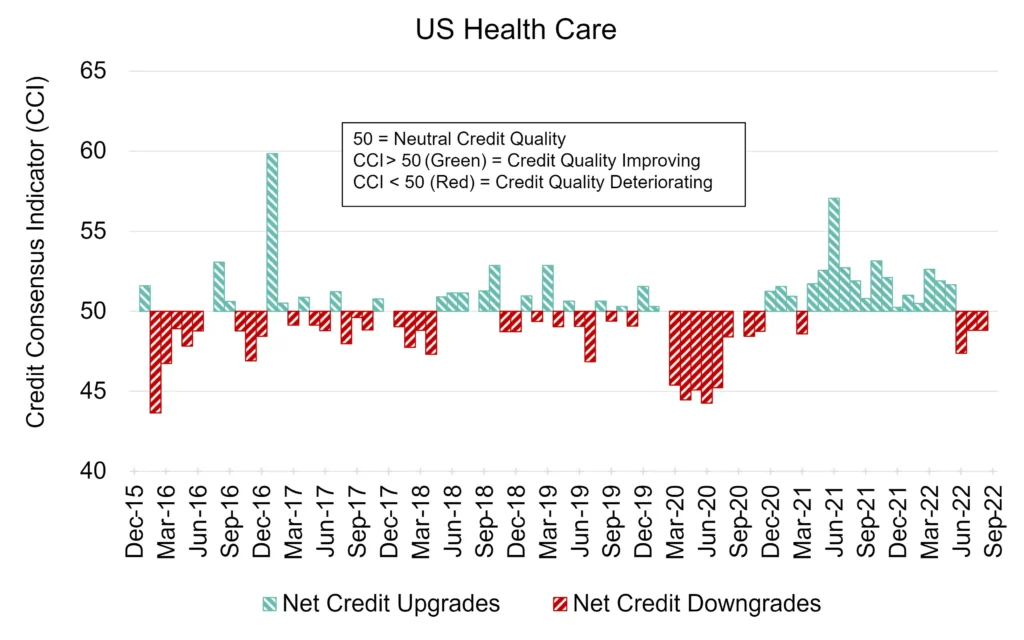

As pandemic-related spending continues to fall, the US Health Care sector is beginning to show credit deterioration. Figure 1 shows the Credit Consensus Indicators1 (CCIs) for US Health Care.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. To arrange a demo of all single name and aggregate data detailed in this report, please request this by sending us an email.

Figure 1: Credit Consensus Indicators (CCIs), US Health Care: Feb-16 to Aug-22

After a record run of 14 months of net improvements, this sample of more than 400 US Health Care companies has recorded three months with a CCI below 50, indicating that downgrades now outnumber upgrades.

More CCI industry graphs can be found within Credit Benchmark’s monthly CCI Monitors.

The changing balance between upgrades and downgrades in US Health Care is mirrored in Figure 2, showing that the long decline in average credit risk – measured by default probability (axis inverted) – has been faltering, with recent periods of credit deterioration.

Figure 2: Credit Trend, US Health Care; Aug-20 to Aug-22

Figure 3 shows the current credit distribution for this sample – the good news is that over 60% are still rated investment grade.

Figure 3: Credit Distribution, US Health Care; Aug-22

While the Inflation Reduction Act (IRA) makes notable strides toward improving the affordability and accessibility of health care in the US, Fitch Ratings believes this act will pressure revenues and margins and have a negative effect on corporate credit, however, the future of US Health Care is still uncertain.

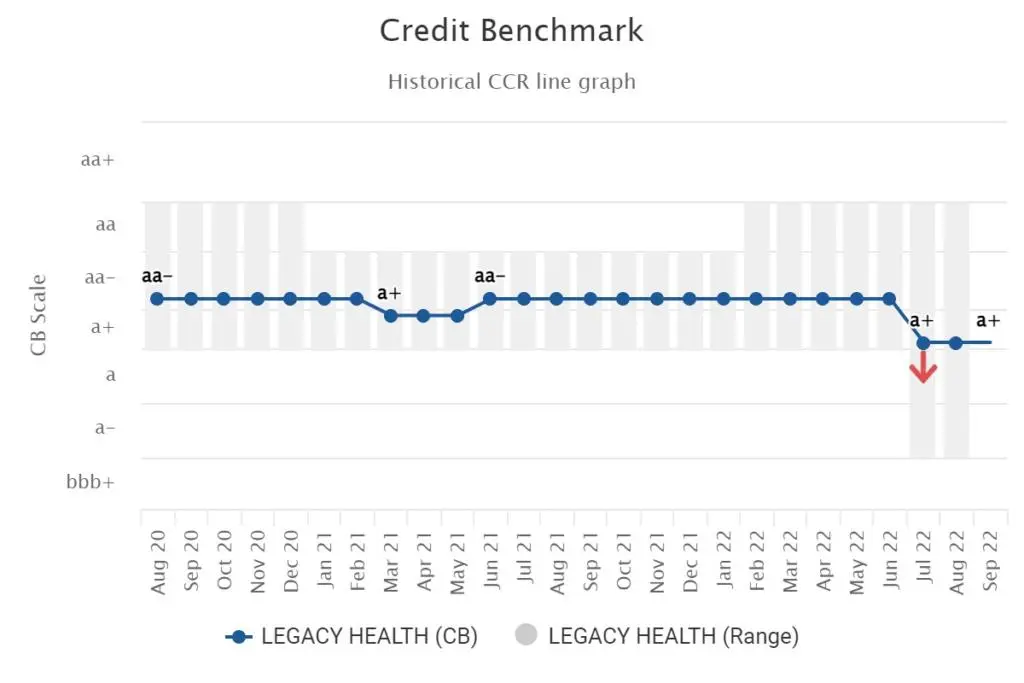

Figures 4-7 show detailed credit trends for some of the US Health Care companies which have experienced credit deterioration recently, majority of which have limited CRA coverage.

Figure 4: Dentsply Sirona Inc

Figure 5: California Physicians’ Service

Figure 6: Marshfield Clinic Health System Inc

Figure 7: Legacy Health

[1] The CCI is an index of forward-looking credit opinions based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.