10,000+ free monthly Industry Reports deliver forward-looking analyses of default risk across various geographies and industries, covering both public and private legal entities, to help you identify key trends and signals at a macro-level.

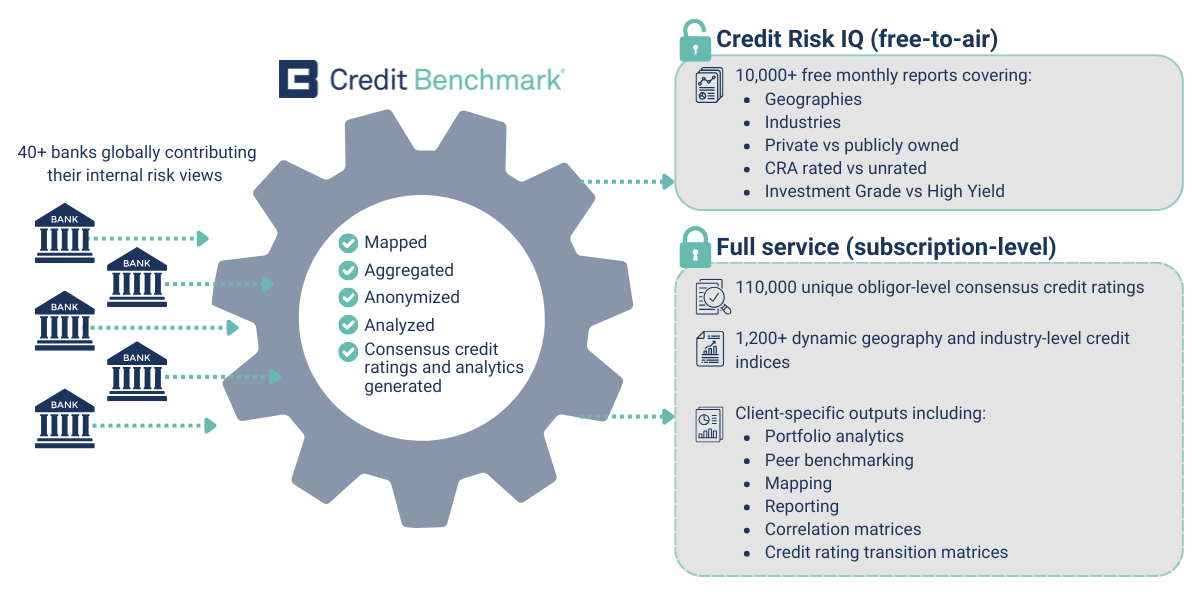

Credit Benchmark collects entity-level risk views every month from over 40 major banks globally. The risk views are anonymized and aggregated to produce 110,000+ dynamic consensus credit ratings, which offer a real-world measure of risk on mostly unrated corporate, financial, fund and government obligors.

These consensus credit ratings feed into a suite of detailed analytics available exclusively to our subscribers, as well as into 10,000+ entirely free Credit Risk IQ Industry Reports.

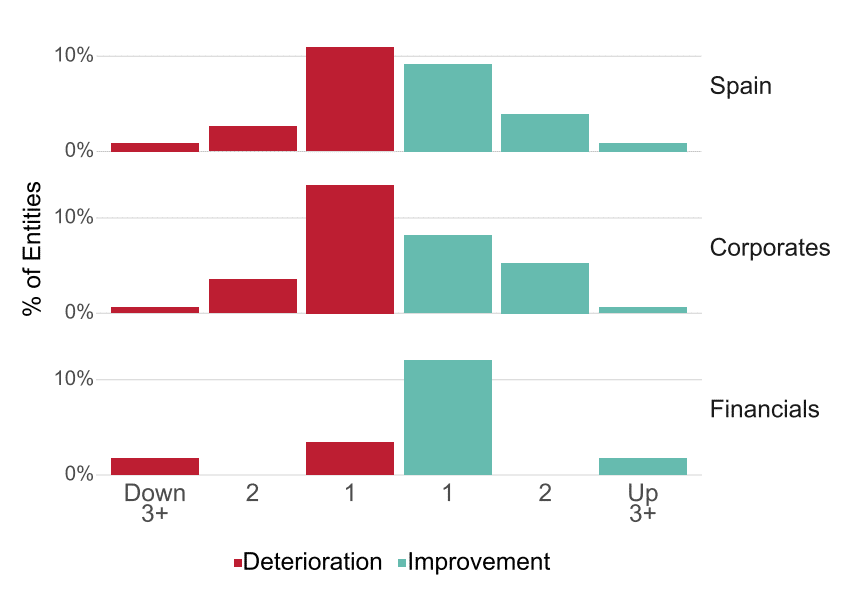

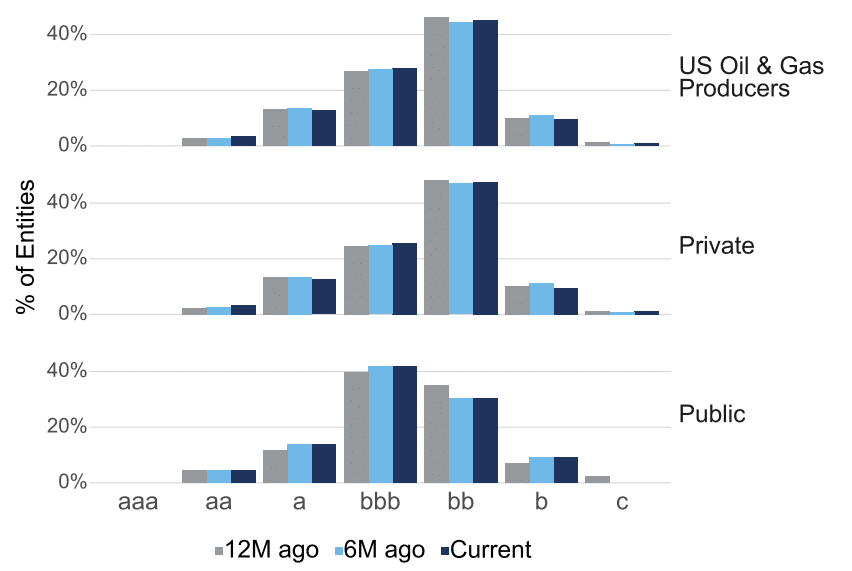

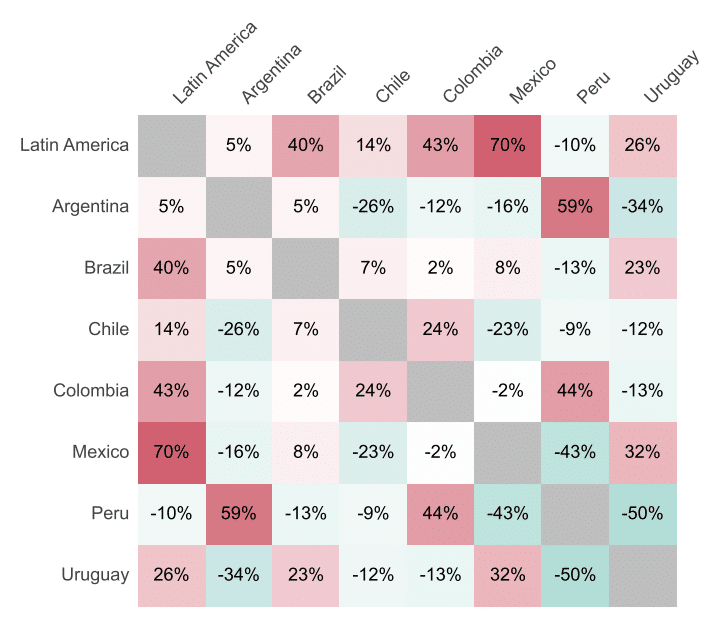

✓ Geography comparison: region and country

✓ Industry comparison: sector and sub-sectors

✓ Ownership comparison: public and private

✓ Rated/unrated comparison: rated by credit rating agencies and unrated

✓ Credit quality comparison: Investment Grade and High Yield

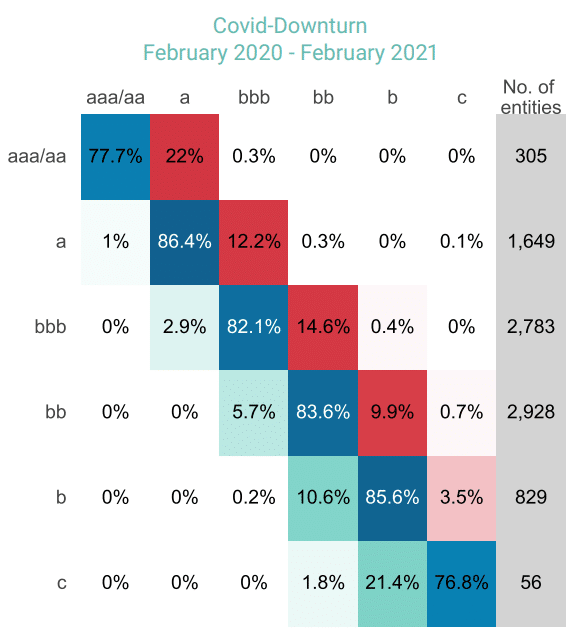

✓ Granular credit rating transition matrices on an annual and multi-period time scale

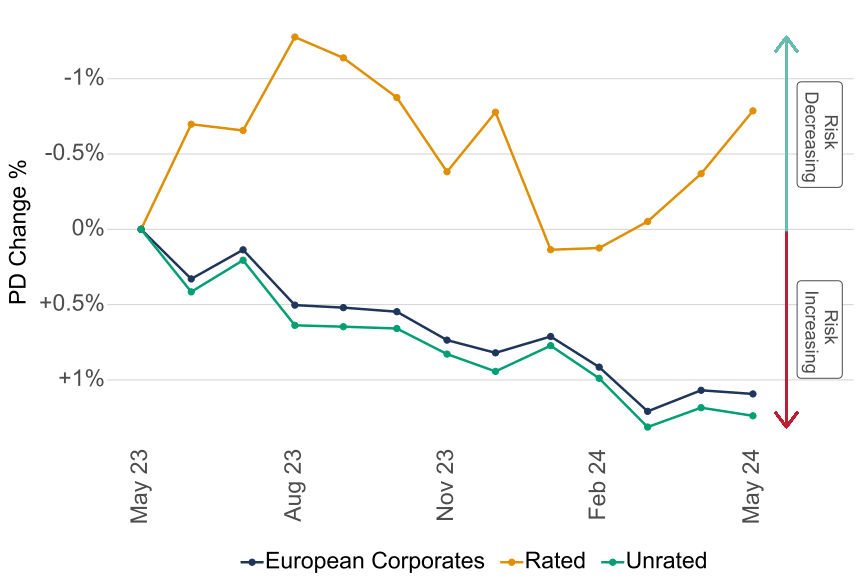

The Credit Risk IQ reports provide unique insights into how credit risk is changing across a wide range of different sectors of the economy. Many industries do not behave uniformly and can diverge in unexpected ways. The forward-looking nature of consensus credit ratings means that our analytics provide a differentiated view into the migration of credit risk.

As an example, the reports could be used in the following ways:

Credit Benchmark offers entity-level Credit Consensus Ratings on over 110,000 counterparts and borrowers globally, alongside an extensive suite of analytical tools and products.

Please contact us to request a full service demo and learn how Credit Benchmark helps risk professionals manage their capital and risk more effectively and efficiently.

By clicking the ‘request demo’ button, you agree to the Credit Benchmark Terms of Use and Privacy Policy.

Credit Benchmark brings together internal credit risk views from over 40 leading global financial institutions. The contributions are anonymized, aggregated, and published in the form of consensus ratings and aggregate analytics to provide an independent, real-world perspective of credit risk. Risk and investment professionals at banks, insurance companies, asset managers and other financial firms use the data for insights into the unrated, monitoring and alerting within their portfolios, benchmarking, assessing and analyzing trends, and fulfilling regulatory requirements and capital.

Please complete the form below to arrange a demo.