The COVID outbreak led to widespread and rapid credit deterioration across multiple sectors; the subsequent recovery has been slower but has reversed much of the decline as economies have re-opened.

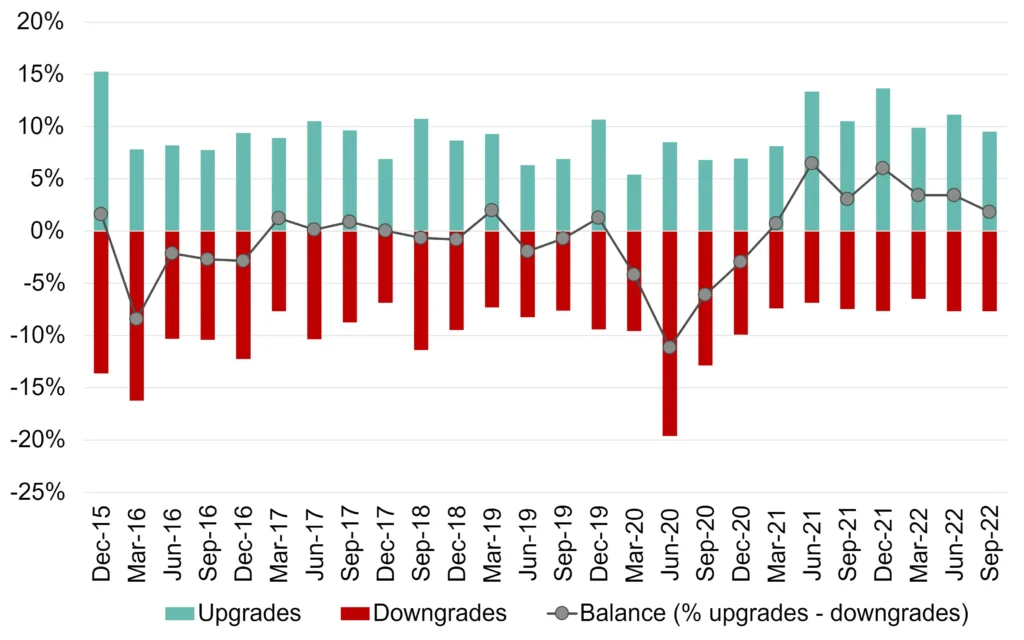

Figure 1.1 shows the balance of upgrades and downgrades for Global Corporates.

Figure 1.1 Global Corporates: Upgrades vs. Downgrades

The COVID impact is clear, with a large negative balance in June 2020 below 40 (downgrades heavily outnumbering upgrades) before rebounding to its recent peak in June 2021. But while the Global Corporates balance between upgrades and downgrades remains positive, it has moved closer to balance in recent months. War, supply shocks, inflation and rising rates have stalled the improvement across multiple sectors and a growing number of them are turning down again.

Figure 1.2 shows the detailed credit trend for corporates by region.

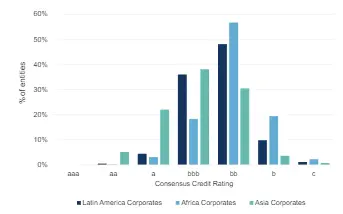

Figure 1.2 Regional Corporates

Credit Trend

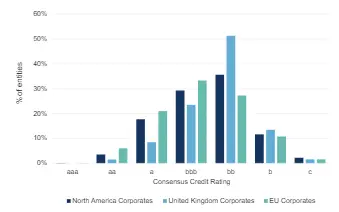

Credit Distribution

Corporates credit is only just still improving, with Americas and Asia leading the pack, however it is slowing down and reaching a turning point.