Download full G5 Corporate Borrower Credit Risk Distributions infographic below.

A raft of stimulus packages have been announced by Governments globally in an effort to combat the worst economic effects of the COVID-19 downturn. Tax deferrals, debt repayment holidays and income subsidies are some of the measures proposed to help individuals and companies stay afloat.

Many nations have unveiled state-backed loan packages for companies in affected sectors, but businesses with weaker balance sheets may struggle to survive even with government support. Credit risk estimates collected from leading global financial institutions can be used to analyse the existing credit category distribution of corporate entities.

A new Credit Benchmark infographic focuses on the corporate credit health of five major economies – USA, UK, Canada, France and Germany. Nations with a greater representation of entities in the b and c consensus categories inevitably face an increased prospect of mass corporate defaults.

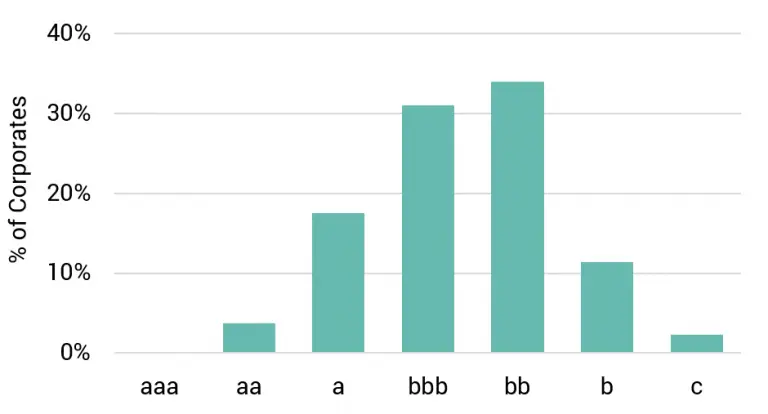

USA Corporate Borrower Credit Risk Distribution

52% of USA corporates in the consensus universe are investment grade, with their borrowing equivalent to 74% of GDP. Markets have focused on the significant proportion of High Yield debt issued by US Corporates, as well as the sheer scale of US non-financial corporate debt which is now valued at more than $10trn (out of a global total of $13trn). More than 10% of the consensus sample are in credit categories b and c.