Download the latest Financial Counterpart Monitor below.

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions.

Credit Benchmark covers 10,576 Financial entities, 82% of which are not rated by a credit rating agency. Financials showed a very slight bias towards net credit deterioration last month.

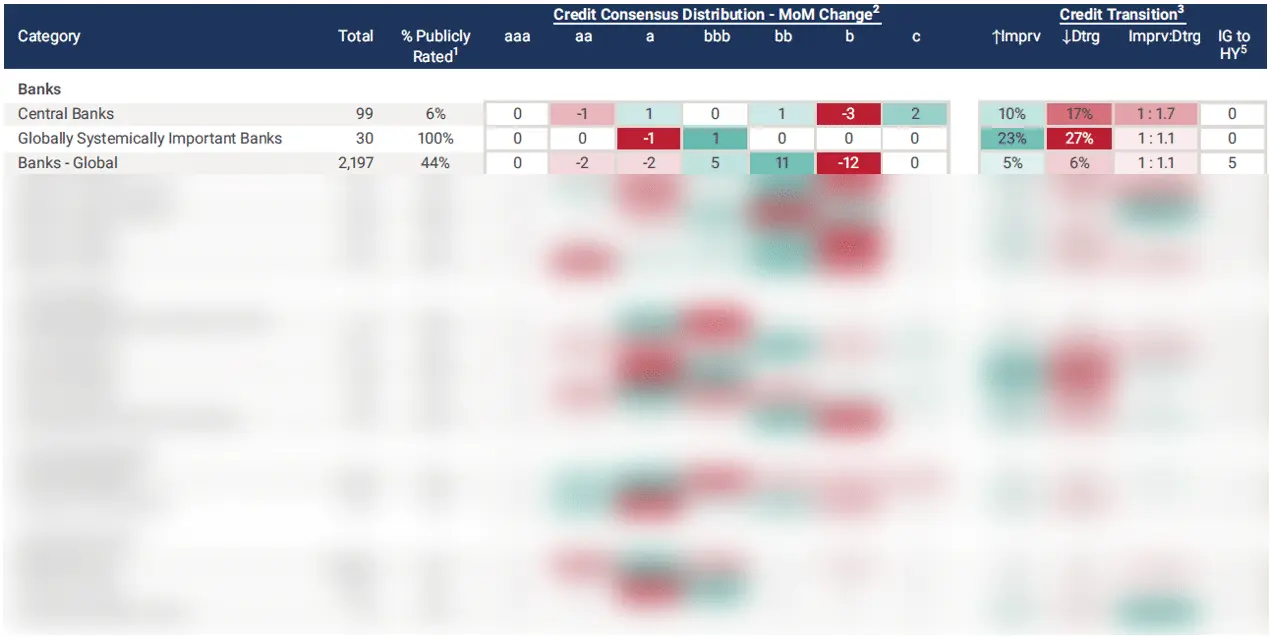

Banks

Within the Bank category, North American Banks (of which we cover 276 entities; 54% of which are not publicly rated) showed the highest levels of deterioration last month, with a negative ratio of 1:1.9 improvements to deteriorations. Central Banks (99 entities; 94% unrated) followed closely, with a negative ratio of 1:1.7. The strongest performers of the group were Latin American Banks (202 entities; 52% unrated), with a positive ratio of 2 improvements to every deterioration. EMEA Banks (1,178 entities; 58% unrated) maintained credit neutrality last month, with an even ratio of 1:1.

Intermediaries

Credit movement was fairly balanced for the Intermediaries, with CCP Members (1,124 entities; 57% unrated) coming off worst with a mildly negative ratio of 1:1.3 improvements to deteriorations. CCPs themselves (47 entities; 72% unrated) remained neutral with a 1:1 ratio, as did Broker Dealers (276 entities; 59% unrated). Prime Brokers (24 entities; 8% unrated) and Custodians and Sub Custodians (151 entities; 46% unrated) both showed positive credit movement, with ratios of 1.2:1 improvements to deteriorations.

Buy Side

Of the Buy Side firms, Sovereign Wealth Funds (37 entities; 92% unrated) were most positive, with a ratio of 2:1 improvements to deteriorations. All other groups were neutral or near-neutral; Mutual Funds (28,396 entities; 99% unrated) and Pension Funds (2,031 entities; 99% unrated) were slightly in the red with ratios of 1:1.1 improvements to deteriorations.

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.