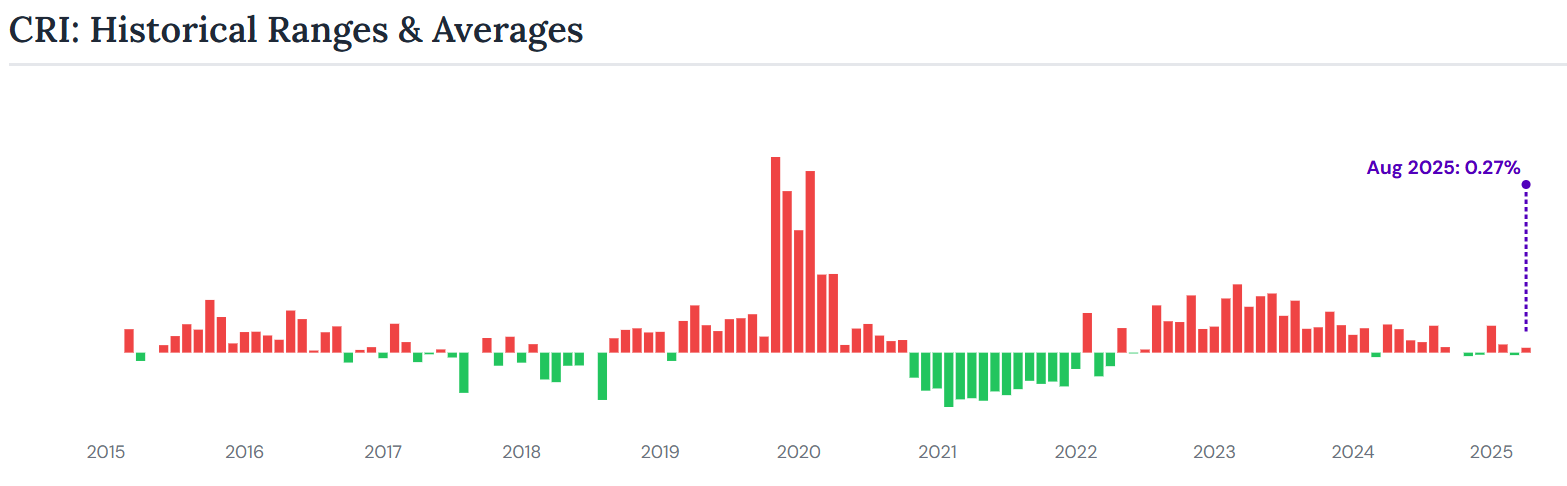

Bank sentiment about the creditworthiness of their borrowers worsened in recent months after improvement earlier this year, according to Credit Benchmark’s new Credit Risk Index (CRI), which tracks internal bank ratings on nearly 3,000 U.S. companies.

Wariness about credit risk has been especially pronounced in autos & parts, with pockets of concern also showing up in travel & leisure, media, household goods and health.

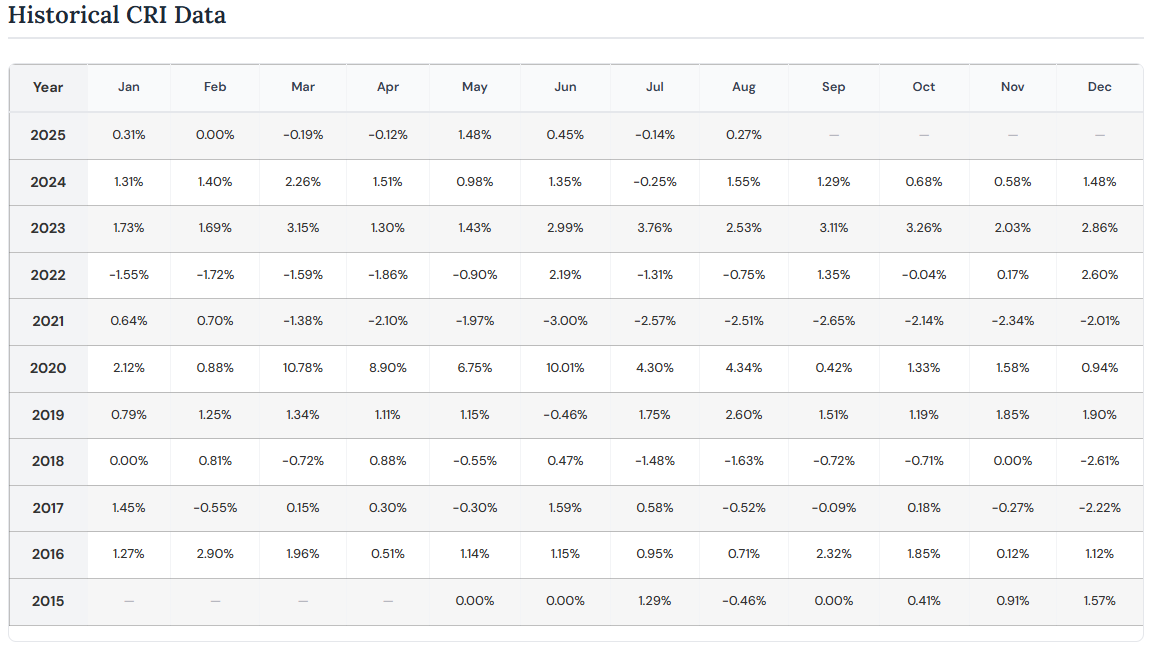

The CRI rose 0.3% in August and has increased in three of the past four months after improving modestly between February and April. The rise in the index means that downgrades exceeded upgrades for companies that receive bank loans.

Bank credit sentiment has generally deteriorated since late 2022. Over the past three years, the 3,000 companies in the index recorded 4,053 downgrades versus 2,872 upgrades. The CRI rose a cumulative 50% during that period and net downgrades were recorded in 30 out of 36 months.

“The CRI addresses a blind spot in regard to understanding credit risk trends in private markets,” said Michael Crumpler, CEO at Credit Benchmark. “It will help risk professionals better monitor these markets by providing an objective, data-driven risk view based on bank sentiment – not secondary market pricing. The CRI will also help market practitioners detect and get ahead of credit deterioration early, so they can more proactively manage their exposures.”

Credit Benchmark’s global database aggregates the judgments of 20,000 analysts across more than 40 leading multinational banks, tracking over 115,000 obligor ratings on $9 trillion in loans across 160 countries. Ratings span corporates, financials, funds and sovereigns on trillions of dollars in aggregate bank credit. Banks use Credit Benchmark’s pooled data to benchmark their own loan assessments.

The CRI focuses on U.S. credit. It tracks net credit downgrades versus upgrades for nearly 3,000 U.S. corporates and financials from Credit Benchmark’s global network of contributor banks.

CRI is a simple, reliable aggregate measure of bank sentiment on thousands of private U.S. loans, distilling independent lender actions into a single, coherent metric.

The pattern of downgrades and upgrades was not uniform in recent months. Financial sectors performed better than real-economy sectors.

Breaking down the index by industry components, risk in the U.S. auto sector sub-index rose sharply during July and August, increasing 12.5% in August and 66% over the past 12 months. The run of downgrades tracked rising bankruptcy risk in auto parts; First Brands Group, a supplier, filed for bankruptcy protection in September.

Other industries showing rising risk include travel & leisure. The sub-index rose 5.6% in August and was up 26% over 12 months through August. Industrial goods, health care, household goods and media have also pointed toward rising risk in recent months. Tech has exhibited steady deterioration over the year, as well.

Risk sentiment has improved in real estate, financial services, insurance and utilities, and more recently basic resources.

Credit Benchmark will publish the CRI at the start of every month. Monitoring it alongside traditional market measures will give investors, lenders, and regulators a fuller, earlier view of emerging credit stress among U.S. private corporates and financials.

[NOTE: See appendix for full index history.]

For more information, contact:

Michael Crumpler, CEO – [email protected]

Christa Ancri, Global Head of Marketing – [email protected]

Ryan Hoffman, Analytics Product Manager – [email protected]

Appendix