The IMF report that post-Covid growth has helped shrink public debt to GDP ratios in major economies (except China), but forecast a trend increase from 2024. Actual debt levels continue to rise; stubborn inflation due to supply chain damage, labour shortages and the Ukraine war have pushed up long term debt funding costs despite sustained global short rate hikes.

The US Debt Ceiling drama is partly a symptom of a growing debt overhang, and Q1 US Bank failures are a reminder that a robust banking system needs a well-financed Government. Growing concerns about shadow banking means that corporates are not immune to credit problems.

A recent paper highlights links between Sovereign default risk and the global financial system. The authors state: “…a substantial portion of the comovement among sovereign spreads is accounted for by changes in global financial risk…spillover effects of global financial risk are more pronounced for speculative-grade sovereign bonds.”

Various other studies have looked at the two-way links between Public and Private default risks. As a credible lender of last resort, Sovereign ratings need to be stronger than their domestic financial sector. (They typically are, with a few exceptions like Turkey.) If the financial sector of a country runs into problems, then domestic corporate borrowers are likely to face higher funding costs from international lenders. Conversely, a struggling corporate sector undermines the fiscal base and ultimately the Sovereign rating.

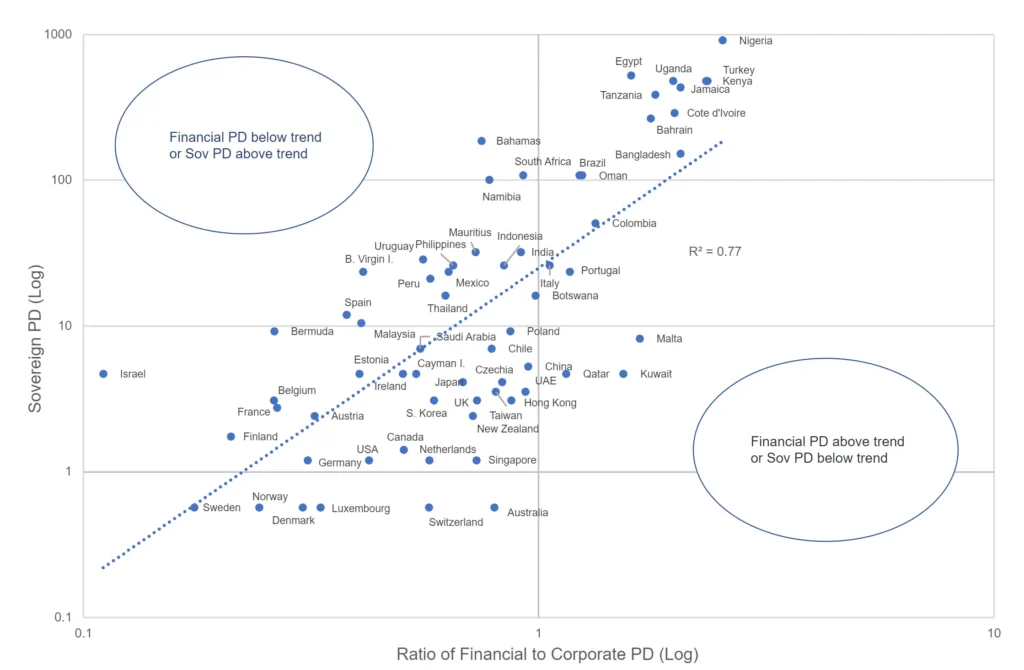

The chart below plots the current relationship between consensus Sovereign credit risk and the Financial / Corporate credit risk ratio, for a large cross section of countries.

The ratio of Financial to Corporate PDs is used to filter out small samples and to adjust for the global spread effect mentioned earlier. Countries in the upper left quadrant either have a Financial PD below trend, a Corporate PD above trend, or a Sovereign PD above trend. The Sovereign PD for Egypt, for example, may be too high, the Financial PD too low, or the Corporate rating too high. Countries in the bottom right quadrant are in the opposite group – so for example the Financial PD for Australia may be too high given the Sovereign and Corporate risk ratings. For Australia the x-axis value is below 1. This means that along with other strong global economies like Germany, USA and UK, Australia has a Financial PD that is less than the Corporate PD.

Comparison with similar economies may shed more light on these anomalies, but the core messages are clear: (1) the credit rating of a country’s financial system is heavily influenced by the credit rating of the Sovereign, and (2) in countries with the strongest credit, the Financial sector is stronger than the Corporate sector.

Enjoyed this report? If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 75,000 public and private global entities, please complete your details to request a demo or coverage check: