Why Credit Benchmark?

Navigate the credit risk of customers, supply chains, financial counterparts, and investments

Corporate treasury departments often have numerous customers, partners, and suppliers around the world. They also tend to have complex supply chains with hard to identify second and third order risks.

Credit Benchmark’s unique coverage of 120,000 legal entities around the world, the majority of which are unrated by major rating agencies, can help corporate treasurers better understand and manage these risks.

Solutions

How we can help your business

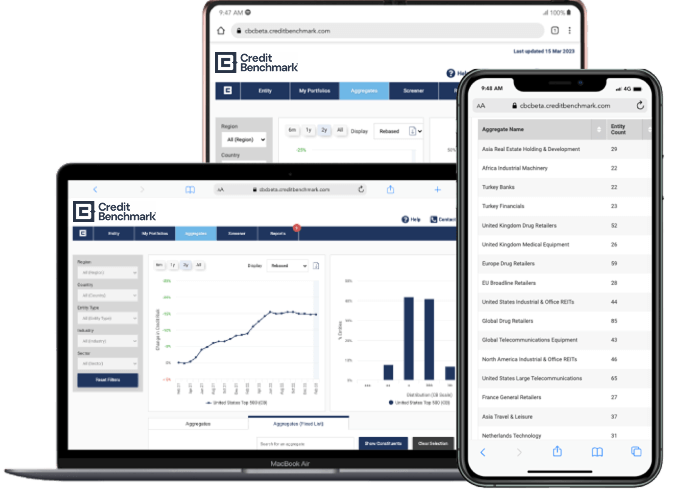

Monitor the credit risk profile of your customers, suppliers and vendors using Credit Benchmark’s expansive coverage, macro indices and analytical tools.

Enhance your visibility of the creditworthiness of unrated and private entities at a subsidiary level.

Seamlessly integrate Credit Benchmark data with other market metrics through Bloomberg supply chain analytics.

Support your existing KYC process by leveraging consensus data in the onboarding process.

Case Study

The Client

The accounts receivable team at a large FTSE 250 company needed a better understanding of their revenue vulnerability amidst the COVID-19 crisis.

The Challenge

The client’s main points of concern were to understand their customers’ credit risk, and to seek additional intelligence for their contract review and negotiation processes. The vast majority of their customers were publicly unrated and their existing external credit reference sources were sometimes a year out of date.

The Solution

After running a comprehensive mapping and coverage exercise on their largest exposures, the client was satisfied that Credit Benchmark would provide them with a valuable source of credit risk information enormously additive to their existing workflows. They were also happy that Credit Benchmark was able to do the heavy lifting of mapping to their internal database and customising the data to fit seamlessly into their own internal systems and dashboards. We were also able to provide the client with their own credit tear sheets to use for accounts payable negotiations.

In Numbers

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $28+ Trillion Outstanding

Risk Observations Feeding Into Weekly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

The Benefits of Consensus Credit Data

Unparalleled coverage

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Robust methodology

Free from “issuer-pays” conflict and any bank bias.

Real-world perspectives

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Identify that entity

Risk data is processed through a sophisticated purpose-built mapping engine.

Up-to-Date, in The Know

The consensus is refreshed weekly to provide dynamic indicators of potential credit risk changes.

Alerting and monitoring

Assess risk over the lifetime of a transaction.

Secure reporting

Ease of internal integration within reporting.

Safety in numbers

A unique growing global dataset.