Industrial & Office REITs likely to show largest increase in default risk this year.

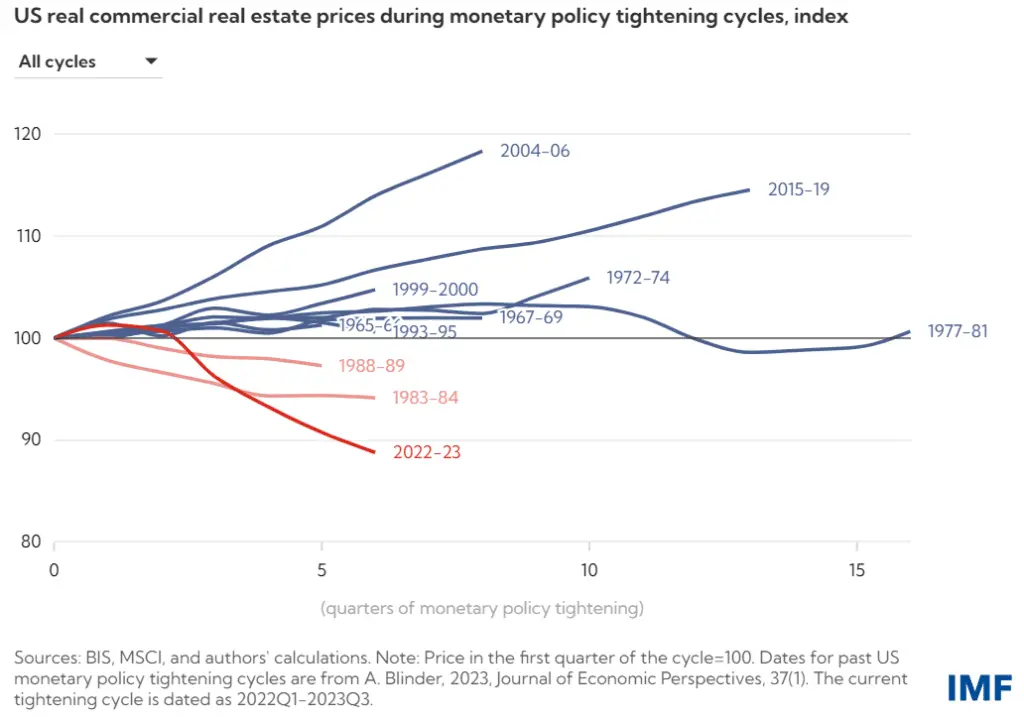

Home working continues to affect US Commercial Real Estate: NYCB results, Blackstone haircuts, Aozora losses. The IMF reports delinquency rates rising and prices falling faster than in previous cycles due to the speed and scale of monetary tightening over the past two years. The chart below compares current valuation trends against previous downturns.

The IMF also highlight the $300bn “maturity wall” facing the Office and Retail segments over the next two years. Much of this is held by commercial banks or investors in CMBS.

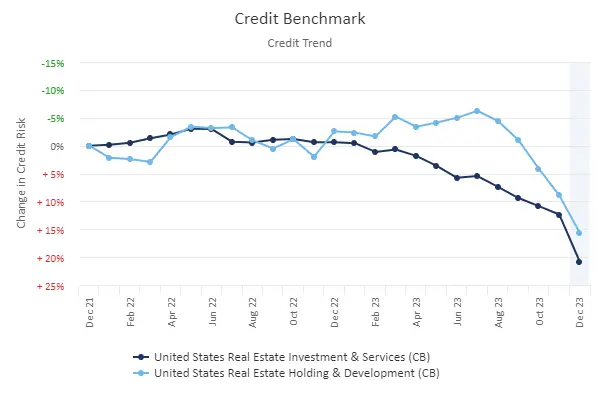

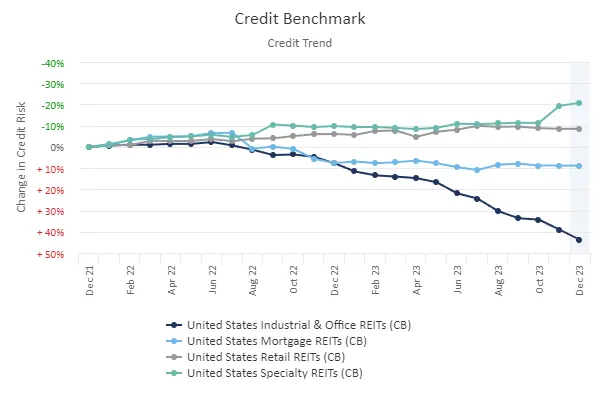

The charts below show recent default risk changes for Credit Benchmark’s US Real Estate Investment & Services, Holding & Development companies, and the main REIT categories indices.

There is a 25% increase in default risk for RE Investment and Holding companies, and a near 50% increase in the Industrial and Office REIT segment. And the latter probably understates the deterioration in Offices, especially across older properties.

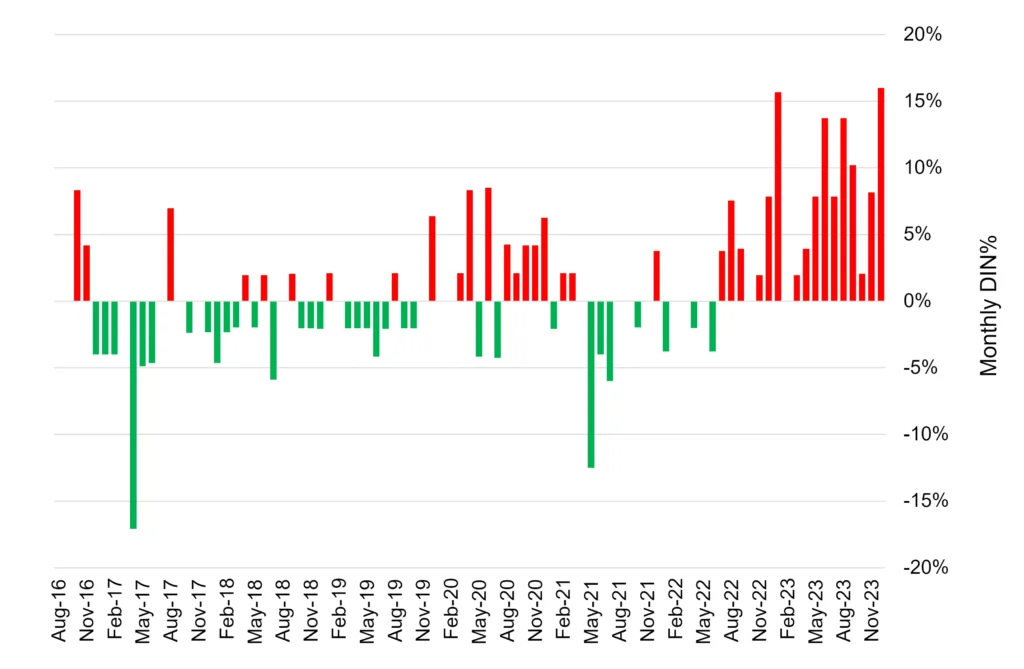

The chart below shows the net balance between deterioration and improvement (“monthly DIN”) in the Industrial & Office sector.

Deterioration-Improvement Net Balance (DIN) – Industrial & Office REITs

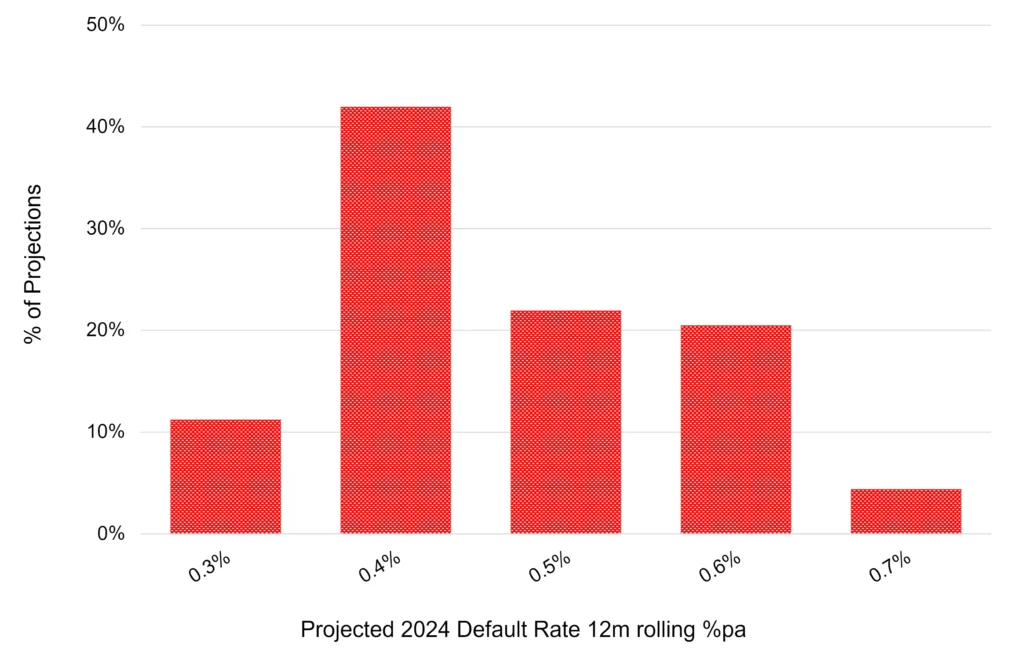

Based on these trends, we predict the projected default rate for the end of this year to show an increase of at least 30% from a very low base of 27 Bps (median over the past 12 months) to around 40 Bps by the end of this year – see the following chart.

Projected 2024 Default Rate – Industrial & Office REITs

In December 2023, the proportion of Industrial and Office REITs in the “c” category jumped from zero to 2%. If the “c” category continues to grow rapidly over the next few months, the end-2024 default rate could be significantly higher; the pessimistic scenario shows it rising to at least 70 Bps.

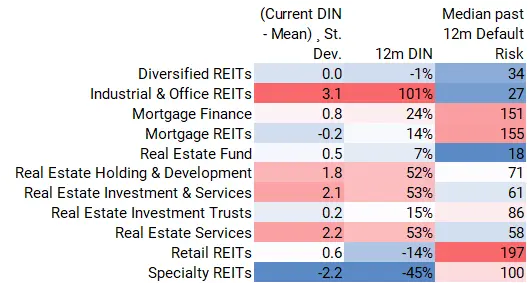

The table below summarizes some key credit consensus metrics for the various segments of the US Commercial Real Estate market.

Client vs CB Rating Comparison

This shows that the 12m DIN for the Industrial & Office REIT index is more than 3 standard deviations above the long term mean; confirming that the current very low level of risk is likely to show a significant increase over the next 12 months. Most segments currently have above-average DIN metrics, with Real Estate Holding & Development, Real Estate Investment & Services, and Real Estate Services all around 2 standard deviations above the long term mean. Traditionally higher risk sectors, like Mortgage Finance, Mortgage REITs, Retail REITs and Specialty REITs are less than one standard deviation above the mean or else below; 2 standard deviations below in the case of Speciality REITs.

In conclusion: Industrial & Office REITs are likely to show the largest % increase in default risk this year; traditional Real Estate Holding, Investment and Service Companies are also set to show significant increases.

Download

Please complete your details to download the PDF of this report: