Credit Benchmark have released the February Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

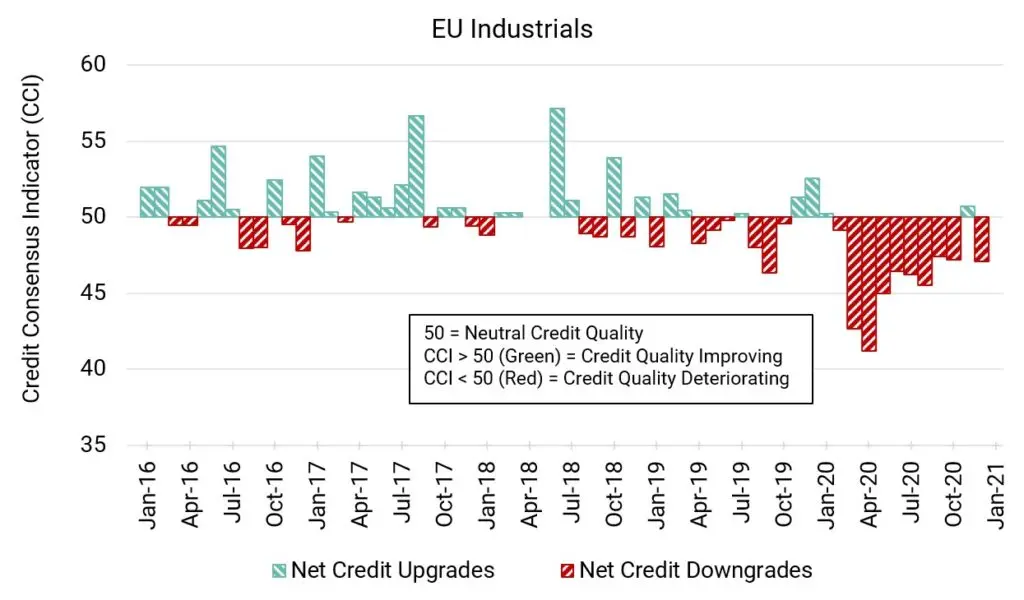

Last month suggested improving sentiment for EU Industrials, but this month’s CCI has dropped back below 50 and sits lower than the US CCI. Business confidence in the Eurozone ended last year on a positive note, yet its economy officially contracted in the final quarter, leaving GDP down 6.8% for the year overall. One CEO said the economic situation in the Eurozone was getting “desperate.” Specific problems like production costs have contributed to the difficult climate. A more robust economic recovery and an upswing for Industrials may be hard to come by until mass vaccination is achieved and society can make a return to so-called normal.

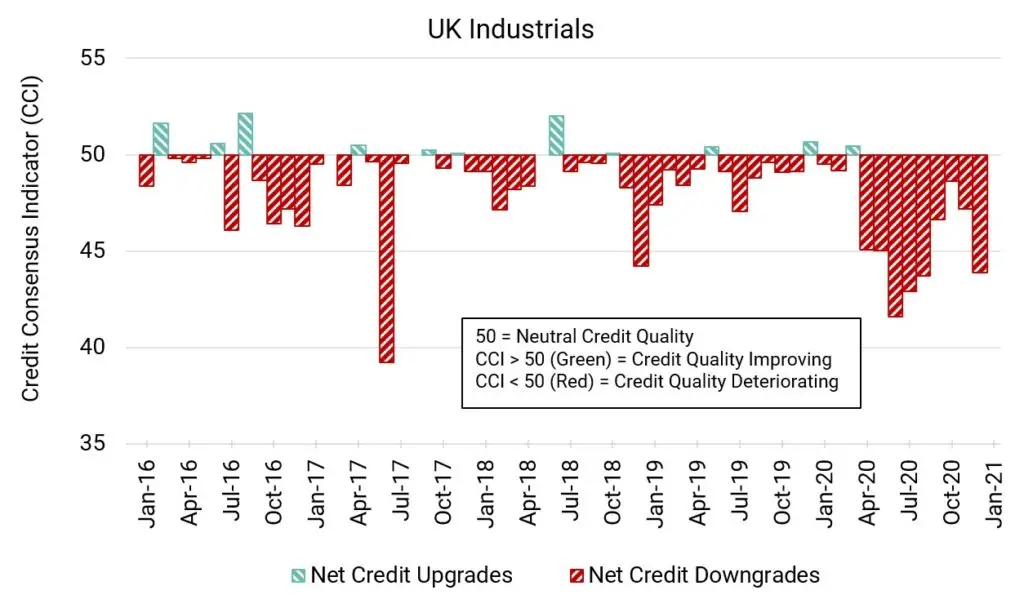

UK Industrials: Low, Low, Low

The CCI score for UK Industrials was trending upwards for a period of five months until last month when it began to drop again, followed by a deeper dive this month.

This month’s CCI reading is 43.9, way down from last month’s CCI of 47.2.

The UK CCI last sat below 45 in July 2020. Beyond COVID, Brexit is still weighing down on the country’s economy and on sectors like manufacturing.

.

EU Industrials: Back to Weakness

Last month’s modest return to positive territory may have been a blip for EU Industrial firms.

This month’s CCI is 47.1, indicating deteriorating credit sentiment for EU Industrials. However, the negative trend remains moderate and has not dropped below 45 since April 2020.

Recent Eurozone industrial production data showed a positive trend, and the European Commission has forecast that the Eurozone would return to its pre-COVID state faster than anticipated.

.

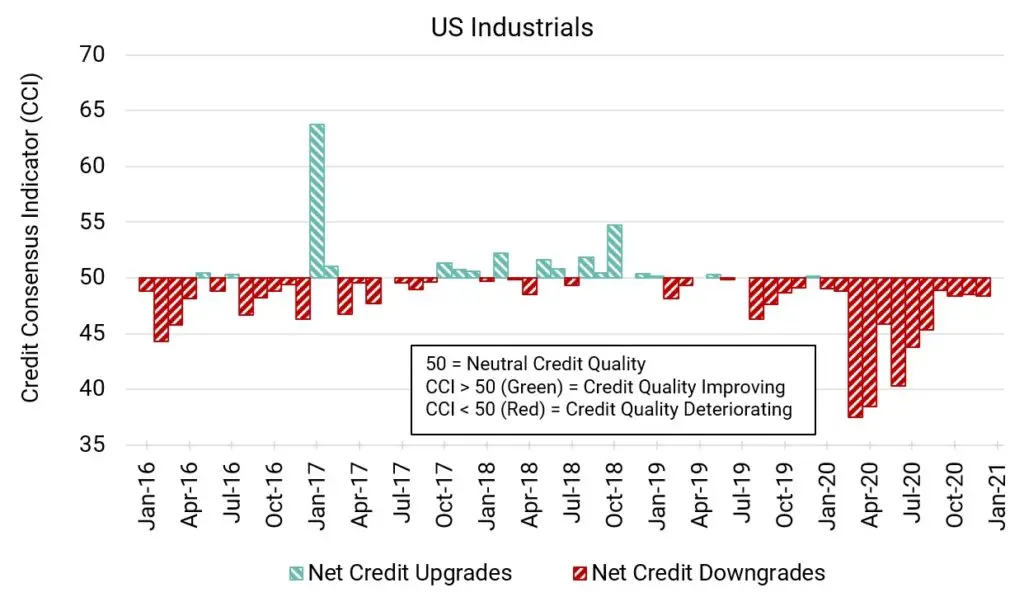

US Industrials: Consistent and Steady

The improvement in sentiment seen for US Industrials has levelled off. Scores are way up from the deep drops seen in early to mid 2020 when the CCI occasionally dropped below 40, but a positive score has not been seen since pre-COVID.

This month’s CCI is 48.5, almost unchanged from last month’s 48.4.

The positive trend for US industrial production may not last, but the US government is negotiating a large fiscal relief package of $1.9 trillion.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: