To download the July 2021 Oil & Gas Aggregate PDF, click here.

.

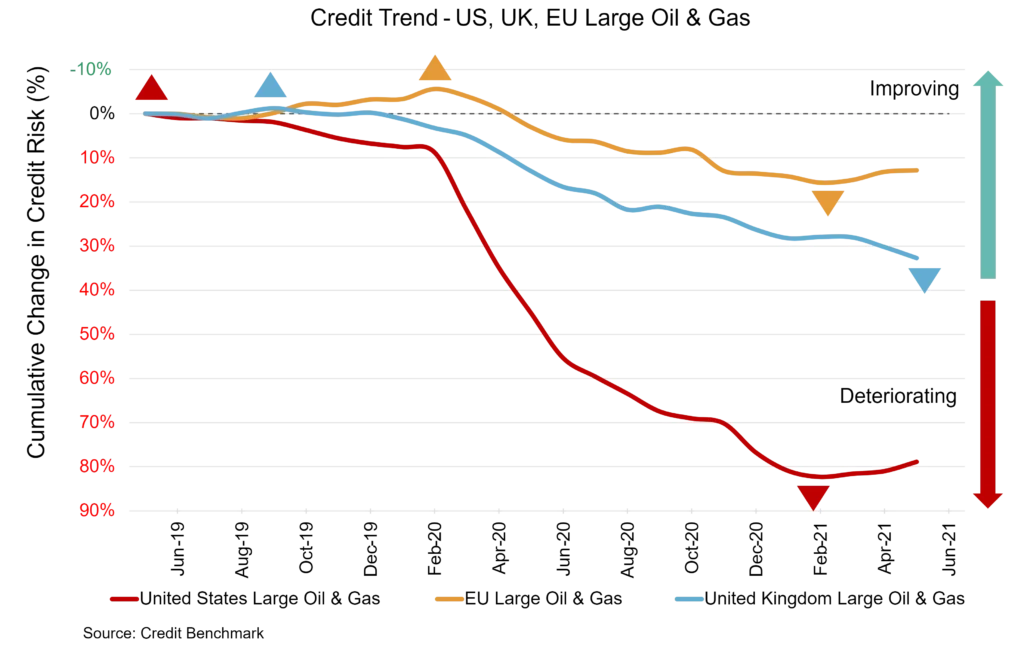

Depending upon who you ask, the world is either headed for the best period of global growth since the early 1970s or problems are mounting as the delta variant of the virus that causes COVID-19 continues to spread. Opinions on either of those options – and some combinations of the two – are already showing up in the energy sector.

Even with high US oil prices, for instance, investment is weak and rig count growth is slow. Volatility may grow, especially if there are supply constraints. There are added pressures from climate activists and potential changes in regulation.

Amid this lack of clarity, monthly changes in credit quality outlook for the energy sector were muted, with the US seeing some improvement and the UK seeing some deterioration in credit. The EU energy sector is stable.

.

US Oil & Gas

Slowly but surely, the US energy sector is looking better. In the latest data, credit quality has improved by 1% compared to last month, even though it’s still down 5% over the last six months and 23% over the last year. Default risk is now 72 bps, compared to 73 bps last month, 69 bps six months ago, and 59 bps at the same point last year. Currently, this sector’s overall CCR rating is bb+ and 86% of firms are at bbb or lower. Overall Large US Corporate default risk is 55 bps, with a CCR of bb+ and 80% of firms at bbb or lower.

UK Oil & Gas

The UK energy sector continues to deteriorate. On top of declines of 17% year-over-year and 8% over the last six months, credit quality dropped 2% from last month. Default risk is now 51 bps; it was 50 bps last month, 48 bps six months ago, and 44 bps at the same point last year. Currently, this sector’s overall CCR rating is bb+ and 75% of firms are at bbb or lower. Overall Large UK Corporate default risk is 65 bps, with a CCR of bb+ and 87% of firms at bbb or lower.

EU Oil & Gas

The EU energy sector is stable. While down 10% year-over-year, credit quality is unchanged from last month and over the last six months. Default risk remains at 31 bps, compared to 29 bps at the same point last year. Currently, this sector’s overall CCR rating is bbb and 70% of firms are at bbb or lower. Overall Large EU Corporate default risk is 34 bps, with a CCR of bbb- and 73% of firms at bbb or lower.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.