Bull markets are said to “Climb a Wall of Worry” – and in 2017 the Dow Jones did just that. Despite a new President, rising interest rates, tensions with N. Korea and impending changes at the Fed, the key US equity indices continued to climb. They ran into some volatility recently – just in time to welcome Powell as the new Fed Chairman. But Trump’s tax cuts are unequivocally good news for most of corporate America. The recently announced infrastructure plan aims to build “new roads, bridges, highways, railways, and waterways” – although there is intense debate about the actual scale of the net impact. In addition, recent Dollar weakness could mean that the US will also benefit from exports to the currently booming European economy.

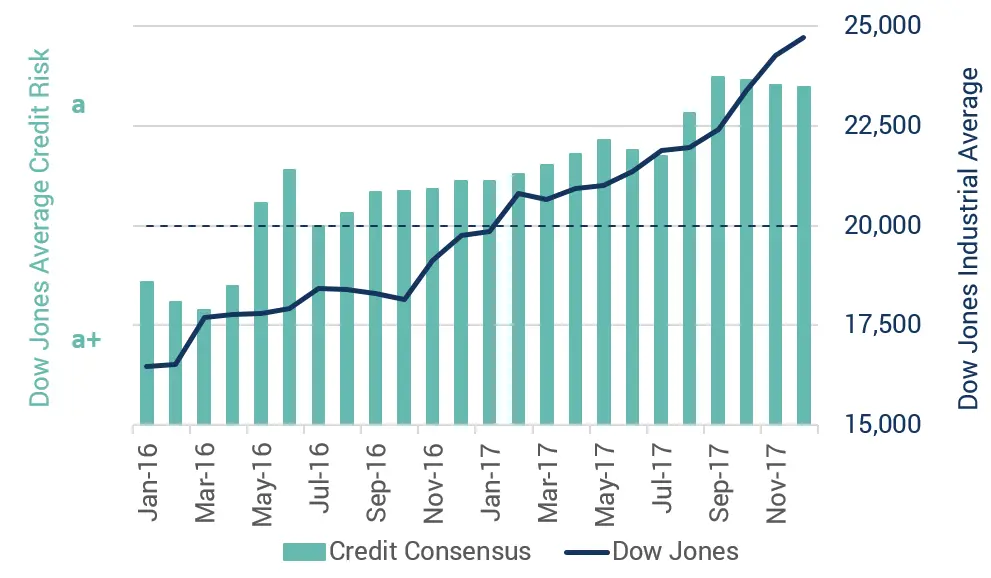

The chart below compares the Dow-Jones Industrials equity index with the credit equivalent based on bank-sourced risk estimates for the Dow-Jones constituents. This shows that credit was another source of concern in 2017, with a fairly steady increase in the estimated credit risk of large US companies until the end of the third quarter of 2017. Over the year, the average credit risk of the Dow-Jones Industrial constituents increased to the point where the index average deteriorated by a full credit notch. But in Q4 2017– ahead of the Trump tax cuts – the average credit risk stabilized and has now moved into a modest decline. This could imply renewed optimism that Trump will be able to get new policies through and that these will have a material and positive impact on the US economy.

Credit Benchmark will post regular updates on this and other equity indices throughout 2018.