To download the July 2021 Auto Aggregate PDF, click here.

In some circumstances a sparsely populated sales lot might be a good sign for auto sellers, but not recently.

As the semiconductor shortage continues to disrupt many areas, especially the auto sector, dealer inventory is suffering. Some estimate that industrywide supply in the US might last around a month, compared to about 60 days in normal circumstances. The tightness of inventories has led to higher prices, but consumer demand is certainly not inelastic.

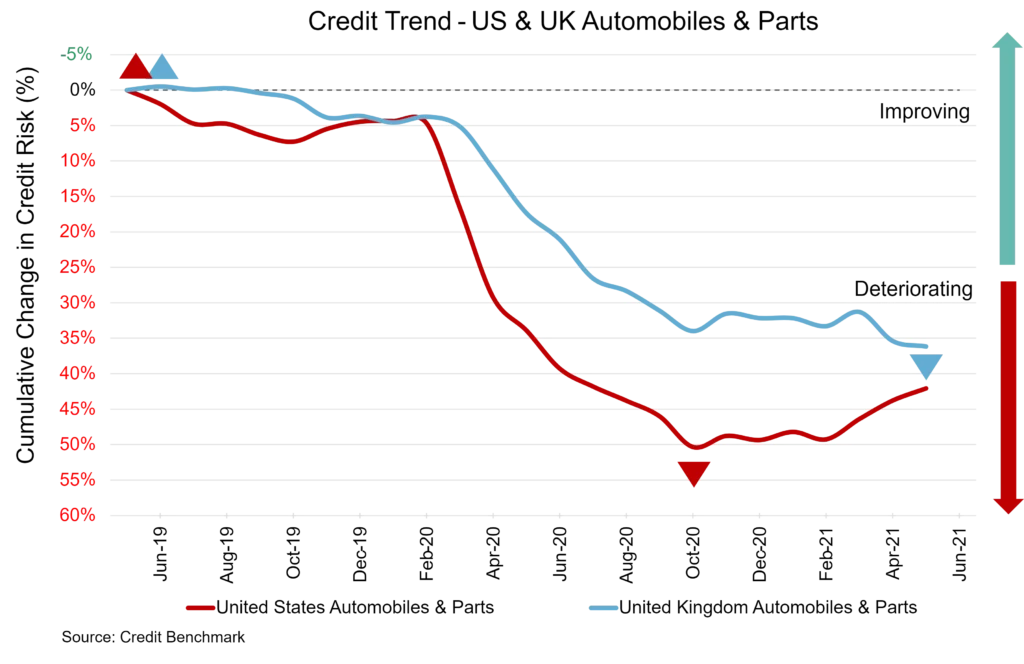

The worst of the pandemic-related challenges may have passed but continued improvement for the US auto sector may be under threat unless supply chain problems ease.

The UK, meanwhile, is seeing similar problems as credit for auto firms deteriorates, and lingering concerns about Brexit remain.

US Auto and Auto Parts Industry

The US auto sector is trending in the right direction. The latest data show improvement of 1% month-over-month and 5% from six months ago; the year-over-year decline is just 6%. Default risk is now 47 bps, compared to 48 bps last month, 50 bps six months ago, and 45 bps at the same point last year. This sector’s current overall CCR rating is bbb- and 80% of firms are at bbb or lower. Overall US corporate default risk is 65 bps, with a CCR of bb+ and 82% of firms at bbb or lower.

UK Auto and Auto Parts Industry

The UK auto sector continues to trend negatively. In the latest update, credit quality has declined by 1% month-over-month, 4% from six months ago, and 16% year-over-year. Default risk is now 93 bps, compared to 92 bps last month, 89 bps six months ago, and 80 bps at the same point last year. This sector’s current overall CCR rating is bb and 89% of the firms are at bbb or lower. Overall UK corporate default risk is 83 bps, with a CCR of bb and 91% of firms at bbb or lower.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.