To download the May 2020 Auto Aggregate PDF, click here.

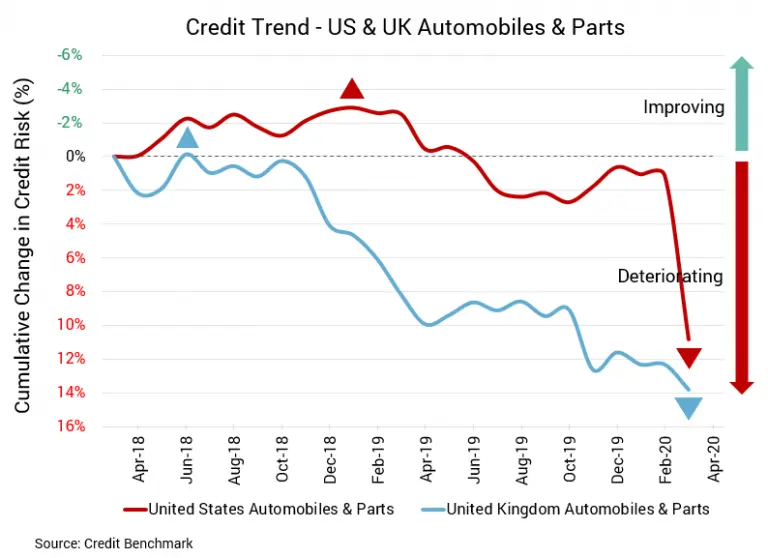

Problems for the US auto sector are making themselves known in credit data, and credit data for the UK already reflects ongoing issues. This comes as the US reaches a possible bottom in COVID-19-related sales declines, with some dealers reporting reasons for optimism as the coronavirus-induced shock begins to subside. Despite this optimism, auto sales were down by 39-54% for some brands in the US. In the UK, auto sales had their worst month since 1946. Such a development affects not only the automakers and dealers but those involved in production as well.

In Just One Month, Default Risk Is Up Almost 10% for US Auto Companies

- Credit quality for US-based firms has fallen 9.6% in the last month.

- While credit quality continues to worsen at a faster pace for the US than for the UK, the Credit Benchmark Consensus (CBC) rating is worse for UK-based firms, reflecting how much credit quality has already declined.

US Auto and Auto Parts Industry

Credit quality has been deteriorating steadily for the US auto sector. Over just the last month, credit risk has increased by 9.6%. This compares to a decline of 13.7% over the last year. The average probability of default for the sector rose to 39.2 basis points, the highest in more than two years. It was 35.8 basis points in the prior month and 34.6 basis points at the same point last year. The current CBC rating for this sector is bbb-, unchanged for the last 12 months. As credit quality continues to deteriorate, the majority of firms in this sector have CBC ratings of bbb or lower.

UK Auto and Auto Parts Industry

Credit quality for the UK auto sector isn’t worsening as quickly as it is for the US, largely due to the fact that it had already deteriorated considerably over the last several months. The average probability of default for the sector is now 58.5 basis points, compared to 57.7 basis points in the prior month and 55.6 basis points at the same point last year. This translates into a decline in credit quality of 1.3% over the last month and 5.2% over the last year. The current CBC rating for this sector is has remained bbb- over the last 12 months. As in the US, the vast majority of firms in this sector have CBC ratings of bbb or lower.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.