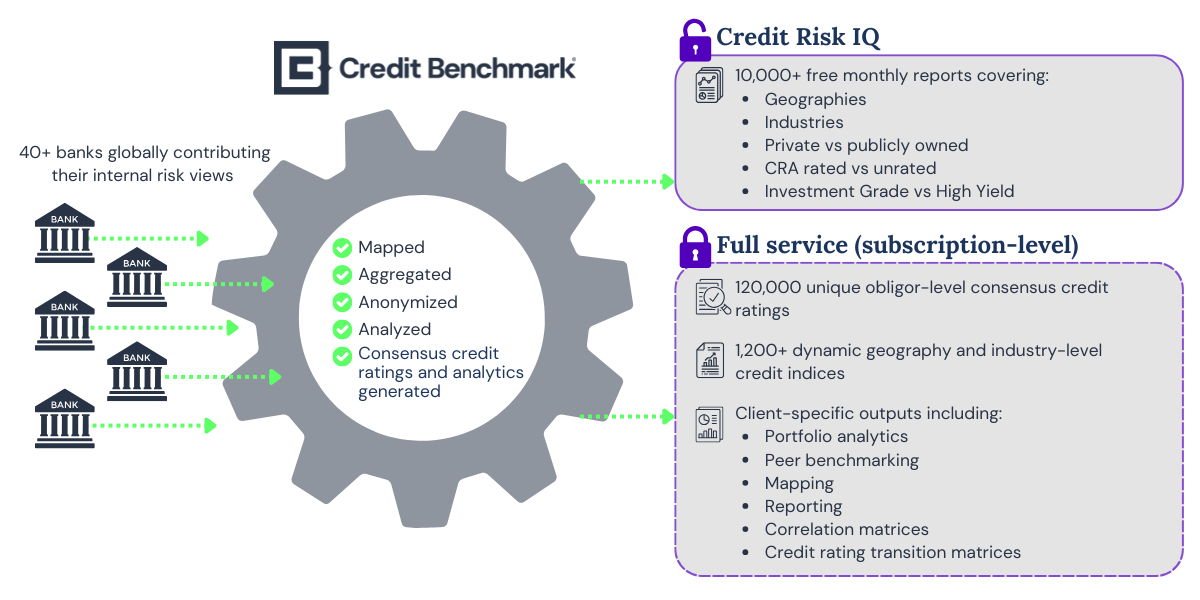

10,000+ free monthly Industry Reports deliver forward-looking analyses of default risk across various geographies and industries, covering both public and private legal entities, to help you identify key trends and signals at a macro-level.

Credit Benchmark collects entity-level risk views every month from over 40 major banks globally. The risk views are anonymized and aggregated to produce 120,000+ dynamic consensus credit ratings, which offer a real-world measure of risk on mostly unrated corporate, financial, fund and government obligors.

These consensus credit ratings feed into a suite of detailed analytics available exclusively to our subscribers, as well as into 10,000+ entirely free Credit Risk IQ Industry Reports.

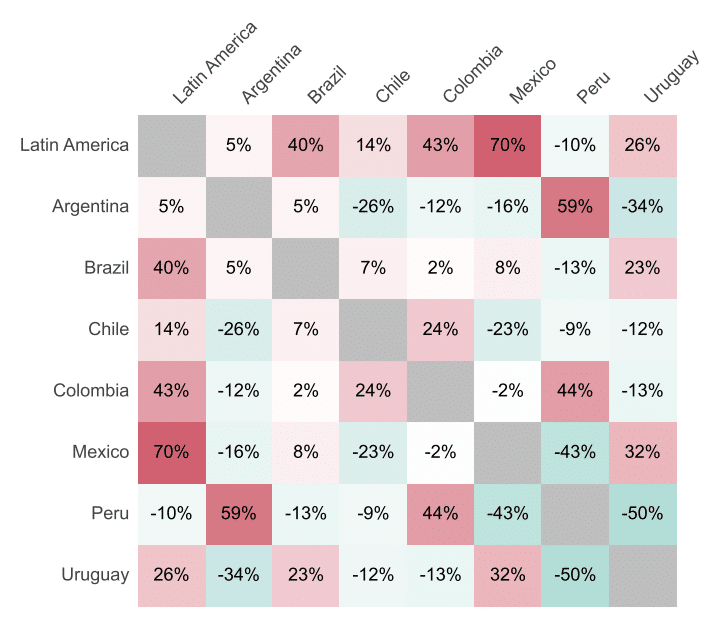

✓ Geography comparison: region and country

✓ Industry comparison: sector and sub-sectors

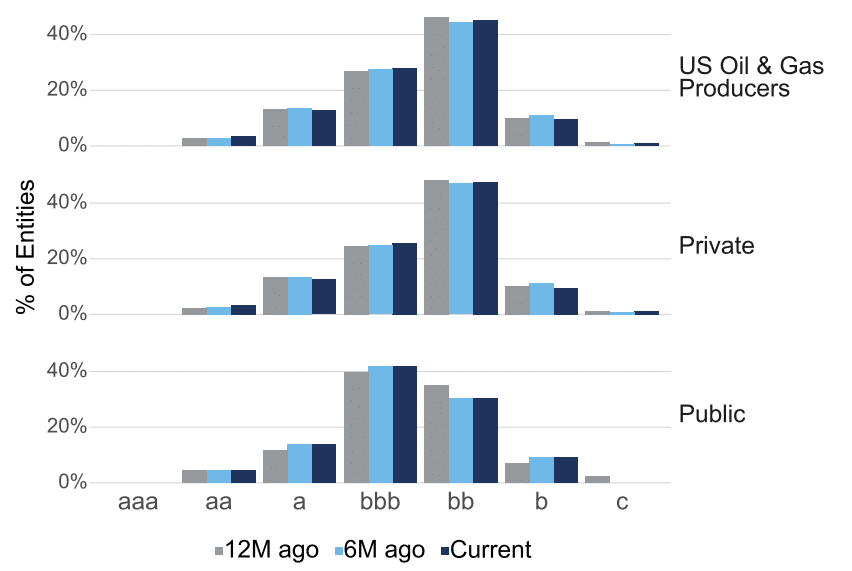

✓ Ownership comparison: public and private

✓ Rated/unrated comparison: rated by credit rating agencies and unrated

✓ Credit quality comparison: Investment Grade and High Yield

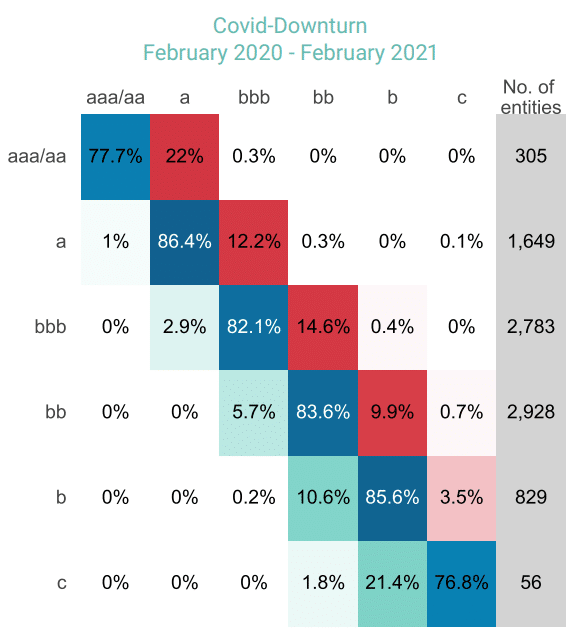

✓ Granular credit rating transition matrices on an annual and multi-period time scale

Please complete the form below to arrange a demo.