To download the August 2020 Oil & Gas Aggregate PDF, click here.

.

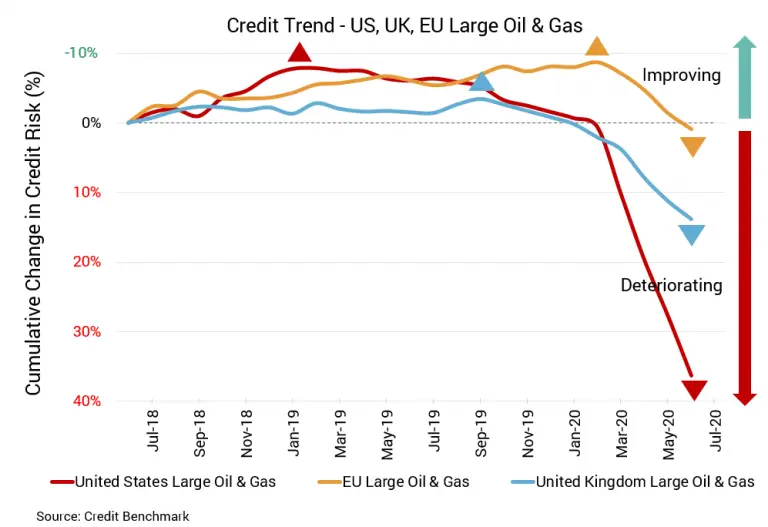

Problems for the beleaguered US energy sector have continued to mount this year. Demand for oil plummeted, bringing down prices as competition and supplies grew. Bankruptcies continue in the industry as the broad economy continues to struggle, and it’s not clear how many firms will benefit from any improvement in prices. There’s also great uncertainty building around natural gas. The UK and EU energy sectors are also showing signs of stress.

Probability of Default for US Oil & Gas Firms Surges by Almost 50% Over Last Year

- Credit quality for US-based oil and gas firms continues to trend lower

- Probability of default remains is considerably higher for US-based firms than for UK-, EU-based firms

US Oil & Gas

The downward trend in credit quality for the US energy sector continues. Large US oil & gas firms have seen credit deterioration of 6.7% from the prior month, 13.8% from two months prior, and 23.7% from three months prior. Since the start of this year, credit quality has fallen by 37.2%. It’s fallen by 45.1% since the same point last year. Default risk continues to climb. Average probability of default is currently 56 basis points, compared to 52 basis points in the prior month, 49 basis points two months prior, and 45 basis points three months prior. It was 40 basis points at the start of the year and 38 basis points at the same point last year. This aggregate’s CBC rating is in the bb+ range.

UK Oil & Gas

Credit quality for the UK energy sector is down 2.3% from last month, 5.5% from two months prior and 9.6% from three months prior. Indicating prior stability for this aggregate, credit quality for large UK oil & gas firms is down 13.5% from the start of this year and 15.5% from the same point last year. Average probability of default is 36 basis points, compared to 35 basis points two months prior and 33 basis points three months prior. It was 32 basis points at the start of the year and at the same point last year. This aggregate’s CBC rating is bbb-.

EU Oil & Gas

For the EU energy sector, there has been some volatility in credit quality. It has declined by 2.4% from one month prior, 6% from two months prior and 8.7% from three months prior. Measured from the start of the year and the same point last year, the decline was 9.7% and 7.5% respectively. Average probability of default is 27 basis points, compared to 26 basis points one and two months prior and 25 basis points three months prior. It was 25 basis points measured from the start of the year and the same point last year. This aggregate’s CBC rating is unchanged at bbb.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.