Supply chain issues appear to be an opportunity for some sectors. Freight and Logistics companies, especially in North America, have recently reported highest-ever quarterly revenue and operating income.

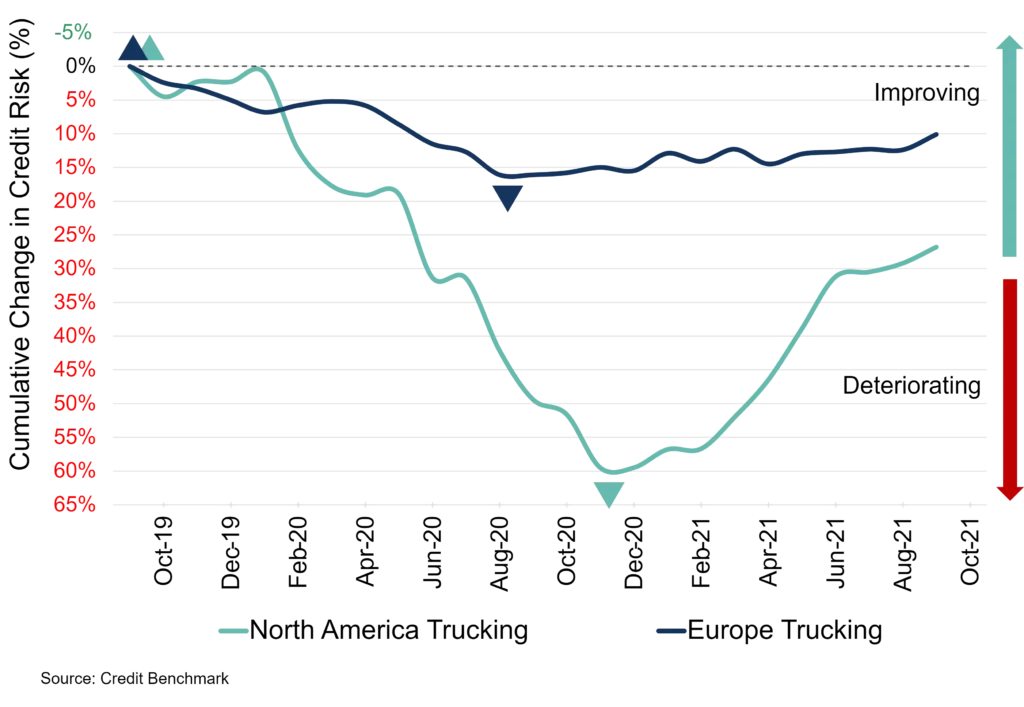

Figure 1 outlines the credit trends for the North America and Europe Trucking sector.

North America trucking firms show a steep decline in credit risk from Jan-20 to Dec-20 but since then has shown significant recovery. The decline in Europe is very shallow, and has been on a gently improving trend since mid-2020.

Figures 2 and 3 show the change in credit distribution over the past year for North America and Europe Trucking respectively [please continue below to access full report].