The value of leveraged loans outstanding has more than doubled in recent years, from $600bn in 2012 to $1.4tn in 2018. This jump in issuance indicates that demand by investors for leveraged loans has been strong despite the fact that a significant number of higher risk “covenant-lite” loans have featured in a number of leveraged loan issues.

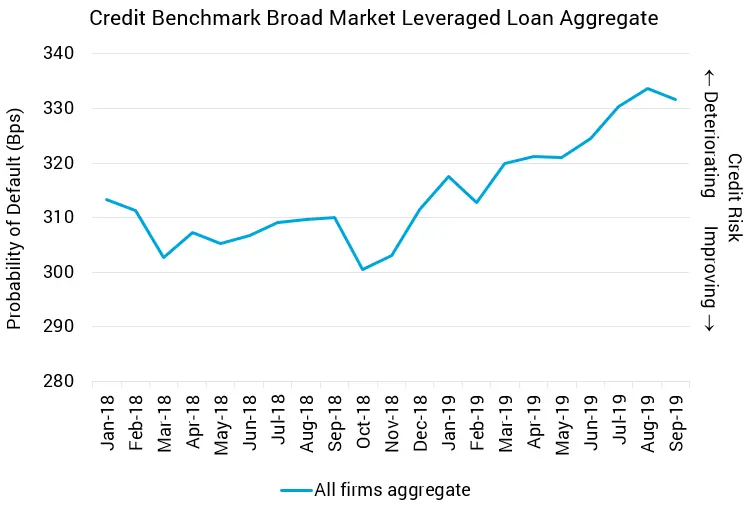

Credit data collected from major financial institutions indicates that the credit risk of leveraged loans has deteriorated since October 2018 by 10%. However this average masks substantial credit quality differences depending on whether the firm issuing leveraged loans or its ultimate parent company is publicly listed or owned by private equity.

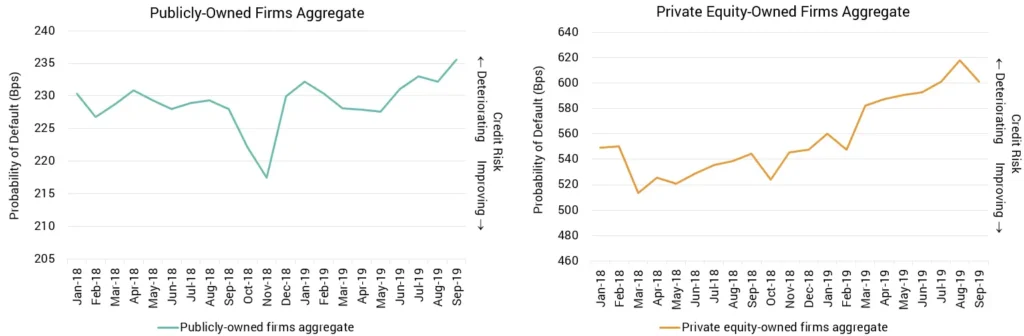

The default risk of private equity-owned firms that issue leveraged loans is more than double that of publicly listed firms and crucially is responsible for most of the deterioration in credit worthiness of the overall leveraged loan aggregate.

Figure 1 plots the recent trend in average default probability for 221 leveraged loan issuers, covering both public and private companies. It indicates that the credit risk of leveraged loan issuers began to deteriorate from an October 2018 low of 301 Bps to 332 Bps where it currently stands – a deterioration of 10%. This corresponds to a consensus rating of b+.

As leveraged loans encompass a diverse range of issuers, broad market averages may obscure some major differences between groups of issuers. Figure 2 shows the trend for two groups of leveraged loan issuers – those that are publicly listed (including the ultimate parent) and those that are issued by private equity owned companies.

.

The average probability of default of private equity owned leveraged loan issuers is now 601 Bps which corresponds to a consensus rating of b, compared to 236 Bps for publicly listed firms which corresponds to a consensus rating of bb-. In essence, the credit risk of private equity owned leveraged loan issuers is more than 2.5 times greater than publicly owned issuers which is equivalent to a 2 notch consensus rating difference.

In addition, private equity owned issuer credit risk has deteriorated by 15% since the low of October 2018; while public companies have only seen a rise in default risk of 6% over the same period.

There are some plausible reasons for these differences. Private firms are subject to less scrutiny, and investors cannot take short positions in the equity of private firms. Both of these factors imply fewer constraints on the debt levels in private firms.

If the credit cycle enters a downturn, then the correlation between the default risks of private equity owned firms is likely to increase. The faster rate of deterioration in the credit risk of privately owned issuers suggests that – in the leveraged loan sector – the cycle may have already entered a downtrend.

This research has been referenced in the Wall Street Journal article, “Lenders Brace for Private-Equity Loan Defaults”, which can be read here.