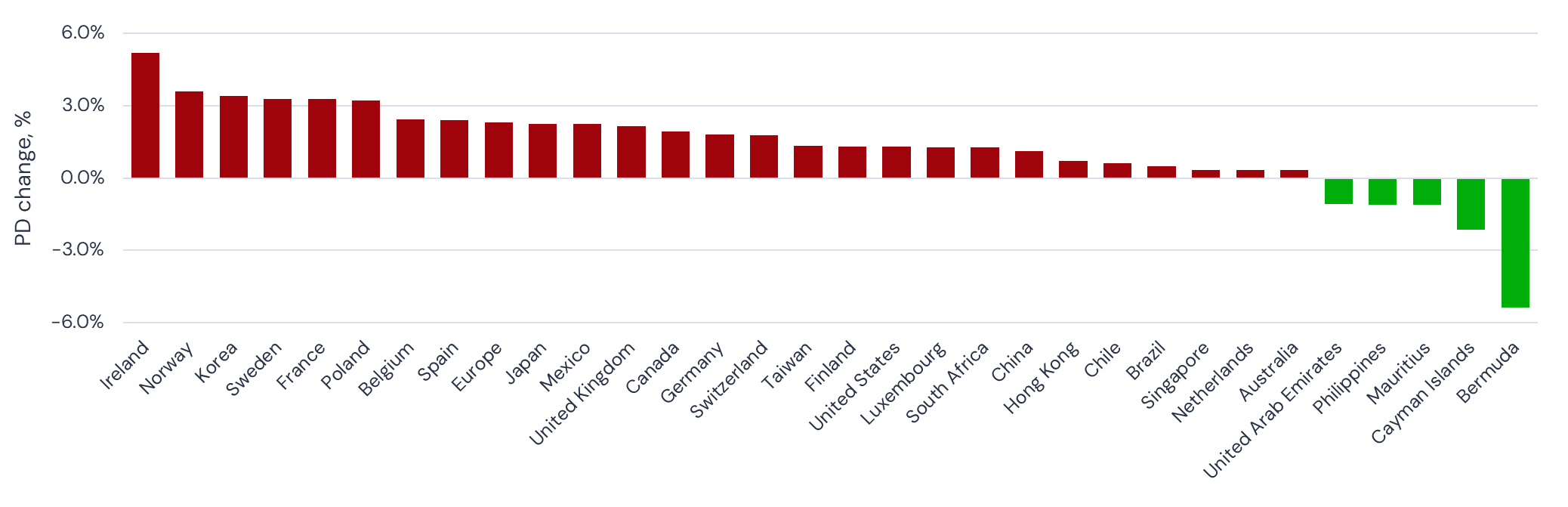

The below chart shows the change in average Corporate default risk (Probability of Default; PD) for selected countries over the last 3 months according to Credit Benchmark’s credit consensus dataset.

3-Month Change in Average Default Risk, March-May 2025

The US is close to the mid-point, with a slight PD increase of 1.3%, just above China at 1.1%. For context, over the same period in 2024 US Corporate risk increased by 1.5%.

Mexico and Canada, both early targets of the new trade regime, have seen Corporate default risk ticking up by 2.2% and 1.9% respectively. Brazil and Chile are unchanged.

The biggest loser is Ireland, with a 5.2% increase in credit risk (+0.8% in the same period last year). Ireland’s business tax regime has made it historically attractive to US companies, especially in the Pharmaceutical sector, but tariffs could cancel that advantage.

Across European countries, corporate credit risk has deteriorated in the past 3 months. After Ireland, the largest increases in risk are in Norway, Sweden, France, Poland and Belgium. Only the Netherlands has emerged unscathed.

There is not much evidence of an EU/non-EU split, reflecting the highly internal overall European trading bloc. The UK, for example is between Mexico and Canada.

In Asia, Korean corporate risk is up 3.4, Japan up 2.3 and Taiwan up 1.3 – all higher than China. Singapore shows little change.

The United Arab Emirates has also improved slightly.

Specialized financial centres also show improvements – Mauritius, Cayman Islands, Bermuda. Luxembourg is the exception, clearly not immune to European headwinds with a slight increase in PD.

Global Sectors Reveal Some Key Divergences

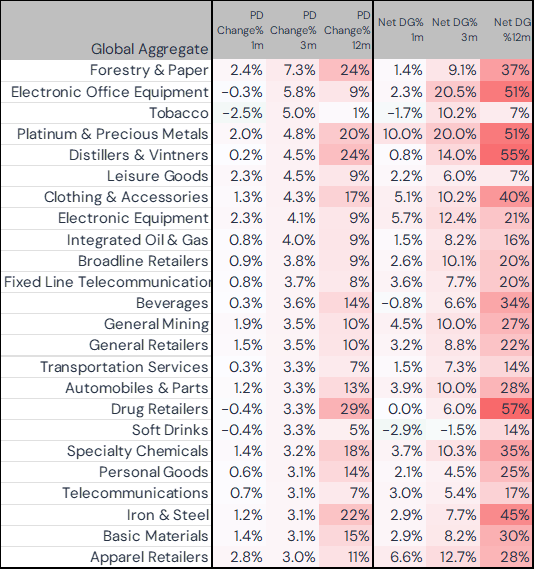

Top 25 Global Sectors, Increasing PD Over 3 Months

Major losers are Forestry, Office Equipment, Tobacco and Beverages, Retailers, Clothing, Autos, Transport, Iron & Steel and Basic Materials, Fixed Line Telecoms, Integrated Oil & Gas. Timber and Steel tariffs are already in place, while retailers are seeing margins squeezed across multiple product lines. Platinum has been hit by the confusion over smart phone tariffs.

Net Downgrades follow a similar pattern suggesting that the next few months will see existing trends continuing. Exceptions are Tobacco and Soft Drinks, which may bottom out; while Platinum and Apparel Retailers look set to see more rapid deterioration.

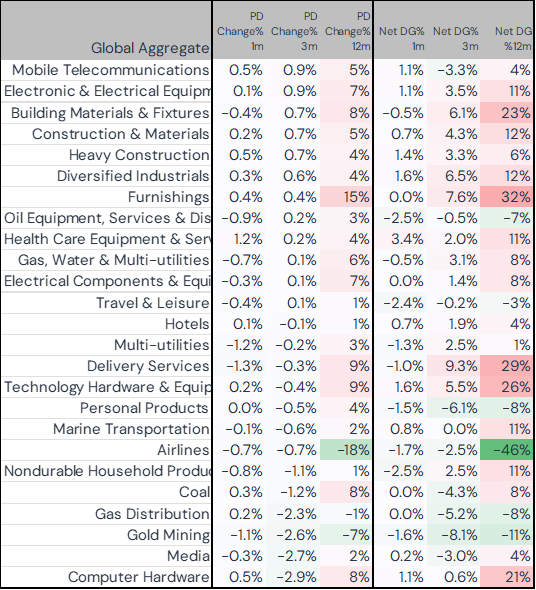

Top 25 Global Sectors, Decreasing PD Over 3 Months

Risk Improvements are concentrated in Construction & Building, Equipment sectors (Electronic, Electric, Oil, Health Care, Technology Hardware) as well as Travel, Airlines, Hotels, Marine Transportation, Delivery Services, Utilities, Media and Gold Mining. This seems to reflect adjustment to new supply chains, shifts in manufacturing bases, changes in vacation plans, and some risk aversion renewing demand for gold.

Net Downgrades are less correlated with PD improvements; sectors likely to see the strongest continued improvement include Oil Equipment, Airlines and Non-Durables. Delivery Services and Furnishings are stabilising after a wave of downgrades, while some of the Equipment sectors may have reach a peak of improvements at least for the short term.

Conclusion

Credit Benchmark’s Credit Consensus data shows that tariffs have had an impact even before their full implementation, and in some cases that impact is significant. The overall trend is towards higher credit risk, but some global sectors have improved as consumers and businesses anticipate the changes that are already happening or likely to unfold soon.

Credit Benchmark provides detailed information on Regional, Country, Industry, Sector and Subsector default risks. Bespoke indices include High Yield vs Investment Grade, Private vs Public, and Rated vs Unrated. Users can track portfolios down to the single name level with weekly alerts.

Credit Benchmark consensus credit data is updated twice-monthly and delivered to our clients via our Web App, Excel add-in, flat-file download and third party channels including Bloomberg, Snowflake and AWS. Advanced analytics like those found within this report are now also available for free on the Credit Benchmark website via Credit Risk IQ. 10,000+ monthly geography-, industry- and sector-specific risk reports and transition matrices are available on Credit Risk IQ.