Bank Credit Risk Management

Strategic Risk Decisions with Credit Risk Management Solution for Banks

Why Credit Benchmark?

5x coverage. Faster Approvals. Stronger Oversight

- Credit Benchmark provides 5X broader credit coverage than traditional agencies, built from the consensus views of 40 leading banks. Credit risk leaders use our unique dataset – covering 120,000+ obligors, most unrated externally – to accelerate approvals, validate internal views, and close blind spots.

- Seamlessly integrated into daily workflows, our entity-level data, trajectory insights, and early warning signals enable faster, safer, and more transparent decision-making. The result: stronger oversight, reduced systemic risk, and the confidence to deploy more capital without compromising safety.

WHAT OTHERS ARE SAYING

Testimonials

"Credit Benchmark enables us to say yes faster and potentially get bigger deals approved. With an independent benchmark validating our internal ratings, we make quicker, more confident decisions at all levels."

"We gain the perspective of multiple analysts in one consensus rating. Credit Benchmark expands our visibility into private and unrated names, improving our models and risk insight."

“Credit Benchmark gives us the confidence to expand our risk appetite, approve larger underwriting deals, and raise ratings where justified — helping us win more business and grow faster, without compromising risk standards.”

"Credit Benchmark strengthens our counterparty risk management and internal reporting. External validation increases regulatory confidence and trust in our credit models."

“Credit Benchmark provides the early warning signals we need to stay ahead of emerging risks. It sharpens our focus, highlights exposures that need action, and enables more proactive portfolio management — strengthening our overall risk oversight.”

"Credit Benchmark lets us monitor more counterparties with greater confidence and no extra headcount – allowing us to streamline credit assessments and focus our resources."

How Credit Benchmark Supports Credit Risk Management in Banks

Fill data gaps on unrated and private entities

Credit Benchmark provides comprehensive consensus views on unrated and private entities that traditional rating agencies miss.

With this wide coverage, banks can:

- Gather intelligence on international subsidiaries of global clients

- Review outliers between agency ratings and Credit Benchmark data

- Eliminate lengthy manual research cycles and make critical business decisions faster

Act faster with weekly consensus updates

Traditional ratings are delayed indicators, but credit risk evolves in real time.

Credit Benchmark delivers weekly consensus updates based on 1 million+ observations from global banks. We offer visibility into how credit views are shifting across sectors, regions, and counterparties before those changes appear in agency ratings.

Timely consensus data enables banks to:

- Proactively manage sector and counterparty concentrations before thresholds are breached

- Identify emerging credit deterioration across unrated, thinly covered, or opaque exposures

- Improve portfolio surveillance and risk monitoring with forward-looking market signals

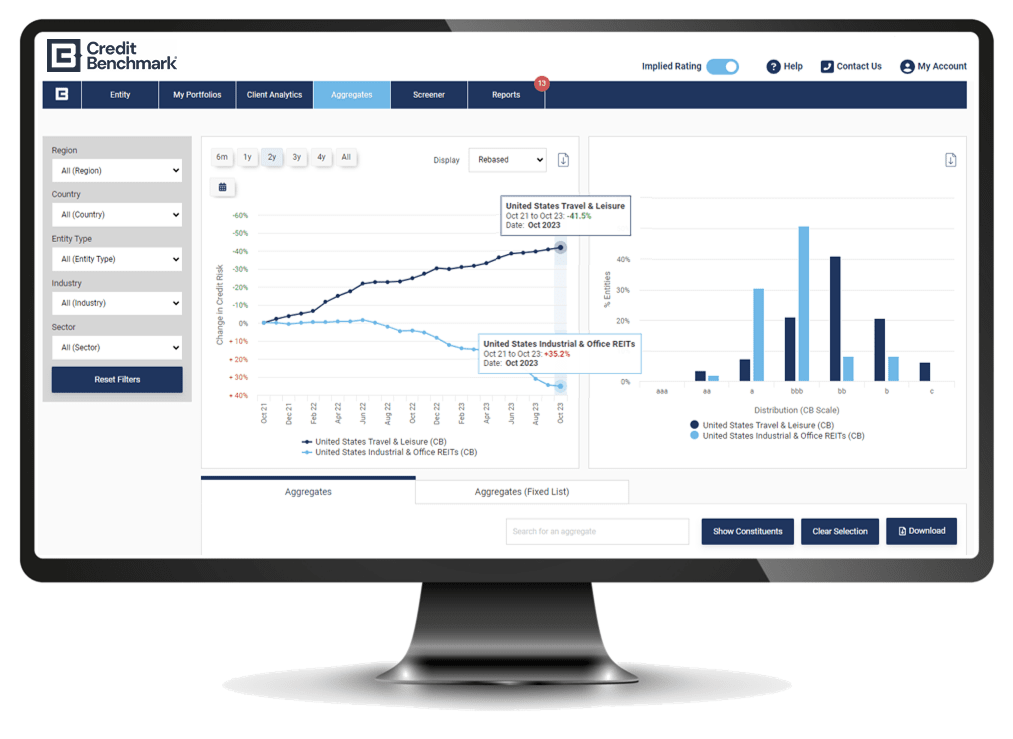

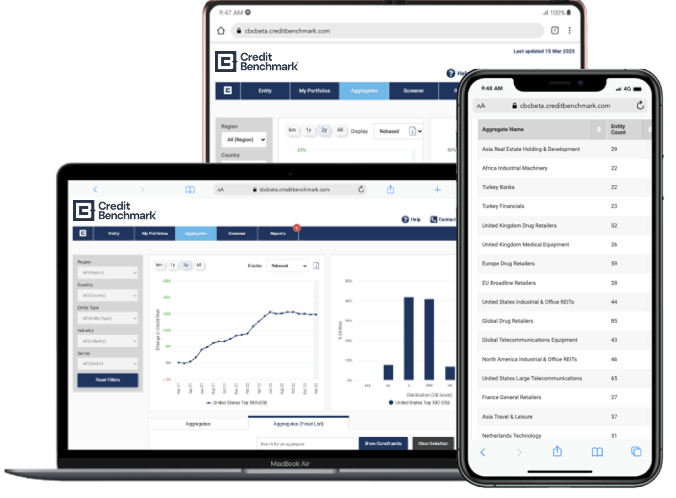

Banks can access credit consensus data and analytics through the web app, APIs, third-party distribution partners, or Excel add-in.

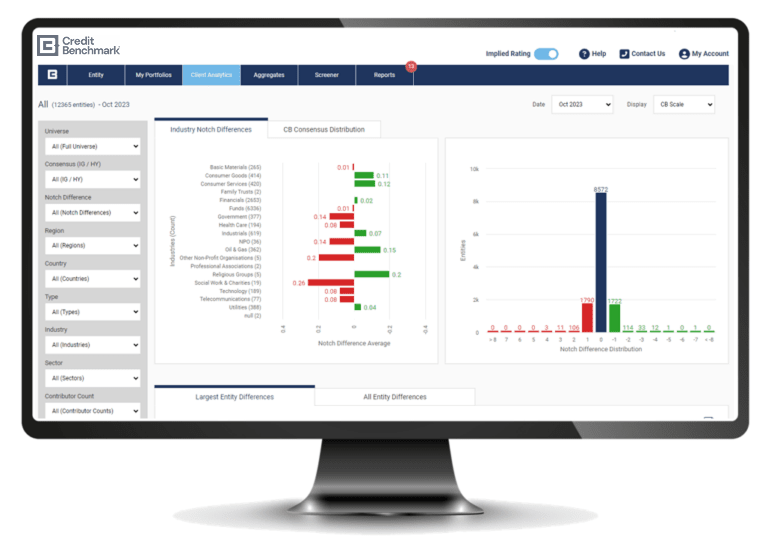

Benchmark internal ratings against market consensus

Credit Benchmark provides consensus credit views from 20,000+ analysts at major global banks, offering a clear external reference point for entities where traditional benchmarks don’t exist or are outdated.

With this comparative insight, banks can:

- Reinforce internal ratings with credible external validation

- Detect material deviations in credit risk assessments compared to peer institutions

- Strengthen model governance and support regulatory discussions with market-aligned evidence

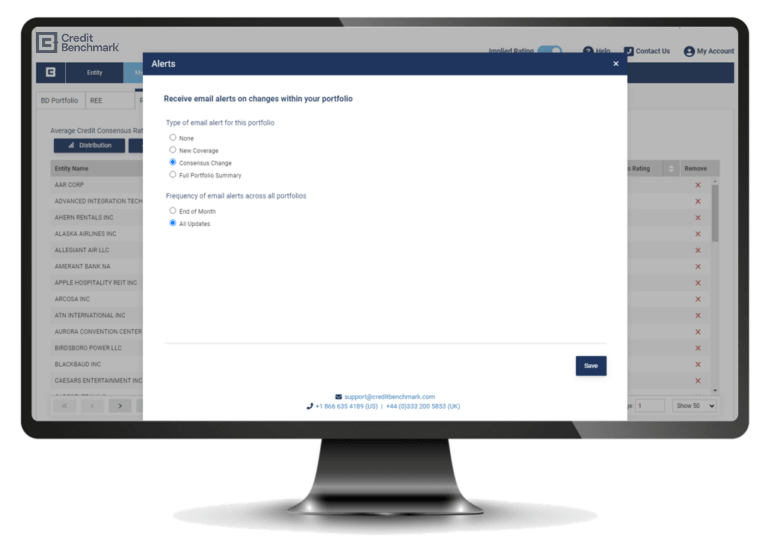

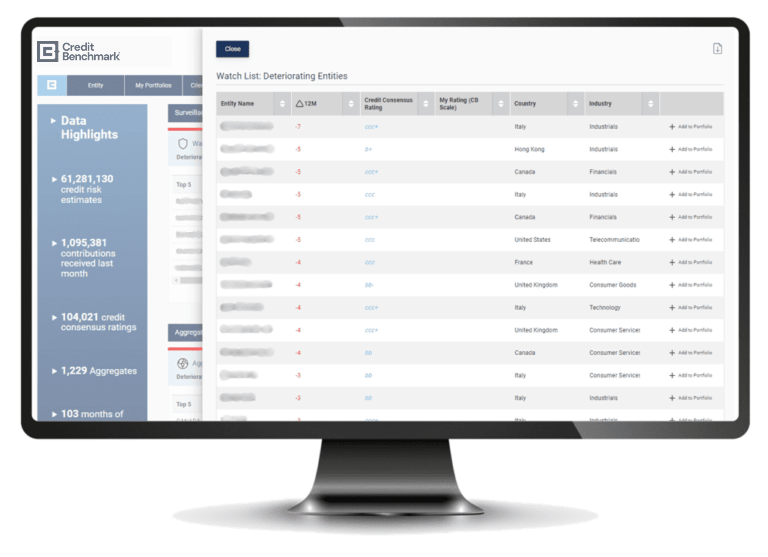

Keep pace with portfolio changes with automated monitoring

Manual surveillance struggles to match the velocity or breadth required for complex credit portfolios.

Credit Benchmark automates monitoring across the full exposure set, surfacing consensus rating movements early enough to inform allocation, hedging, and capital decisions.

Banks get sharper insight and can deploy analytical capacity where it delivers the greatest return.

Automated monitoring enables institutions to:

- Extend oversight to rated, unrated, and private entities without diverting analysts from high-value work

- Pre-empt deterioration and adjust positions before adverse migration materializes

Strengthen compliance and capital optimization

Regulatory credibility is difficult to demonstrate, particularly for unrated or low-default portfolios.

Credit Benchmark delivers bank-sourced consensus data from models already validated and recognized by regulators.

It strengthens IFRS 9 benchmarking, informs CVA for unrated counterparties, and supports capital allocation with peer-validated intelligence.

With this regulatory-grade insight, banks can:

- Defend impairment models, staging decisions, and PD calibrations with market-aligned benchmarks

- Incorporate trusted, peer-sourced data into CVA, capital planning, and regulatory dialogue

- Optimize capital allocation while meeting regulatory expectations with greater confidence

Global Risk Teams at Leading Banks and other Financial Institutions Rely on Credit Benchmark

How A Major US Bank Recalibrated Credit Models with Peer Consensus

The Client

One of the largest banks in the United States with approximately $150B in total assets.

The Challenge

The bank’s Chief Credit Officer knew that they needed peer-driven insights to better understand where they stood compared to other banks and enhance their modeling techniques. They needed external validation to pressure-test their internal models and gain confidence in risk assessments, particularly for entities that lacked traditional ratings. Without this outside perspective, it was difficult to know if their credit views were too conservative, too aggressive, or right on target.

The Credit Benchmark Solution

The bank embedded consensus data directly into their credit models, using the data to recalibrate their PDs and LGDs while leveraging peer insights for SNC exam preparation. They initiated an internal recalibration of credit models using Credit Benchmark data to refine their models and improve alignment with market and peer views.

Key Results Achieved

- Better model accuracy by pressure-testing against market consensus and improving alignment with peer views

- Stronger regulatory positioning through peer validation used in SNC exam preparation

- Confident decisions on unrated entities where traditional validation methods weren’t available

- Improved benchmarking by validating internal assessments against anonymized peer views

“Credit Benchmark has given us a clearer lens into how our peers assess credit risk, especially for unrated names. The ability to benchmark our internal views has significantly increased our confidence in risk decisions, and it’s directly informed model recalibration efforts.”

– Chief Credit Officer

How State Street Improved Risk Alignment Through Market Benchmarking

The Client

State Street Corporation, a global financial services provider with approximately $370 billion in total assets, delivering investment services to institutional clients worldwide.

The Challenge

State Street’s Front-Office Risk team couldn’t see how their internal ratings compared to market consensus, which made it challenging to defend their credit decisions. They struggled to justify rating changes to Enterprise Risk Management (ERM), especially for emerging opportunities, while seeking growth that required expanding risk guidelines without compromising their risk standards.

The Credit Benchmark Solution

Consensus data enabled State Street to benchmark against industry peers, providing surveillance insights, rating change alerts, and tools to evaluate how quickly they adjust ratings versus the broader market. Credit Benchmark’s market intelligence strengthened their foundation for engaging internal stakeholders and gave them the external validation they needed to support strategic decisions.

Key Results Achieved

- Faster decision processes enabling quicker evaluation of existing and prospective counterparties

- Better internal alignment through peer-validated data that strengthened cases for risk appetite expansion

- Enhanced monitoring capabilities that identified focus areas and supported ongoing risk assessment activities

- New revenue opportunities where conservative internal ratings could be reassessed through enhanced due diligence processes

“No one else does what you do. Credit Benchmark data makes my job easier.”

– Eliott Bryson, Front Office Risk, State Street

FAQs

What are the features to look for in credit risk management tools for banks?

When evaluating credit risk management tools, the priority is securing intelligence that improves portfolio performance, strengthens regulatory standing, and reduces operational drag. Look for:

- Coverage that reflects your true risk exposures: Insights should extend beyond well-rated names to include the unrated and thinly covered entities that often carry hidden risk.

- Integration without disruption: The tool must plug into existing risk models, data warehouses, and reporting processes without long onboarding cycles or workflow redesigns.

- Update cycles matched to decision velocity: Whether you need weekly alerts to act on market moves or monthly updates for stable exposures, data timeliness should support your governance cadence.

- Built-in regulatory defensibility: Features that directly support IFRS 9, CECL, and Basel III compliance, including audit trails, model benchmarking, and stress testing, are critical for regulatory confidence.

- Transparent, verifiable data sources: Consensus-based or market-derived data you can defend to both internal committees and regulators carries far more weight than opaque, model-only outputs.

What are the benefits of using advanced credit risk management tools?

Most banks see several key improvements when they implement the right credit risk software and solutions to manage their credit risk management models:

- Better visibility into entities that lack comprehensive external coverage

- Faster decision-making through automated monitoring and early warning systems

- Stronger regulatory conversations because you can point to external validation instead of relying purely on internal models

- Improved capital allocation through better risk assessment, though this depends heavily on implementation quality

What is the best credit risk management software for banks?

There’s no one-size-fits-all answer since every bank has different priorities and internally built models that may dictate solutions. Successful implementations tend to share some common characteristics, such as providing practical coverage of the entities you work with and integrating well with existing systems while delivering timely updates.

Beyond traditional software platforms, many banks are also turning to specialized solutions that enhance their existing risk management capabilities. Credit Benchmark is one such solution that addresses coverage gaps by aggregating consensus views from 40+ major global banks, providing insights that work alongside your existing risk management approach.

What are the best practices for managing credit risk in a bank?

Effective credit risk management in a bank starts with a governance framework that pairs strong internal processes with timely, defensible market intelligence. Establish a clearly defined risk appetite, sector and counterparty limits, and approval processes that align to strategic and regulatory priorities. Strengthen borrower assessments by combining financial analysis and internal ratings with external data that closes blind spots on unrated, thinly covered, or opaque credit exposures.

Build continuous monitoring into your workflow, using early warning indicators, sector trends, and concentration analysis to surface risk before it impacts capital. Maintain reserves and provisioning in line with IFRS 9, CECL, and Basel IV, supported by evidence you can defend to supervisors.

Credit Benchmark supports this approach with weekly, consensus-based credit views from 40+ global banks, covering 120,000+ entities. The peer-validated intelligence benchmarks internal ratings, highlights emerging deterioration, and extends oversight to areas traditional sources miss.

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $28+ Trillion Outstanding

Risk Observations Feeding Into Weekly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Unparalleled coverage

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Robust methodology

Free from “issuer-pays” conflict and any bank bias.

Real-world perspectives

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Up-to-Date, in The Know

The consensus is refreshed weekly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Safety in numbers

A unique growing global dataset.