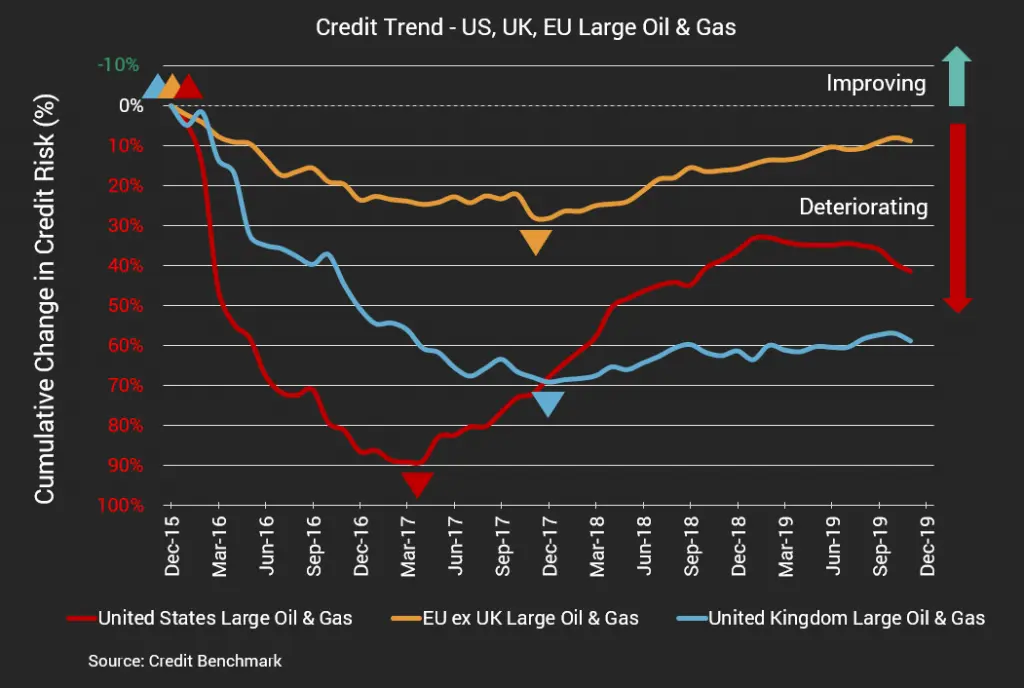

EU and UK Oil and Gas Firms Show Slight Reduction in Credit Risk

- Credit quality for large oil and gas companies in the US has continued to deteriorate for a fifth straight month, falling 3.8% since December of 2018 and 1.3% since November 2019.

- The EU (ex-UK) and UK energy sectors have both logged monthly declines in credit quality after showing slight improvement in recent months. EU oil and gas credit quality has deteriorated 0.5% this month and UK oil and gas credit quality is down 1.1%.

US Oil & Gas

US oil and gas firms have seen their credit quality decline 3.8% since December 2018. On a month-over-month basis, credit quality for US oil and gas firms is down 1.3%. Currently, the average probability of default for US oil and gas firms is 46.7 basis points.

UK Oil & Gas

UK oil and gas firms saw their credit quality deteriorate 1.1% on a month-over-month basis to close the month with an average probability of default of 37.8 basis points. On a year-over-year basis, however, UK oil and gas corporate credit is up 1.6%, driven by slow-but-steady improvements over much of the course of 2019.

EU (ex-UK) Oil & Gas

The EU energy sector has been the lone bright spot in the global oil and gas industry, showing steady improvement in credit quality throughout much of 2019. That improvement streak ended this month, with credit quality deteriorating 0.5% and an average probability of default of 21.1 basis points. On a year-over-year basis, credit quality for EU oil and gas corporates is up 6.2%.

About Credit Benchmark Consensus Aggregates

Aggregate Analytics are macro-level risk indicators that assess and compare credit trends and distributions across 105 countries, 300 industries and 75 sectors. Hundreds of trend-tracking, forward-looking Aggregates are available, reflecting Credit Benchmark’s expanding universe of 800,000+ contributed credit risk observations from the world’s leading financial institutions.

To download the January 2020 Oil & Gas Aggregate PDF, click here.