Credit Benchmark have released the August Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

There is reason for optimism in the latest CCI data. Scores for the UK, EU, and US are all above 50. For the US, this would the six consecutive month above this threshold. Fiscal policy will remain robust; in fact, in the US, trillions in additional spending seems likely. Even with some tightening, monetary policy will remain relatively loose for the UK and US and even looser for the EU.

At the same time, warning signs and potential obstacles abound. The virus, driven by the Delta variant, continues its hold globally, including in countries with high vaccination rates. Despite ample availability of vaccines in the US, vaccination momentum has dropped significantly since the spring of this year. While infection rates remain high, a return to normal will be hindered. Some companies are delaying a return to the office, and there are signs of unevenness in travel rates, particularly business travel.

Ongoing supply chain and logistics issues persist, grinding the gears of production and shipping and contributing to inflation, even if transitory.

The worst may be behind us, but improvement may end up being slower or more uneven and volatile than anticipated even just a few months ago.

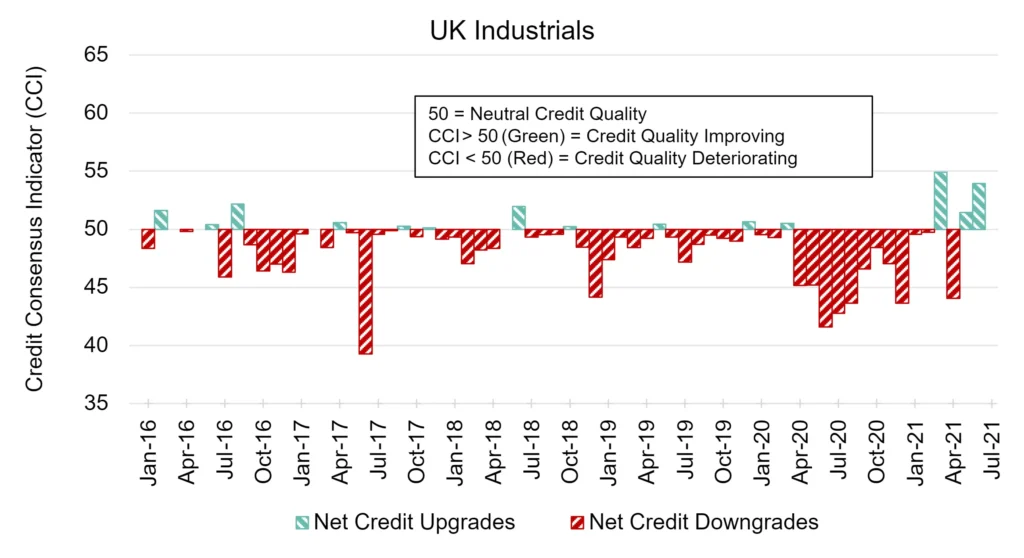

UK Industrials: More Improvement

UK Industrial firms have maintained positive credit quality after a recent tumble.

The UK CCI score is 53.9, compared to 51.4 last month.

The Delta variant is posing problems for the UK, but it might not be as bad as earlier waves due to vaccines and individuals exercising caution even with reduced restrictions. UK manufacturing activity has slowed.

.

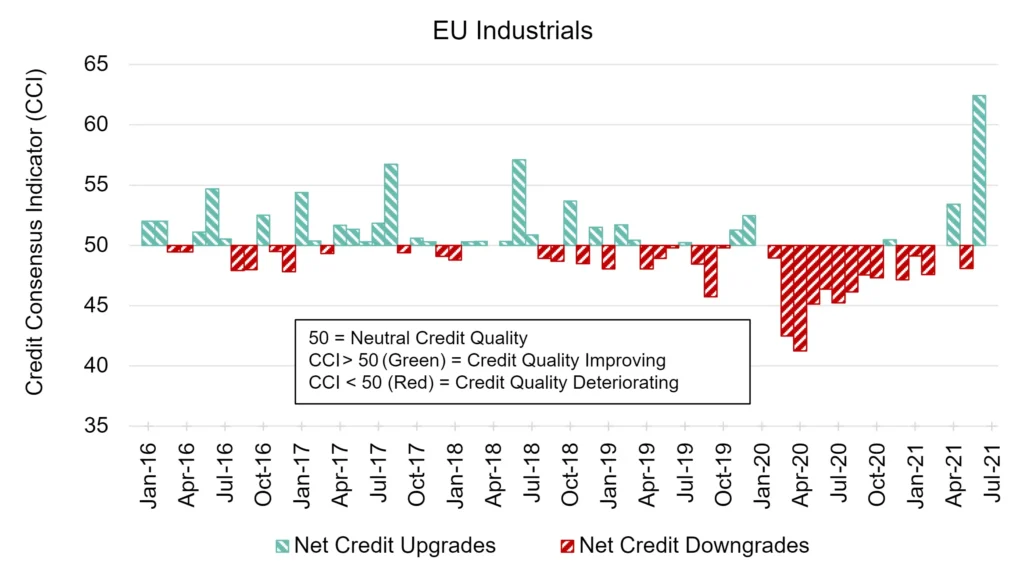

EU Industrials: Positive Movement

EU Industrial companies have returned to positive territory after last month’s negative blip.

Now the EU CCI score is 62.4, compared to 48.1 last month.

The EU has passed the US in vaccinations, which will help limit the damage from the virus. Eurozone manufacturing activity keeps expanding quickly.

.

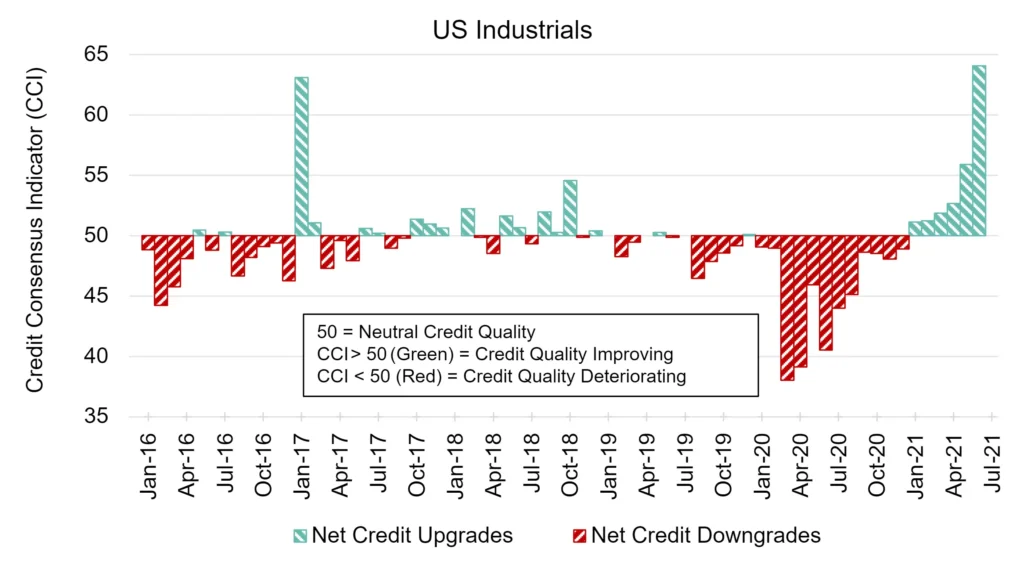

US Industrials: Ongoing Strength

US Industrial firms remain in a good position.

The US CCI score is currently 64.1, compared to 55.9 last month.

The virus continues to hold parts of the US in a grip, but there are signs vaccinations are trending higher, especially in states that have been laggards thus far. US manufacturing activity continues to expand robustly.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: