Governments around the world are scrambling to rearrange their budgetary plans as COVID-19 turns economic forecasts upside down. Leading economists have likened the current environment to wartime, with an appropriate fiscal response demanded to prevent major financial catastrophe.

As the situation unfolds, governments have announced unprecedented stimulus and support packages. Germany, for example, have announced a €608 billion package, representing 15.6% of total GDP. The US government has pledged a $1 trillion stimulus package, about 5% of GDP, at 4.9%. China has granted approval to banks to relax rules on loan repayments and debt reporting.

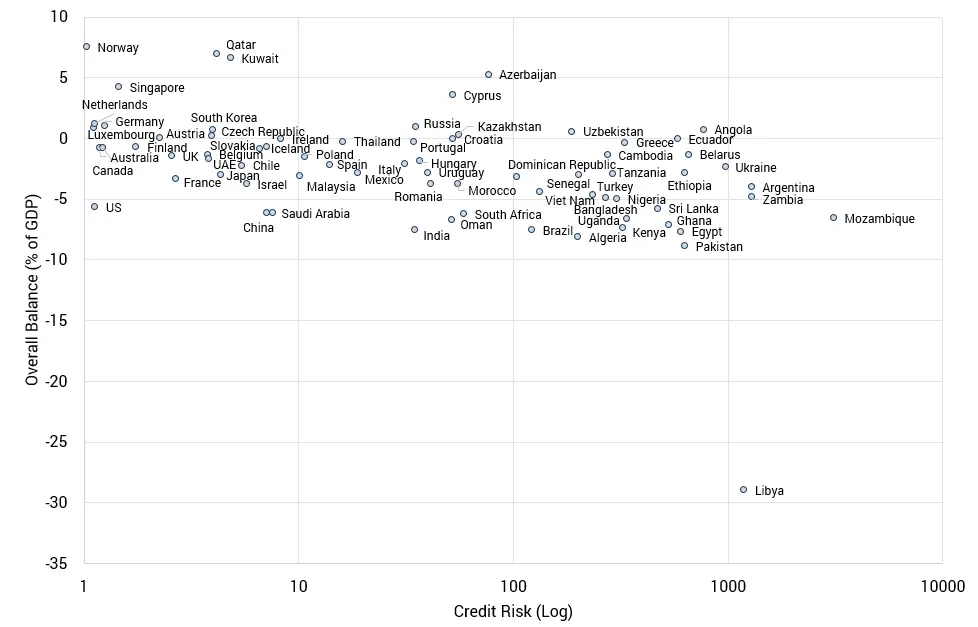

Once the dust has settled and the money has been distributed, what view will lenders take on the creditworthiness of these sovereigns? Using credit risk data collected from leading global financial institutions, Credit Benchmark is able to compare sovereign credit quality against the IMF’s Fiscal Monitor*, showing each government’s current levels of net lending/borrowing (overall balance) (% of GDP). The below chart plots sovereign credit risk on the x-axis and overall balance (% of GDP) on the y-axis (see following page for observations).

Sovereign Credit Risk vs Overall Balance (% of GDP)

The chart shows:

- The United States has a Credit Benchmark Consensus (CBC) of aaa, along with Canada, Australia,

Luxembourg, Netherlands, Norway and Germany. However, the United States fiscal balance

is noticeably worse than other aaa

rated sovereigns, with a deficit of -5.6%.

- Similarly, China (a), Saudi Arabia (a) and India (bbb-) have significantly lower overall

balances than other sovereigns sharing the same ratings bands.

- Germany also has a consensus rating of aaa and a positive fiscal balance of

1.1%, but their stimulus plans may put both measures in jeopardy. Germany’s

massive stimulus package means that it is suspending its adherence to its

self-imposed balanced budget rule, and the underlying probability of default –

1.24 basis points – puts it very close to being downgraded to aa+.

- Italy has higher levels of government

debt and lower levels of government investment than its European neighbours, and

a negative fiscal balance of -2%. Credit Benchmark data shows a probability of

default of 31 basis points, placing them just 2 basis points away from being

downgraded from a current CBC of bbb

to bbb-.

The IMF has announced a major addition to its global credit facilities, which is some comfort to the fiscally weak countries on the right hand side of the chart with limited or no capacity to pump prime their economies. As a footnote, there is some evidence that the virus may be most prevalent in specific latitudes and temperatures; in which case some of the poorest countries may be spared the worst of the direct economic damage. But supply chains are long and complex, so few countries are likely to be completely unscathed.

.

This research has been referenced in the Reuters article, “Ramped Up Spending Puts Germany’s Triple-A Rating At Risk – Credit Benchmark”, which can be read here.

.

*Source: IMF. (2019). Fiscal Monitor. [online]. Available at: https://data.imf.org/?sk=4be0c9cb-272a-4667-8892-34b582b21ba6&sId=1390030341854 [accessed 18 March 2020]