To download the June 2021 Auto Aggregate PDF, click here.

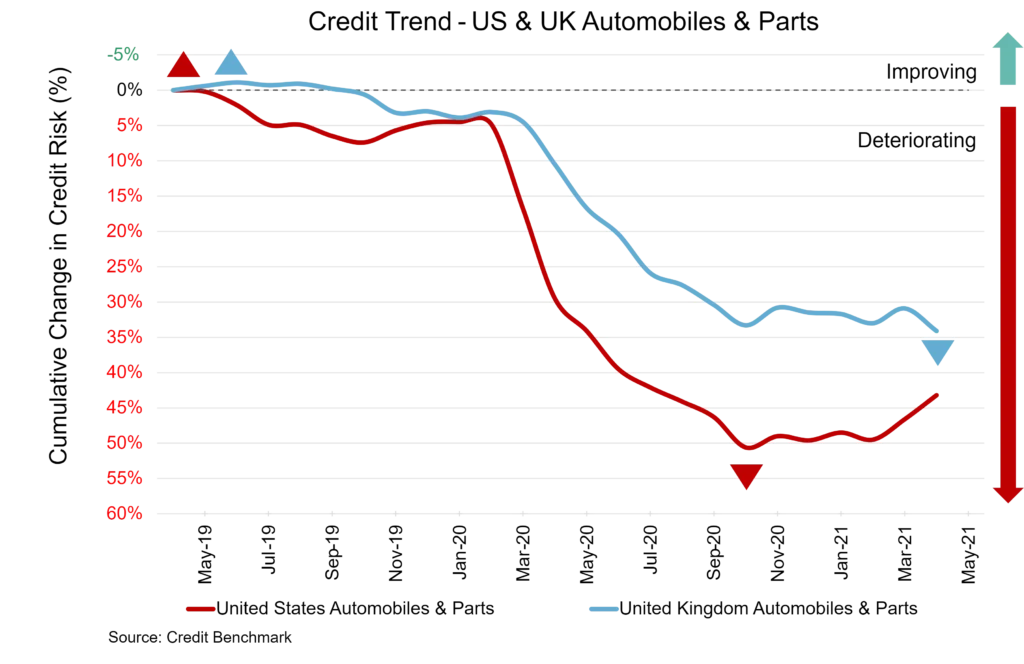

Conditions are ripe for the US and UK auto sectors. The threat of new COVID variants persists, but vaccination rates continue to move higher and new cases remain relatively low. Fiscal and monetary policy will stay supportive. Job growth is not spectacular but certainly positive. Many consumers remain ready to spend.

But car makers are having difficulties procuring computer chips for production lines and the problem shows little sign of abating. Flex, a manufacturer of electronical components like semiconductors, said problems may persist into the middle of 2022, and some believe into 2023. This will limit production and put pressure on prices, hitting the bottom line even for companies handling the situation well like GM (there may also be issues with certain suppliers for companies like GM, as Credit Benchmark research has found.) One estimate from KPMG suggests the blow to automakers at $100 billion globally; another estimate from AlixPartners says the global auto industry will lose $110 billion in revenue this year, up from an earlier estimate of $60.6 billion in January.

Supply chain pressures will ease eventually, but in the meantime the otherwise bright outlook for the US and UK auto sectors will be hampered by this ongoing issue.

US Auto and Auto Parts Industry

Conditions are improving for the US auto sector. Even though credit quality is down 11% year-over-year, it has improved 2% month-over-month and 5% over the last six months. Default risk is currently 47 bps; it was 48 bps last month, 49 bps six months ago, and 42 bps at the same point last year. Now this sector’s overall CCR rating is bbb- and 74% of firms are at bbb or lower. Overall US corporate default risk is 65 bps, with a CCR of bb+ and 82% of firms at bbb or lower.

UK Auto and Auto Parts Industry

The situation worsened for the UK auto sector in the latest update but remains steady overall. Credit quality is down by 2% over the last month; it’s fallen by 1% from six months ago and 21% year-over-year. Default risk is now 90 bps; it was 88 bps last month, 90 bps six months ago, and 74 bps at the same point last year. Now this sector’s overall CCR rating is bb and 90% of firms are at bbb or lower. Overall UK corporate default risk is 81 bps, with a CCR of bb and 91% of firms at bbb or lower.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.