Semiconductor supplies have not yet recovered from COVID disruption. This has caused problems for many industries, but the impact is becoming acute for manufacturers of automobiles and parts.

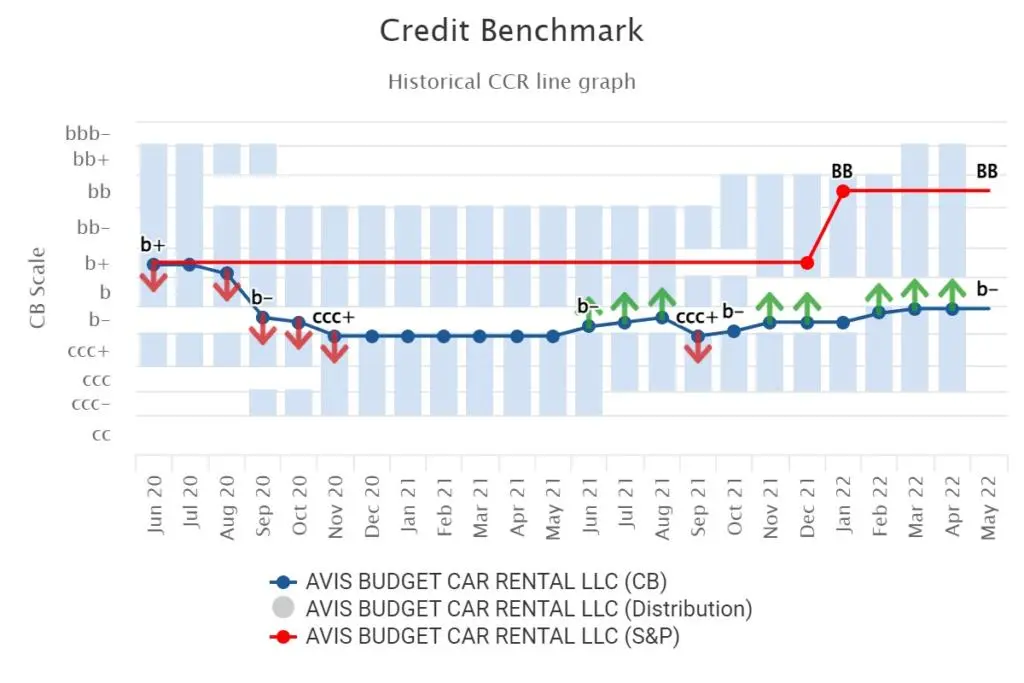

Figure 1 and 2 show credit trends and credit distributions for auto manufacturers in the main regions.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: Credit Trend, Global, North America, Asia & Europe Automobile & Parts; May-20 to Apr-22

Figure 2: Credit Distribution, Global, North America, Asia & Europe Automobile & Parts; Apr-21 vs Apr-22

Auto-maker credit deteriorated during lockdown, but recovery began early as the public shunned public transport on health grounds. Credit has continued to recover as economies have reopened but it is now plateauing globally, with Asia turning negative again.

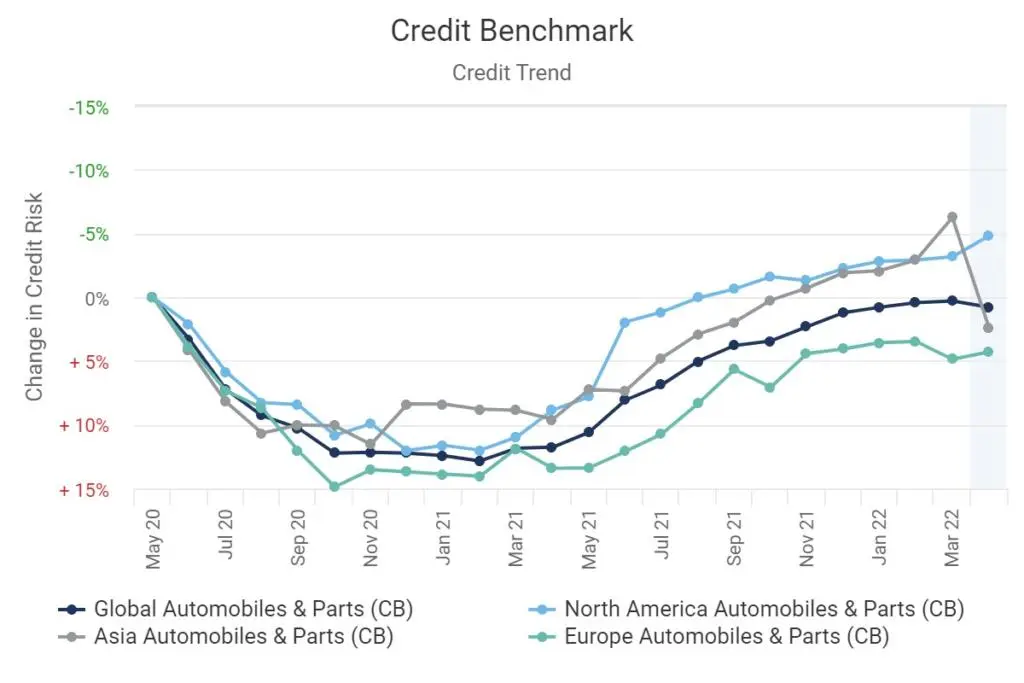

COVID disrupted supplies of labour and materials at all stages of car manufacture, but silicon chip supplies are particularly tight – bad news for automobiles, but good news for semiconductor firms. Figure 3 shows the dramatically improving credit trend for 28 semiconductor companies in the iShares Semiconductor ETF index – 86% of these are now investment grade.

Figure 3: Credit Trend, 28 semiconductor companies listed on the iShares Semiconductor ETF index

But Taiwan Semiconductor has 50% of the global semiconductor market – so it is possible that recent military rhetoric from China over Taiwanese sovereignty has encouraged stockpiling.

Electric car technology is very semiconductor intensive, needing about 2,000 chips per vehicle, and demand is strong – registrations of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) have risen steadily, and government policies in Europe and China are increasingly pro-EVs. But labour and supply shortages mean long waiting lists, with over a year for some electric models from Porsche and Volkswagen and many petrol models are also suffering long lead times.

Semiconductors are not the whole story – as new car manufacturing struggles with shortages of labour and general parts (with rising car thefts specifically aimed at scarce components), prices of second-hand cars have risen sharply. Used car sales grew 11.5% YOY in 2021. Prices of second-hand cars have been rising sharply; since April 2020 used car prices have risen by as much as 12%.

This is good for some dealers, but negative for online car dealers like Carvan (ccc+) and Cazoo (b) which have recently announced staff layoffs against a backdrop of plummeting valuations. Consumer cutbacks combined with easing of COVID restrictions have dented online car sales, and online listings have also dropped as professional dealers hoover up any surplus stock.

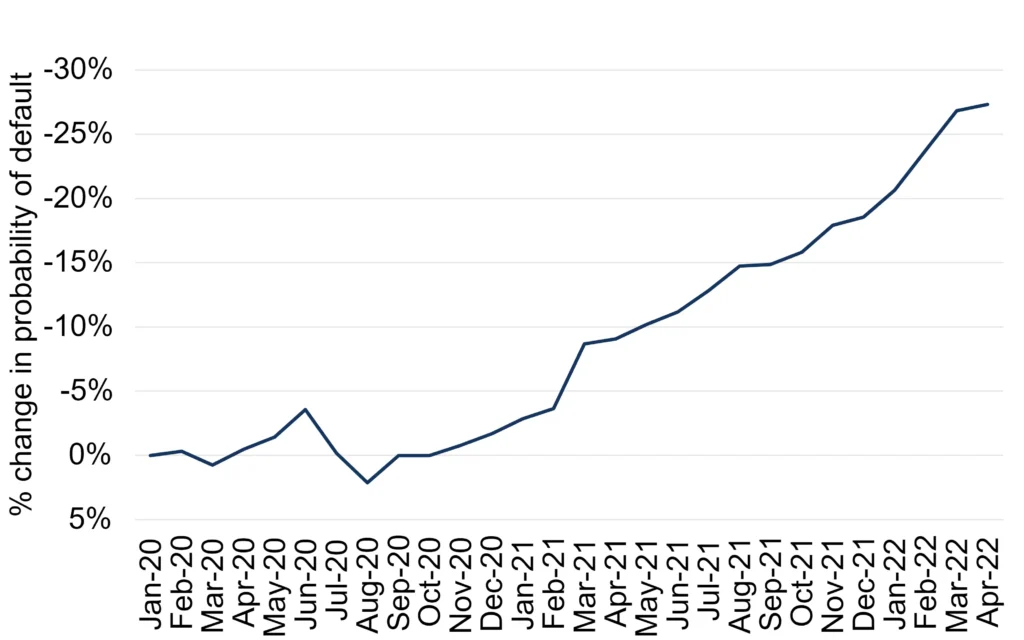

The shortage of new cars and parts has affected car rental supplies – existing stock is not easy to repair or replace, and demand is growing as tourism recovers with COVID restrictions easing from mid-2021 onwards. Some drivers, expecting WFH to be permanent, sold their cars to take advantage of the spike in second hand prices; now they can either pay up for a replacement or rent for special occasions – but rental rates have spiked, so the global car market is effectively in backwardation.

Figure 4 lists some car rental companies and their current Credit Consensus Rating (CCR).

Figure 4: Car Rental Companies

| Car Rental Company Name | CCR | Country |

| AVIS BUDGET CAR RENTAL LLC | b- | United States |

| DONLEN FLEET LEASE FUNDING 2 LLC | a+ | United States |

| ENTERPRISE RENT A CAR UK LTD | a | United Kingdom |

| GRANTHAM MOTOR CO LTD | bb | United Kingdom |

| HA FLEET PTY LTD | a+ | United States |

| HERTZ CORP | b+ | United States |

| INTERNATIONAL CAR RENTAL LTD | bb | United Kingdom |

| LOCALIZA RENT A CAR SA | bb | Brazil |

| SIXT RENT A CAR LTD | bb | United Kingdom |

War in Ukraine has led to record petrol prices, but many drivers have no realistic alternative. And those who can are determined to hold on to traditions: Rolls-Royce reported that COVID spurred wealthy motorists to buy more Rolls-Royces than ever before – because it made them realise life is short. In 2021, the luxury carmaker booked the highest annual sales in its 117-year history, selling 5,586 vehicles.

Despite higher costs of cars, parts, technology and fuel, petrol cars are likely to be around for some time yet.

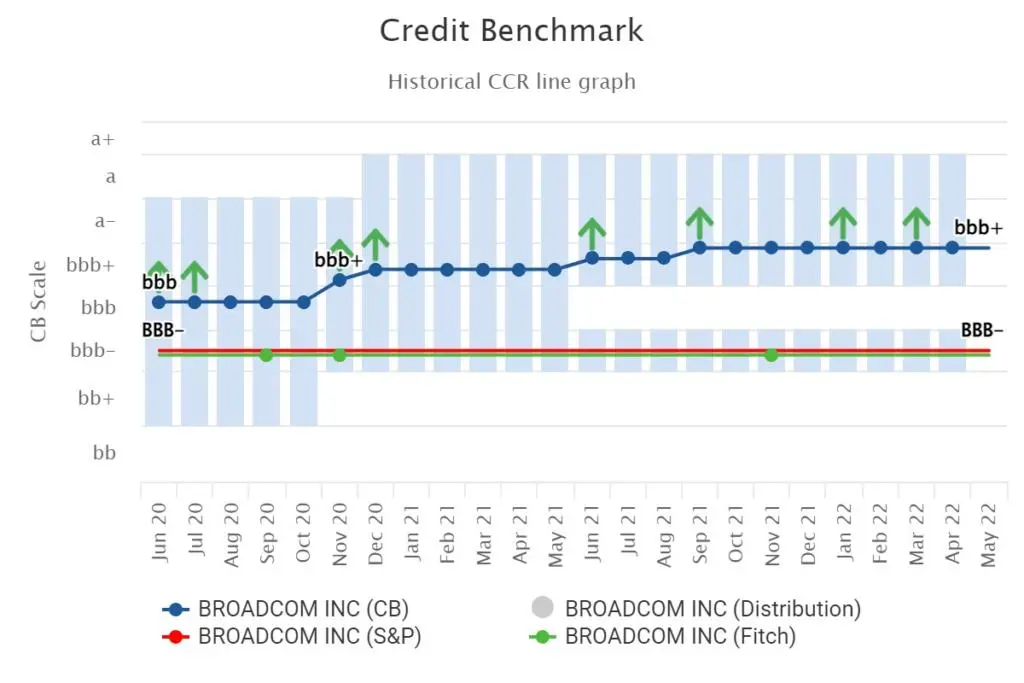

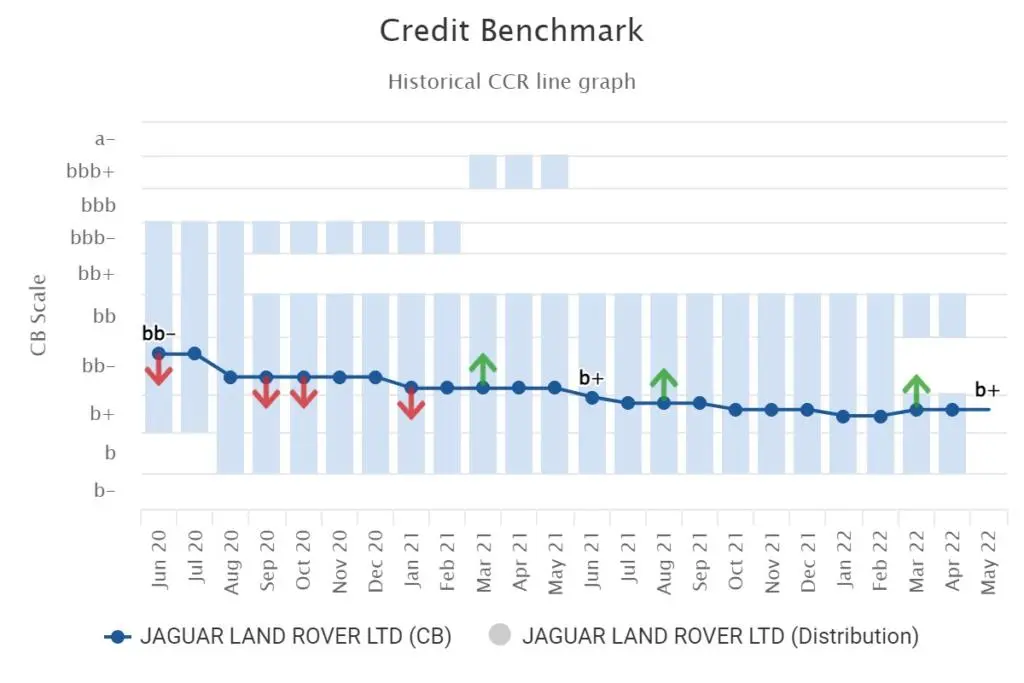

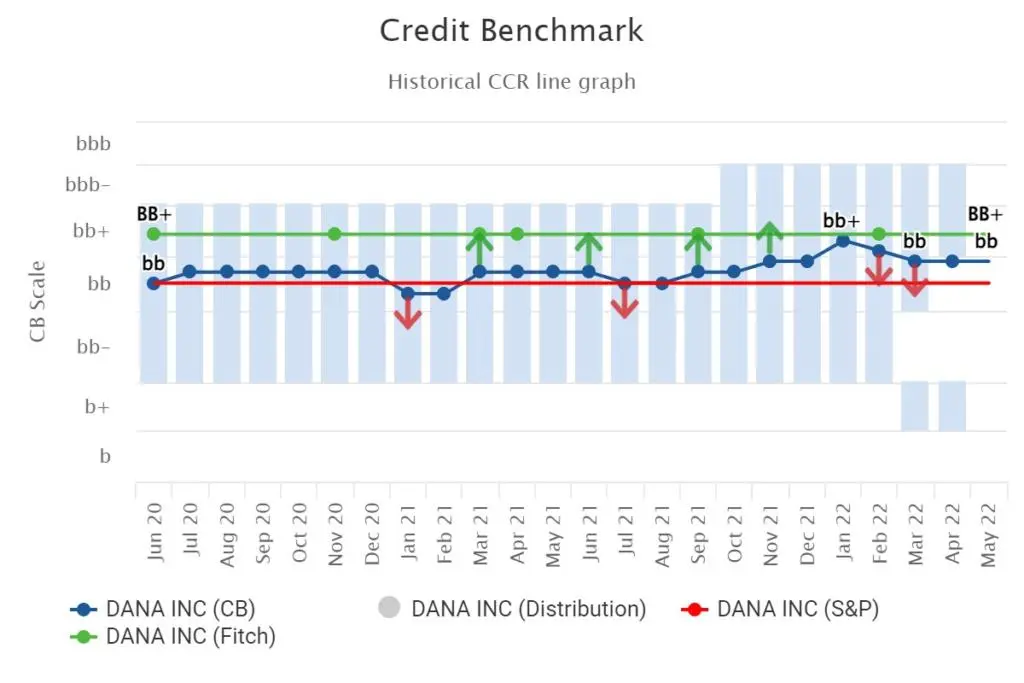

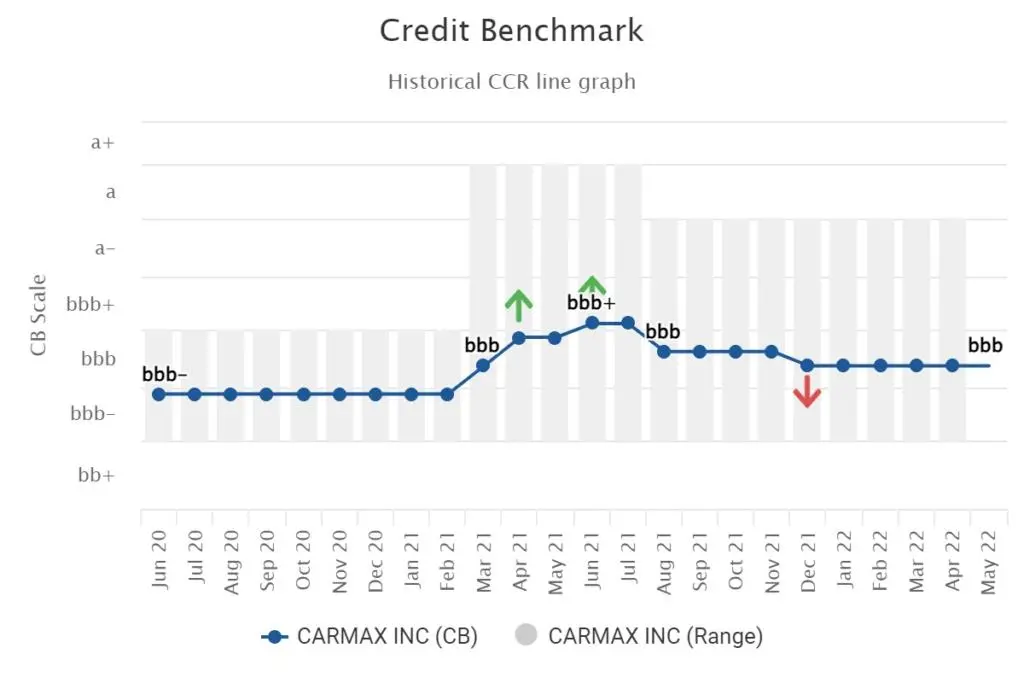

Figures 5-9 show detailed credit trends for some of the affected companies.

Figure 5: Broadcom Inc, an American designer, developer, manufacturer and global supplier of a wide range of semiconductor and infrastructure software products.

Figure 6: Jaguar Land Rover LTD, a British multinational automobile manufacturer which produces luxury vehicles and sport utility vehicles.

Figure 7: Dana Inc, is a leading automobile parts supplier of fully integrated drivetrain and electrified propulsion systems for all passenger vehicles.

Figure 8: CarMax Inc, an online used vehicle retailer based in the United States – limited CRA information available.

Figure 9: Avis Budget Car Rental LLC, one of the world’s largest car rental providers.