To download the August 2020 Housing Aggregate PDF, click here.

.

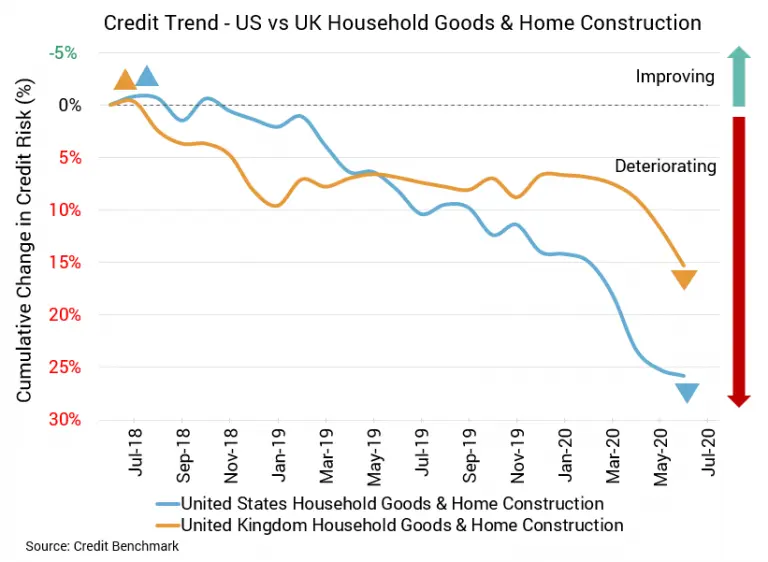

The US housing sector can breathe a (perhaps temporary) sigh of relief. The UK housing sector, however, may be taking a turn for the worse, with credit quality diminishing. There have been some positive signs in recent weeks, like rising sales, increased construction, and regulatory changes that allow for more construction. But with the UK experiencing the worst recession on record, this sector’s credit prospects may be restrained for some time.

Default Risk for US Housing Sector Unchanged

- Deterioration in credit quality for the US housing sector has stopped (for now), but credit quality is getting worse for the UK housing sector.

- More than three quarters of firms in each aggregate have a Credit Benchmark Consensus (CBC) rating of bbb or worse, highlighting overall credit weakness.

US Household Goods and Home Construction Firms

Credit quality for the US housing sector has begun to plateau. There was no change in credit quality from the prior month, and only a 2% decline from two months prior. Year over year, credit quality is still down 16.7%. Average probability of default for this sector is now 49 basis points, unchanged from the prior month and compared to 48 basis points two months prior. At the same point last year, it was 42 basis points. While credit quality may not be getting worse, about 77% firms with a CBC rating are at bbb or lower. The aggregate’s average CBC rating is bb+.

UK Household Goods and Home Construction Firms

The holding pattern for the UK housing sector appears to have ended. After seeing little to no change since the end of 2018, credit quality has taken a turn for the worse, starting in March this year. The deterioration in credit quality for this sector is 4% compared to one month prior and 6% compared to two months prior, and it’s down by 8% year-over-year. Average probability of default is now 56 basis points, compared to 54 basis points one month prior and 53 basis points two months prior. At the same point last year, it was 52 basis points. About 83% of the firms in the sector with CBC rating are at bbb or lower. The aggregate’s average CBC rating is bb+.

About Credit Benchmark Monthly Housing Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the household goods and home construction sectors. It illustrates the probability of default for a variety of companies in the home construction space as well as firms that would benefit from increased home building and buying. Worsening credit risk means a greater probability of default; improving credit risk means a reduced probability of default. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.