Insights

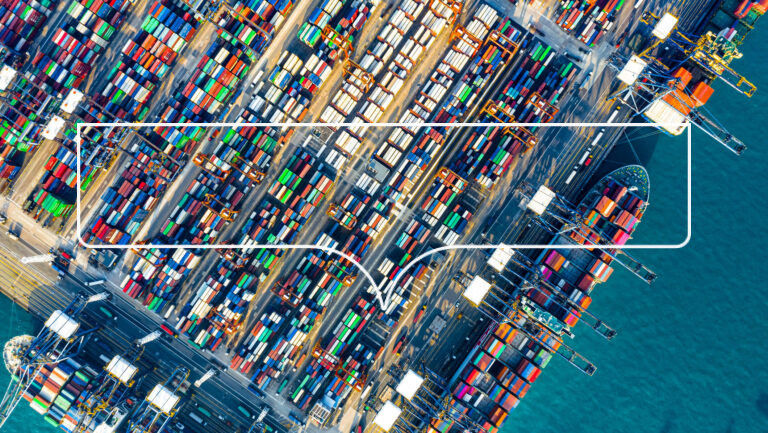

Credit Spotlight on Tariffs: The Wider Impact

Tariffs are reshaping trade and credit risk. Credit Benchmark data highlights early signs of strain and resilience.

FILTER:

ARCHIVES:

SEARCH:

Oil And Gas Pumping Up, With Upgrades Outweighing Downgrades For The First Time In 2017

Earlier this year, we unveiled the findings of our research into credit risk trends in the Oil & Gas sector. The report covered credit risk estimates for more than 384 entities in the sector, including many companies which are unrated by the “Big Three” credit ratings agencies. At the time the

Consensus Credit Risk Across Global Banks: Europe, Japan And U.S.

Credit Benchmark brings together the credit risk assessments of the world’s leading banks to deliver greater visibility into the credit quality of individual entities. Today’s blog post looks at the banking sector, specifically Scandinavia, the Visegrad group (Central Europe), Western Europe, the UK and Ireland, the U.S., Japan and Asia

Consensus Credit Risk Across Global Banks: Europe, Japan And U.S.

Credit Benchmark brings together the credit risk assessments of the world’s leading banks to deliver greater visibility into the credit quality of individual entities. Today’s blog post looks at the banking sector, specifically Scandinavia, the Visegrad group (Central Europe), Western Europe, the UK and Ireland, the U.S., Japan and Asia

June Credit Update: More Downgrades Than Upgrades, Coverage Includes Snap Inc

Credit Benchmark has published the latest monthly credit consensus data (from May 2017), with 14 contributor banks now providing bank-sourced credit views (CBCs*) on more than 10,300 separate legal entities over the past 12 months. Sovereign coverage now includes Government of Saint Kitts and Nevis . Additions to the data

April Credit Update: More Downgrades Than Upgrades

Credit Benchmark has published the latest monthly credit consensus data (from April 2017), with 13 contributor banks now providing bank-sourced credit views (CBCs*) on more than 8,400 separate legal entities. Additions to the data include Nvidia Corp, Insight Enterprises, Korean Airlines, Hormel Foods Corp, Tupperware Brands, National Basketball Association, England

Spain: Improving Sovereign Credit Risk Owes More To Economics Than Politics

The Spanish economy grew by 0.8% in Q1 2017, an annual rate of more than 3%, higher than recent data for Germany, France and the Netherlands. Unemployment has been trending down and currently stands at a post-crisis low of 18%. Spain suffered more than most during the Eurozone downturn but