To download the August 2020 Auto Aggregate PDF, click here.

While there are some signs the US auto industry is restarting after COVID, numerous challenges remain – and that’s not even factoring in overall weakness in the economy and personal finances. Credit weakness continues, and it’s unlikely to get much better until everything else improves.

Similar can be said about the UK, where car sales are on the rise but where the economy is coming off its worst drop on record.

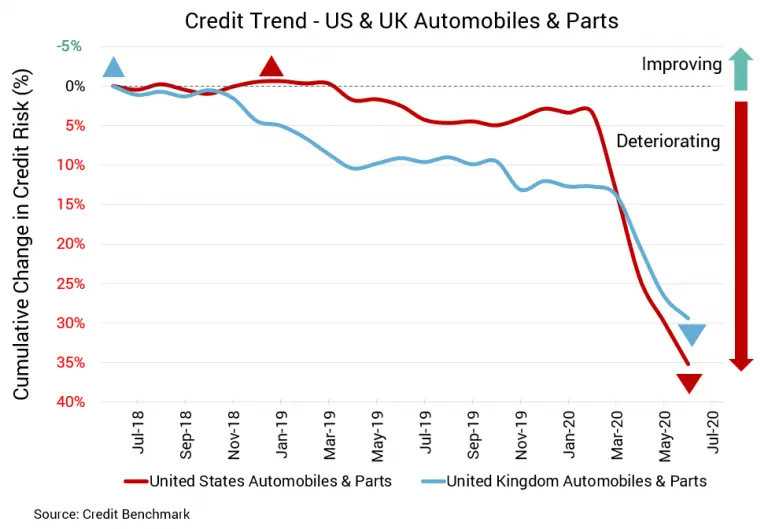

Default Risk Surges More Than 30% Over Last Year

- Credit quality for the US-based auto industry has fallen 31.4% since the start of this year

- Overall credit quality remains worse for UK auto sector firms, which have higher overall probability of default

US Auto and Auto Parts Industry

Deterioration for the US auto sector began earlier this year and continues with the latest update. Credit quality has declined by 5% from the prior month, 10% from two months prior, and 21.1% from three months prior. It’s down 31.4% from the start of this year and from the same point last year. Average probability of default for this sector is 46 basis points, compared to 44 basis points the prior month, 42 basis points two months prior, and 38 basis points three months prior. At the start of this year and at the same point last year, average probability of default was 35 basis points. This sector’s CBC rating has remained bbb-, and about 83% of firms with such a rating are at bbb or lower.

UK Auto and Auto Parts Industry

The month-to-month trend in credit quality for the UK auto sector has been deteriorating at a slower rate in recent months. The decline from the prior month is 2%, while the drop from two months prior is 7% and the drop from the beginning of the year is 14.6%. Credit quality has declined 18.9% from the same point last year. Average probability of default for this sector is 63 basis points, compared to 62 basis points the prior month, 59 basis points two months prior, and 55 basis points at the start of the year. At the same point last year, average probability of default was 53 basis points. The current CBC rating for this sector is bb+, and about 86% of the firms with a rating are at bbb or lower.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.