Credit Benchmark have released the October Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

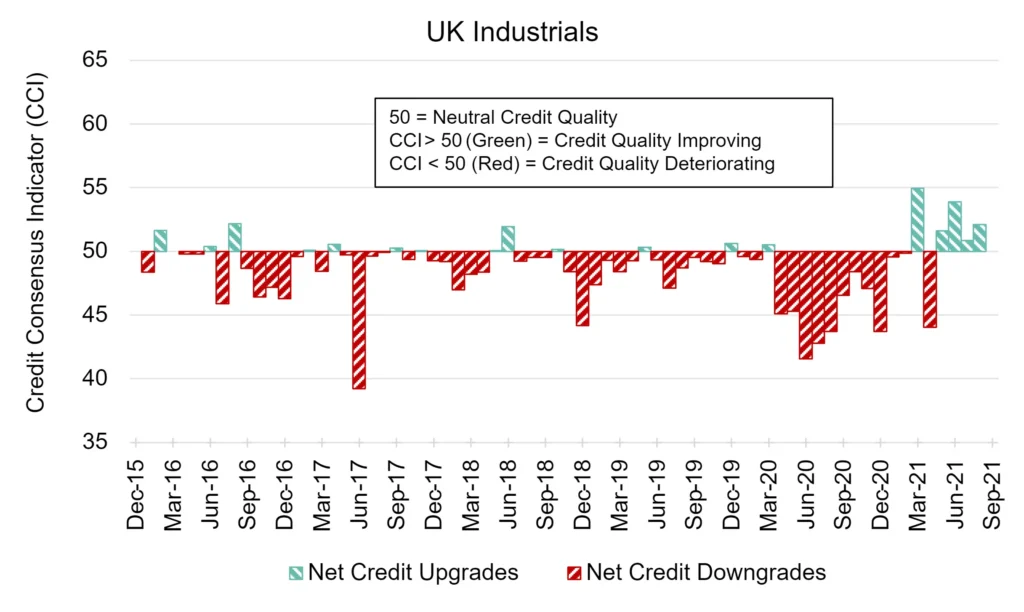

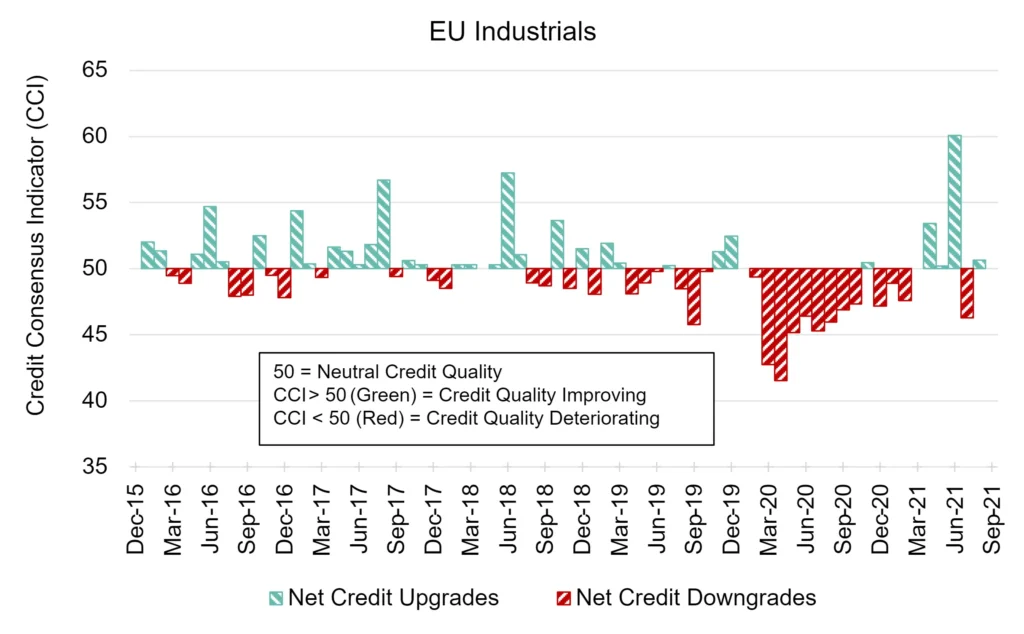

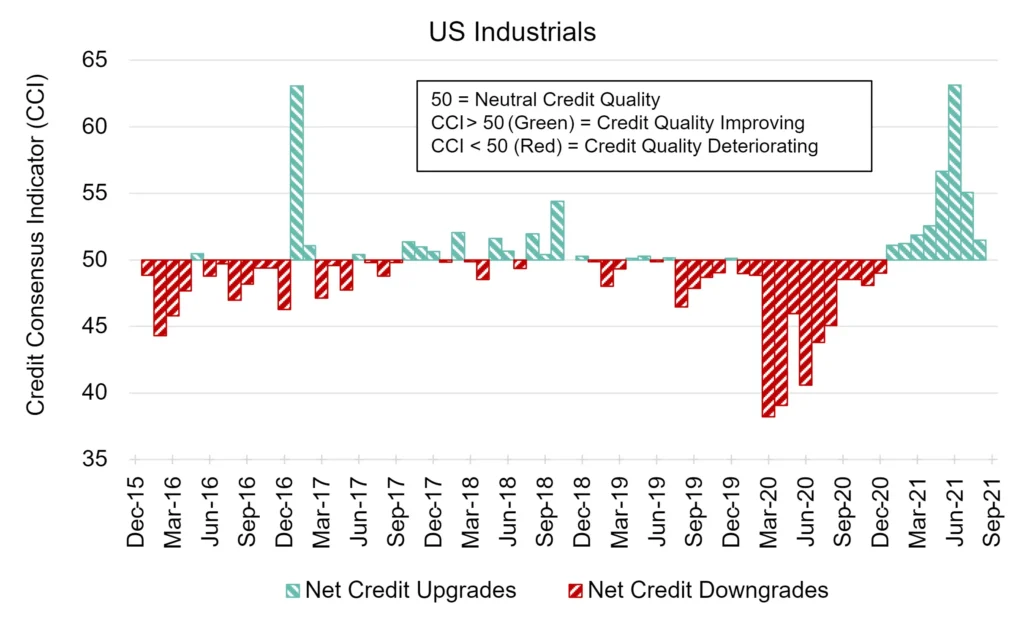

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

This month: is the glass half full or half empty for major economy industrial firms?

On the one hand, forward-looking sentiment is positive for the UK, EU, and US. There’s good reason for this. Though the pandemic is not entirely under control, all three regions have vaccinated the large majority of their populations and rates continue to grow. The economies of all three are growing. Monetary and fiscal policy may remain relatively accommodative.

On the other hand, forward-looking sentiment has been volatile for the UK and EU and is trending in the wrong direction for the US. There are also plenty of obstacles and pitfalls, from broader supply chain and logistics challenges to energy sector problems. In the US specifically, there’s no guarantee of approval for infrastructure legislation. And while monetary and fiscal policy remain loose, they may get tighter if inflation continues to be stronger than anticipated earlier this year. There is also a risk of crisis contagion from issues affecting other areas of the world. Efforts to untangle these challenges will take time. Some suggest the problems may get even worse his year.

The global economy, and specifically economies for the UK, EU, and US, may have improved from the low points of the last few years, but they aren’t out of the woods just yet. Neither are their respective industrial firms.

UK Industrials: Positive Streak Continues

Consensus outlook on credit quality for UK Industrial firms has remained positive for a fourth consecutive month; the longest run since tracking began.

The UK CCI score is now 52.1, compared to 50.9 last month.

UK manufacturing activity is growing but slowing amid supply chain problems and rising costs. Energy prices are proving to be a headache for the UK.

.

EU Industrials: Modest Positivity

Consensus outlook on EU Industrial firms is also back in positive territory, but the swing towards improvement is far weaker than in recent months.

The EU CCI score is now 50.7, compared to 46.3 last month.

Eurozone manufacturing activity is growing strongly but still slowing due to supply chain challenges and inflationary pressures. Surging energy prices are also causing problems for the EU.

.

US Industrials: Struggling With Momentum

US Industrials are clinging onto a positive credit trend, though opinions have risen and fallen in recent months and currently sit in their weakest position for six months.

The US CCI score is 51.5, down from 55.1 and marking the eighth consecutive month in a row this score is in positive territory, yet the trend is in the wrong direction.

US manufacturing activity is still rising but is now at a five-month low due to supply chain difficulties. Global energy problems could be on their way to the US.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: