Credit Benchmark have released the April Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK & EU Industrials based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

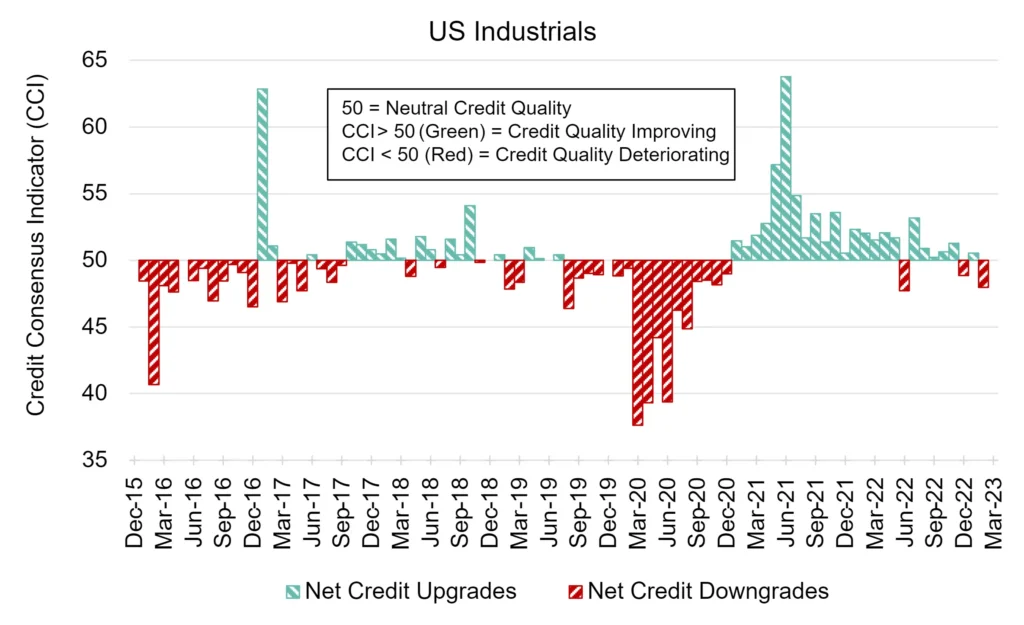

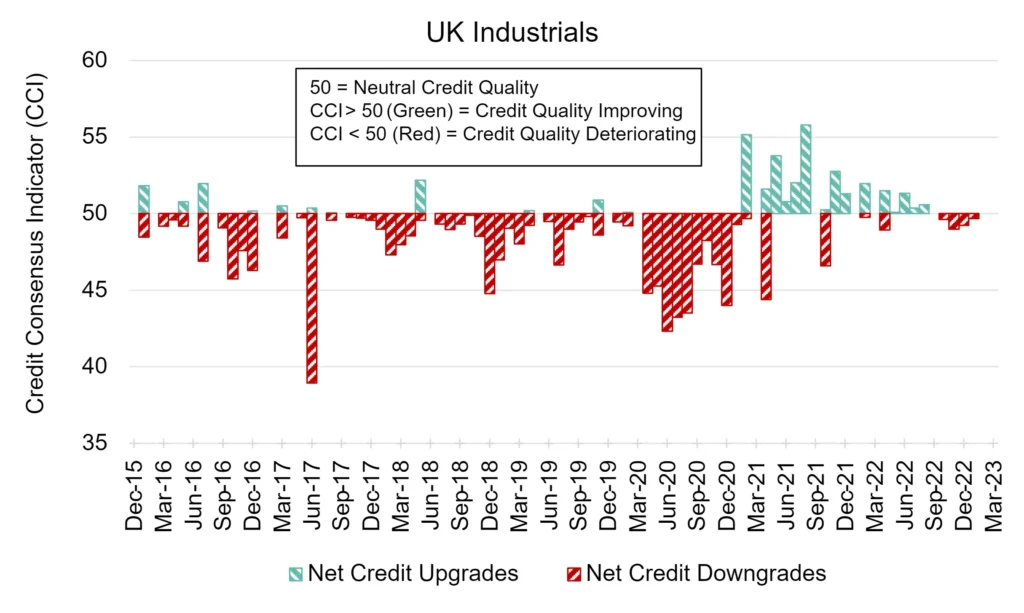

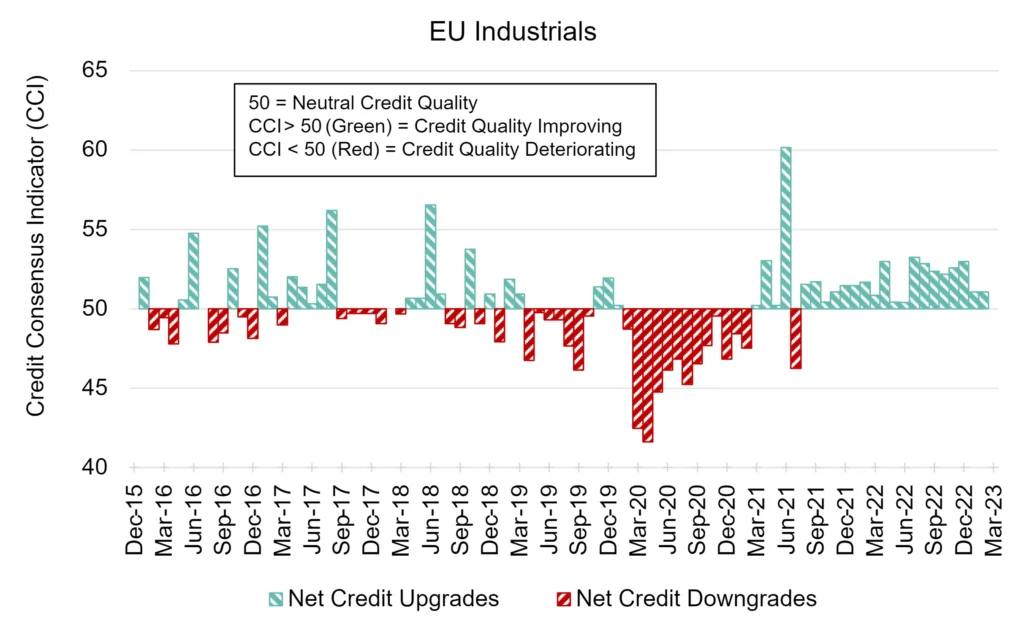

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

US Industrial firms return to negative credit balance this month. UK Industrial firms ended their trend of net deterioration, with a neutral credit quality score. EU Industrial firms continue their run of positive credit movement.

US Industrials: Return to Net Deterioration

US Industrial firms have experienced recent instability in their collective credit balance.

The US Industrials CCI score this month is 48.0, a decrease from last month’s CCI of 50.5.

Lawmakers aim to train more truck drivers, ease supply chain issues through bipartisan bill.

UK Industrials: Neutral

UK Industrial firms ended their trend of net deterioration this month.

The UK Industrials CCI score this month is 50, suggesting neutral credit quality.

UK construction activity eases amid steep drop in housing demand

EU Industrials: Trend of Net Improvement Continues

EU Industrial firms have registered another positive CCI for this month, which is the nineteenth consecutive instance of a positive score.

The EU Industrials CCI score this month is 51.1, the same score as last month.

German rocket maker Isar Aerospace raises $165m Series C — 2023’s biggest spacetech round globally so far.

To download the full CCI tear sheets for US, UK & EU Industrials, please enter your details below: