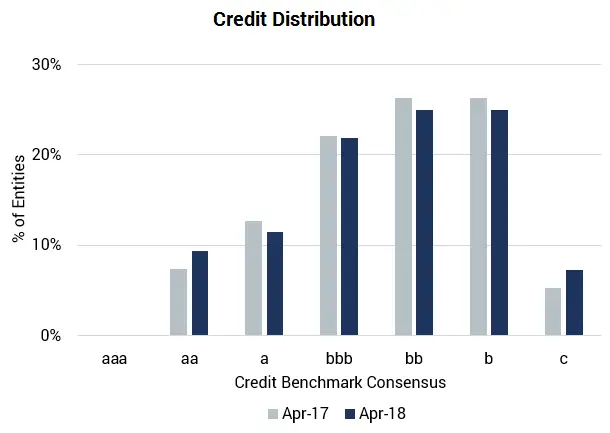

Last week, the FT reported on recent signs of stress in Emerging Markets. These include weakness in a number of key currencies and stock markets, and increasing local currency yields for Sovereign bonds. Rising yields can compensate, in part, for currency losses; but investors usually need to see a currency floor being established before they take advantage of higher rates. The chart below shows the credit distribution and trends for 90 Sovereign governments in the Emerging and Frontier economies.

A surprisingly large proportion (nearly 40%) are Investment Grade, although the most recent data shows an increase in the proportion in the “tails” of the distribution (i.e. CBC* categories aa and c have both increased). The time series chart below shows an improvement in credit risk in the latter half of 2016, but credit has been deteriorating ever since with a particularly sharp decline in early 2018. This predates and confirms the recent warning signals in currency, equity and bond markets.