Download the latest Financial Counterpart Monitor below.

Financials have seen strong credit quality improvement this month across a variety of counterparts.

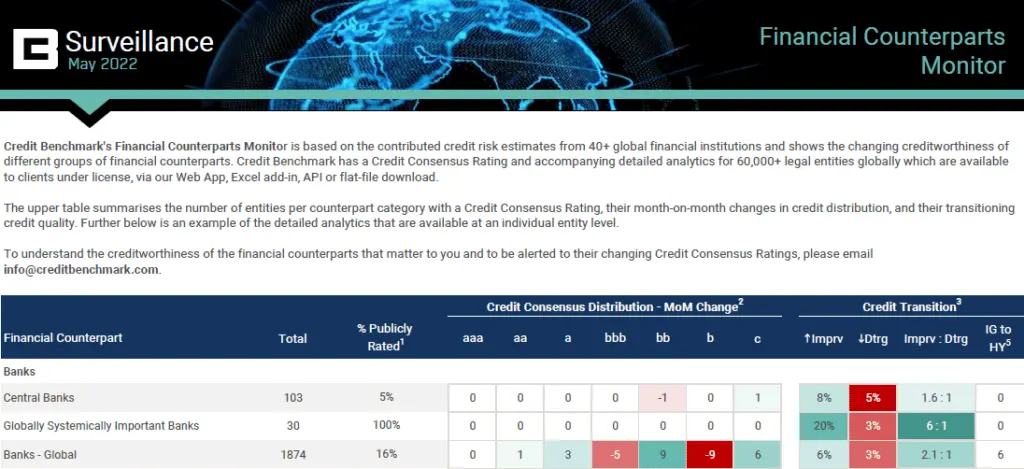

Globally Systematically Important Banks (GSIBs) were the stand-outs in the Banking group, with an improving to deteriorating ratio of 6:1. North American Banks followed closely behind with a ratio of 5.3:1. The other groups all also showed net improvement to varying degrees, with the exception of Latin American Banks which were neutral with a ratio of 1:1.

Among the Intermediaries, Prime Brokers led the pack with 5 improvements to each deterioration, followed by CCP Members with a 3:1 ratio. CCPs themselves showed no instances of deterioration this month.

On the Buy-Side, Sovereign Wealth Funds showed the strongest performance this month with a ratio of 5:1. Asset Managers and Insurance Companies showed similar levels of net credit improvement, at 2.2:1 and 2.1:1 respectively.

The only net deterioration this month was observed in Pension Funds, with an improving to deteriorating ratio of 1:3.1.

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.