Credit Consensus Data on Bloomberg

Credit Benchmark Data on the Bloomberg Terminal and via Enterprise Data License

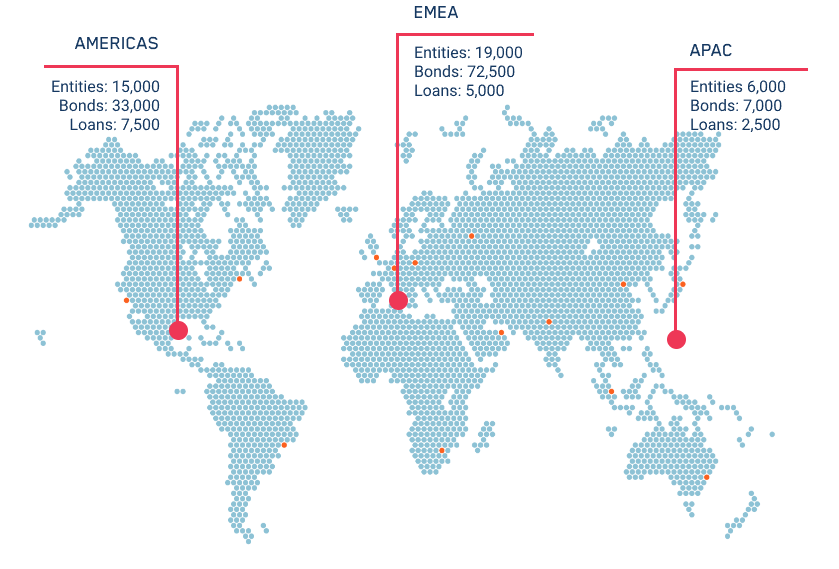

Precise consensus-based credit ratings, probabilities of default, and advanced analytics on 40,000 mostly unrated private and public companies and 140,000 corporate bonds and loans are now available to licensed clients via the Bloomberg Terminal and Data License service.

Credit Consensus Ratings on Bloomberg

Credit Consensus Ratings available on Bloomberg provide a unique measure of creditworthiness on 40,000 counterparts and borrowers across emerging and developed markets. Compiled from the anonymized and aggregated internal risk views of 40+ of the world’s leading banks, Credit Consensus Ratings provide an independent, real-world perspective of risk.

Updated twice monthly, the data provides dynamic and unparalleled coverage of public and private companies; 90% of the entities covered are unrated by the top three rating agencies.

Credit Consensus Ratings are supplemented by descriptive analytics that provides insights into the underlying credit views that make up the consensus.

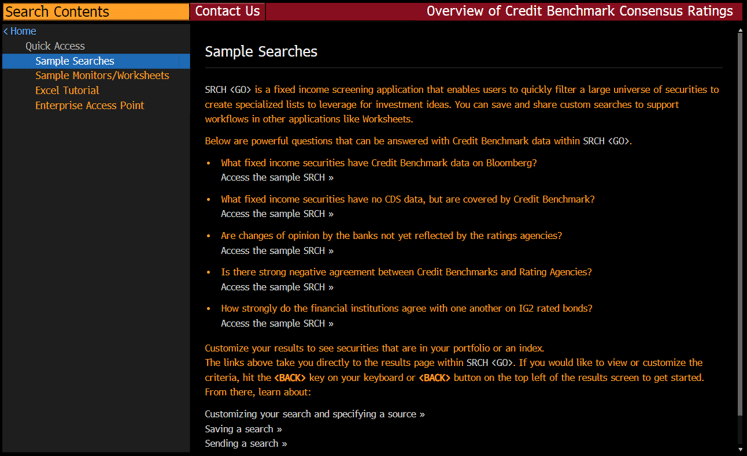

Credit Benchmark data can now be seamlessly integrated into your existing workflows and alongside other content on the Bloomberg Terminal. The data is easily accessible on CRPR, SRCH, and throughout the Terminal to help support various risk management and investment management use cases.

Use Cases for Credit Consensus Ratings

Credit Benchmark data enhances existing risk management processes and frameworks, including for Counterparty, Supply Chain, Vendor and Enterprise Risk Management applications.

Overlay Credit Benchmark data against your portfolio within the Terminal to unlock unique insights. The data can complement your existing portfolio monitoring, analysis, and decision-making workflows.

Leverage Credit Benchmark data as an input into fixed income screens to efficiently identify new investment opportunities. The data can complement your existing security selection and portfolio construction workflows.

Overlay Credit Benchmark data for new macro credit insights on industries and sectors as well as for Bloomberg Indices. Identify whether a certain index is overbought or oversold relative to the credit profile.

Bond and Loan Rating Assessments on Bloomberg

Through a partnership with Bloomberg, Credit Benchmark also offers rating assessments (notching) for bonds and loans issued by the 40,000 entities with Credit Consensus Ratings.

This service combines the Credit Benchmark Consensus with Bloomberg’s security reference dataset to create security-level rating assessments for approximately 140,000 bonds and loans amounting to $34+ trillion outstanding.

The production combines both Credit Benchmark and Bloomberg information and technology. As the resulting Rating Assessments are at the security level, the Bloomberg platform provides the perfect distribution mechanism.

These Bond and Loan Rating Assessments are available to licensed clients alongside the existing Credit Benchmark entity-level coverage via standard Bloomberg functions, including Search, Worksheets, Launchpad, Excel API, and CRPR.

Bloomberg also offers access to the same information via Data License Per Security for clients looking to use this information within their internal systems.

Use Cases for Bond and Loan Assessments

Improving the scope of collateral eligibility to include unrated securities and optimize the use of existing collateral.

Using Credit Benchmark Rating Assessment to support optimization of regulatory capital requirements.

Use within investment risk management reporting and governance.

Using Credit Benchmark data as an input into credit analysis and associated reporting.

Demonstrate independent assessment of credit risk of bond or loan exposure.