To download the September 2020 Oil & Gas Aggregate PDF, click here.

.

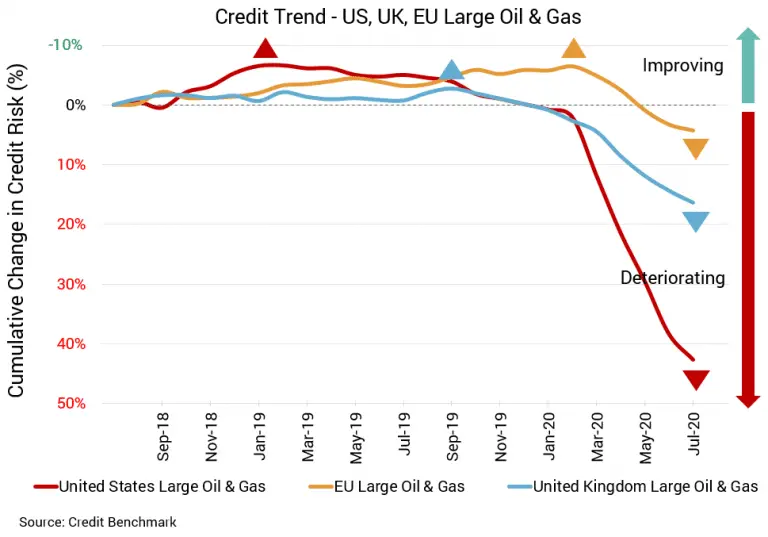

The besieged US energy sector continues to see credit deterioration, and with a multitude of problems facing the industry there is little cause for optimism. In the US, energy companies were supplying fewer barrels of gas per day even with the recovery in consumption, and shale producers are facing a cash crunch. Meanwhile, European oil producers are questioning whether it’s worth drilling. Problems that began months ago continue to fester for firms around the world. Demand will likely remain depressed until the economy picks up, and credit will continue to be stressed.

Probability of Default for US Oil & Gas Firms Increases by 50% Over Last Year

- Credit quality for US-based oil and gas firms continues to trend lower and probability of default has surged

- Percentage of firms with a low CBC rating is much higher for US than for UK, EU energy aggregates

.

US Oil & Gas

The credit deterioration in US energy continues, but at a slower pace than in recent months. With the latest update, large US oil & gas firms have seen credit quality drop just 3% from the prior month. That compares to a drop of 10% from two months prior, 17.4% from three months prior, or 41.5% from six months prior. Credit quality has dipped about 50% from the same point last year. Default risk is surging. Average probability of default is now 58.7 basis points. That compares to 57 bps the prior month, 53.4 bps two months prior, 50 bps three months prior, and 41.5 bps six months prior. At the same point last year, average probability of default was 39.1 bps. This aggregate’s CBC rating is bb+.

UK Oil & Gas

Credit is also deteriorating in the UK energy sector. For large UK oil & gas firms, credit quality is down 2% from the prior month, 4% from two months prior, 7% from three months prior, and 15.4% from six months prior. Compared to the same point last year, it’s down 17.3%. Default risk is climbing as credit quality drops. Average probability of default is now 38.5 bps. That compares to 37.9 bps the prior month, 37 bps two months prior, 35.9 bps three months prior, and 33.4 bps six months prior. At the same point last year, average probability of default was 32.8 bps. This aggregate’s CBC rating is bbb-.

EU Oil & Gas

Credit quality is also trending down for large EU oil & gas firms. It’s declined by 1% from one month prior, 3% from two months prior, 7% from three months prior, and 10.6% from six months prior. Year-over-year, it’s down by 8%, indicating some volatility and that the decline in quality is a more recent trend. Default risk is growing. Average probability of default is now 27.3 bps. That compares to 27.1 bps the prior month, 26.4 bps two months prior, 25.5 bps three months prior, and 24.7 bps six months prior. At the same point last year, average probability of default was 25.4 bps. This aggregate’s CBC rating is bbb.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.